Canada’s Purpose Investments may spur SEC approval of a U.S. spot XRP ETF, as Canada’s launch sets a key precedent for regulators.

Like the United States, Canada has an approved set of exchange-traded funds.

The most recent addition is the Spot XRP ETF, which will be operational on June 18.

Numerous spot Bitcoin and Ethereum exchange-traded funds were trading before this; however, Purpose Investments has since obtained sanction for the Ripple token ETF.

This action can potentially compel the SEC to take similar action despite US investors being divided.

Numerous factors suggest that this is a viable option. We should engage in a conversation.

Canada Is Set To Introduce First-Ever Spot XRP ETF In North America

Purpose Investments, a Canadian asset manager with an AUM exceeding $24 billion, will introduce the first-ever spot XRP ETF this week.

The Purpose Investments ETF will be listed on the Toronto Stock Exchange (TSX) under the tickers XRPP (CAD-hedged), CRPP.B (CAD non-hedged), and XRPP.U (USD predominate).

This would enable Canadian investors to possess this within their registered accounts, which include Registered Retirement Savings Plans (RRSPs) and tax-free savings accounts (TFSAs).

Due to this launch, Canada is becoming a forerunner in regulated crypto investment products.

Additionally, it challenges the United States and President Donald Trump, who is committed to ensuring that “Crypto is made in America.”

The SEC is currently experiencing regulatory delays causing it to fall behind. However, experts are optimistic that it will soon catch up.

Why United States Approve Spot XRP ETF Next?

Franklin Templeton, Bitwise, and numerous other prominent US ETF issuers anticipate the SEC’s decision on their spot XRP ETF filings.

Despite the recent delay, the experts predict that all of these will be approved in 2025.

Bloomberg analysts recently disclosed that the SEC has an 85% likelihood of approving the Ripple ETF in the fourth quarter of the year.

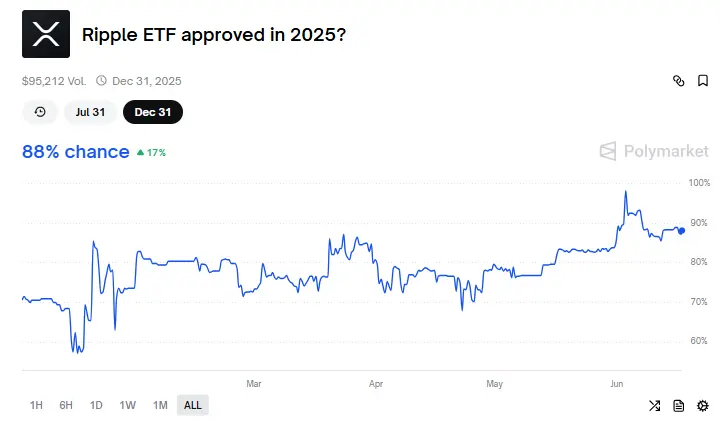

More importantly, investors anticipate the same, as the Polymarket data indicates an 88% approval likelihood.

Previously, these odds had reached 98%; however, they have since declined due to competition from the spot Solana ETF approval likelihoods.

The Ripple ETF offered by Purpose Investments has the potential to provide the SEC with additional regulatory clarity and may encourage the agency to sanction it in the United States.

Additionally, the likelihood has been elevated by the launch of numerous leveraged ETF products predicated on this cryptocurrency.

Additionally, the Ripple v. SEC case continues to pose the most significant obstacle to its approval; however, it is approaching its conclusion.

This further enhances the likelihood of approval; however, the timeline for approval remains uncertain.