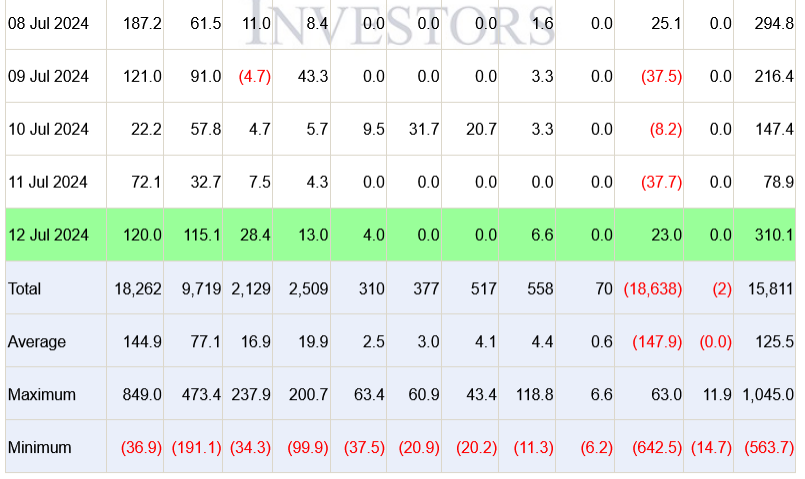

The BlackRock and Fidelity Bitcoin ETFs saw the most inflows, totaling $310 million

Grayscale experienced a rare inflow day, with $23 million.

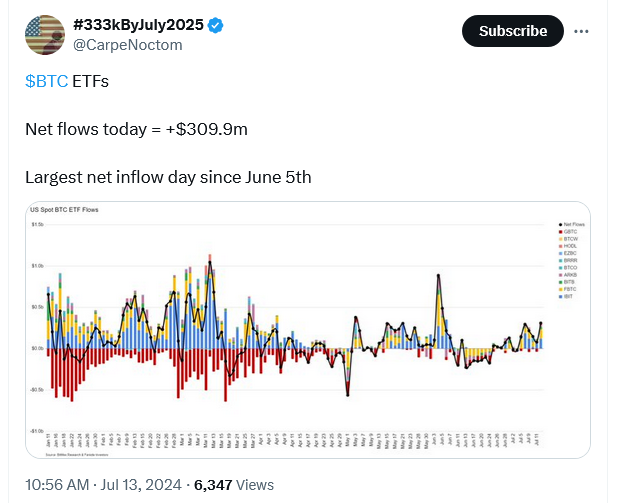

On July 12, spot Bitcoin exchange-traded funds in the United States experienced inflows exceeding $310 million, which was their most successful day since June 5.

The Fidelity Wise Origin Bitcoin Fund (FBTC) and BlackRock’s iShares Bitcoin Trust (IBIT) saw the majority of the transactions, with $120 million and $115.1 million, respectively, according to Farside Investors data.

The Grayscale Bitcoin Trust (GBTC) experienced another uncommon inflow day, with $23 million, while the Bitwise Bitcoin ETF finished in third place with $28.4 million.

Similarly, the VanEck Bitcoin Trust ETF and the Invesco Galaxy Bitcoin ETF experienced inflows of $6 million and $4 million, respectively.

In the interim, the spot Bitcoin ETFs issued by WisdomTree, Franklin Templeton Valkyrie, and Hashdex did not experience any inflows on the day.

It was the most significant flow day since June 5, when the spot Bitcoin ETF issuers recorded $488.1 million inflows.

The spot Bitcoin ETF issuers generated a combined $1.04 billion in revenue this week, according to the tally from Friday.

Since their introduction approximately six months ago, the spot Bitcoin ETFs have generated $15.8 billion in net inflows.

Grayscale’s signature Bitcoin product, converted into spot form following the US securities regulator’s approval in January, accounted for over $18.6 billion in outflows.

The Hashdex Bitcoin ETF (DEFI) is the sole other spot Bitcoin ETF to experience a net outflow, albeit a relatively modest $2 million.

According to CoinGecko data, Bitcoin (BTC) has experienced a 1.1% increase in the past 24 hours and is presently trading at $57,858, totaling $57,792.

Nevertheless, it has experienced a nearly 15% decline in the past month and is currently more than 21% below its all-time high.

Nate Geraci, President of The ETF Store, has indicated that certain Bitcoin ETF issuers are preparing to release spot Ether ETH $3,115 ETFs, which could be launched as early as next week.

After receiving their initial feedback late last month, these issuers anticipate the US securities regulator’s approval of their amended S-1 registration statements.