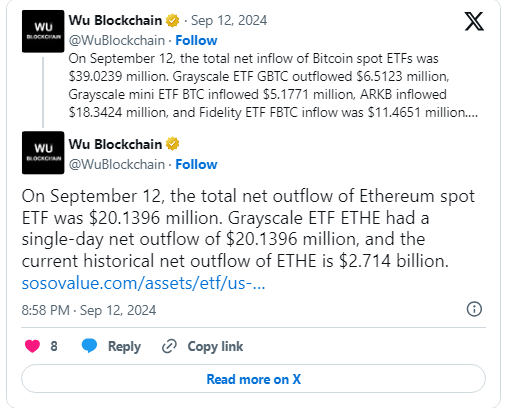

On Thursday, U.S. spot Bitcoin exchange-traded funds (ETFs) experienced daily net inflows of $39.02 million, a rebound from the negative flows experienced the previous day.

Ark and 21Shares’ ARKB fund attracted $18.34 million, according to data from SoSoValue, which accounted for most of these inflows.

Grayscale’s Bitcoin Mini Trust received $5.18 million, while Fidelity’s FBTC recorded $11.47 million in inflows.

More Funds See Inflows

VanEck’s HODL, which received $4.95 million, and Franklin Templeton’s Bitcoin fund, which received $3.38 million, are also notable contributors to the inflows.

Bitwise’s BITB also experienced positive movement, with $2.22 million in inflows.

Despite the overall positive trend, Grayscale’s GBTC, the sole Bitcoin ETF to experience outflows, was the only one to do so.

In the interim, BlackRock’s IBIT, the most prominent spot Bitcoin ETF by net assets, reported no net inflows. It is important to note that IBIT has not received any new inflows since August 27.

The daily volume of the 12 Bitcoin ETFs was $896.92 million, a decrease from $1.27 billion the previous day on the trading front.

These funds have amassed $17.03 billion in net inflows since their inception in January.

On the other hand, U.S. spot Ethereum ETFs encountered net outflows of $20.14 million on Thursday, the second consecutive day of negative flows.

Grayscale’s ETHE was the sole contributor to the outflows, while the eight Ethereum ETFs did not experience any movement.

The total daily trading volume for Ethereum ETFs decreased to $106.14 million from the $126.22 million recorded on Wednesday.

Ethereum ETFs have experienced cumulative net outflows of $582.74 million.

The inflows occur as Bitcoin maintains its equilibrium at approximately $58,000 despite a 0.6% decline to $57,916.

The cryptocurrency experienced a decline below $53,000 last week due to subpar U.S. non-farm payroll data; however, it has since recovered.

Investors are anticipating the Federal Reserve’s forthcoming Open Market Committee meeting to obtain additional market guidance.

How Would Rate Cuts Impact the Crypto Market?

Ryan Lee, Chief Analyst at Bitget Research, anticipates that a Federal Reserve rate reduction will benefit the cryptocurrency market regardless of whether it is 25 or 50 basis points.

Lee stated that a 25-basis point reduction indicates moderate economic concerns and could result in a progressive increase in crypto prices as investors pursue higher returns beyond traditional markets.

The rebound is anticipated to be modest and features minimal volatility.

He wrote, “Investors may gradually reallocate funds from low-yield traditional assets to riskier ones, resulting in a moderate market upswing.”

Conversely, a 50-basis point reduction implies more profound economic concerns and could result in substantial capital inflows into cryptocurrencies, particularly Bitcoin, as investors focus on risk assets.

This would lead to a more robust market rally, but it would also increase volatility.

According to Lee, the crypto market may experience significant price volatility in the short term as investor sentiment fluctuates, particularly during the initial phase, as the market processes positive news.

He stated that either rate reduction would bolster the demand for cryptocurrencies in the long term by reinforcing expectations of ongoing Federal Reserve easing.