S&P Global highlights strong demand for Bitcoin and crypto ETFs since launch, signaling growing investor interest in digital assets.

S&P Global, the world’s largest credit rating agency, recently published a report underscoring the robust demand for Bitcoin ETFs and other crypto ETFs since their introduction last year.

This occurs amid substantial infusions into these crypto funds, with BlackRock’s IBIT as the most prominent example.

S&P Global Underscores Demand For Bitcoin ETFs

In a research report, the credit rating agency declared that the Bitcoin ETFs were met with an overwhelming response and popularity, facilitating the crypto ETF market opening.

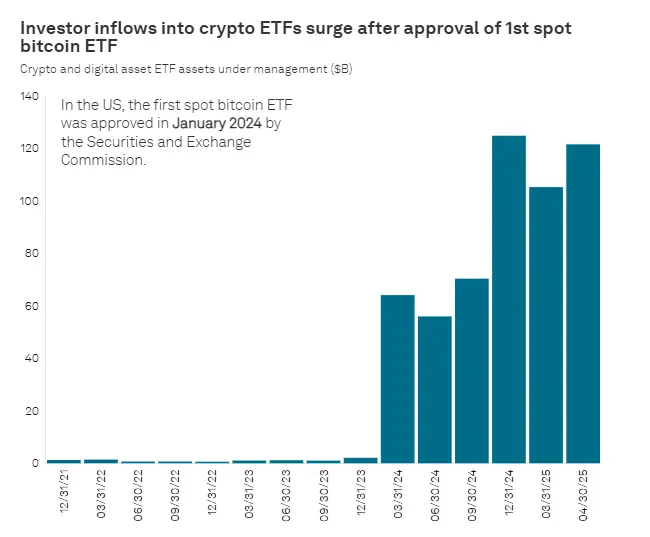

The agency observed that the investor inflows into these funds have been “robust” since their inception in 2024.

The S&P Global also emphasized that the assets under management (AuM) for these crypto ETFs more than doubled from the end of the first quarter in 2024 to year-end 2024, eclipsing $120 billion, despite the volatility of this growth.

In the interim, the report also observed that institutional investors have become more receptive to Bitcoin ETFs and other crypto funds, enabling them to acquire crypto exposure without directly owning the asset.

Additionally, S&P Global asserted that these ETFs effectively mitigate the obstacles institutions encounter when purchasing, holding, or disposing of cryptocurrency.

Intriguingly, this research report was released simultaneously with BlackRock’s IBIT, which remains one of the largest ETFs this year regarding year-to-date (YTD) flows.

BlackRock’s ETF has exceeded $14 billion in year-to-date transactions and is now on the brink of the 700,000 BTC milestone, as CoinGape reported.

Michael Saylor of Strategy has predicted that IBIT could surpass Vanguard’s VOO in terms of year-to-date flows by the end of the year due to BlackRock’s inflows this year.

In the interim, the Bitcoin ETFs have a total net asset of $133.53 billion, as indicated by the SoSo Value data.

This represents 6% of the market capitalization of Bitcoin.

Since their introduction in July of last year, Ethereum ETFs have also experienced substantial demand.

According to SoSo Value data, these funds possess $9.90 billion in net assets, constituting 3.35% of Ethereum’s market capitalization.

Why People Will Continue To Want ETFs

According to S&P Global, the “simple point-and-click ease of trading an ETF via an online brokerage account” will continue to drive significant demand for Bitcoin ETFs and other crypto funds.

Initially, the report observed that ETFs provide a straightforward buy-and-sell experience through established channels.

Secondly, and perhaps most significantly for institutions, trading shares of these ETFs implies that a reputable technology provider oversees the custody of the underlying assets.

At the same time, the research observed that the digital market is still experiencing a “rapid proliferation” of altcoins, stablecoins, DeFi tokens, meme coins, and other tokenized assets.

S&P Global also mentioned that crypto ETF issuers focus on XRP, Solana, and novelty coin assets such as Dogecoin and PENGU.

Additionally, multi-asset ETFs are being considered.

The Solana, XRP, and Dogecoin ETFs are expected to be introduced this year, joining the Bitcoin ETFs and Ethereum ETFs on the market, according to Bloomberg analysts Eric Balchunas and James Seyffart.