In the past three trading days, Germany’s BTC selling binge was not sufficiently counterbalanced by investors’ investment in Bitcoin ETFs.

Bitcoin investors have invested over $650 million in United States-listed spot Bitcoin exchange-traded funds (ETFs) in the past three trading days.

This resulted from yet another robust day of net inflows for the 11 Bitcoin ETFs, which occurred on July 9. The iShares Bitcoin Trust (IBIT), a Bitcoin ETF managed by BlackRock, received $121 million in inflows. Fidelity Wise Origin Bitcoin (FBTC) followed with $91 million.

According to data from Farside Investors, the total net inflows across all ETFs for July 9 amounted to $216.4 million, or 3,760 Bitcoin.

The total of $654 million over the past three trading days results from the surge of inflows, which includes $294.8 million on July 8 and $143.1 million on July 5.

Since July 4, Bitcoin has been unable to surpass $60,000. It is trading at $59,165, a decrease of nearly 15% over the past month, according to TradingView.

Some analysts anticipate that the ETFs will contribute to the increase in the price of Bitcoin, as they did in the months preceding March when Bitcoin achieved a new all-time high.

In an analysis thread on X, Sina G, the co-founder and chief operating officer of Bitcoin custody consultancy firm 21st Capital, stated that the ETFs were the primary factor behind the increase from $16K to $73K, which was a result of a buy-the-rumor buy-the-news phenomenon.

“The market experienced a significant increase in value, and ETF flows were particularly robust until mid-March.” He wrote that bankruptcy outflows have taken over since then, and ETFs have slowed down, resulting in a feeble price action that has fallen to $56K.

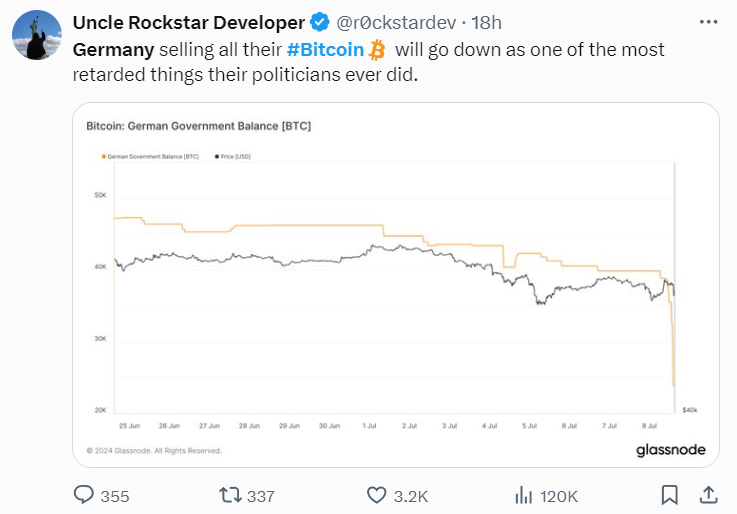

Insufficient to counteract Germany’s BTC transfer

The Bundeskriminalamt (BKA), Germany’s federal criminal police, has recently engaged in a Bitcoin selling frenzy that the inflows to US Bitcoin ETFs have not surpassed. The BKA seized nearly 50,000 Bitcoin in mid-January to investigate a movie pirating website.

Arkham Intelligence reports that the BKA’s wallet has decreased its BTC holdings by over $850 million since July 5, with hundreds of millions of Bitcoins being transferred to wallets owned by centralized exchanges and market makers.

Its wallet currently contains 23,960 Bitcoin, valued at $1.4 billion. This amount is less than half of the total Bitcoin initially confiscated from the film infringement site Movie2k in mid-January.

According to on-chain data from Arkham, the BKA initiated the sale of Bitcoin on June 19 and increased its efforts at the beginning of July.