Stablecoin regulation in June 2025 just got real as new laws define the future of crypto-backed finance for assets like USDC, PYUSD, and DeFi.

- 1 Introduction: The Stablecoin Moment Has Arrived

- 2 Global Overview: Regulation Heats Up Across Borders

- 3 Stablecoin Types Under the Microscope

- 4 Issuers, Custodians, and the New Gatekeepers

- 5 Technical & Legal Implications for Developers and DeFi

- 6 Risks, Gaps, and Criticism

- 7 What This Means for the Future of Money

- 8 Conclusion

- 9 Frequently Asked Questions (FAQs)

Introduction: The Stablecoin Moment Has Arrived

In June 2025, stablecoins moved from the fringes of policy ambiguity into the global financial spotlight. Once the darlings of crypto-native ecosystems and fintech experiments, they are now central to discussions in regulatory boardrooms from Washington to Brussels and Singapore.

Stablecoin Regulation in June 2025 signals the biggest policy shift since MiCA’s passage and the Biden administration’s executive order. Spurred by a surge in adoption, ongoing central bank digital currency (CBDC) pilots, and the institutional embrace of decentralized finance (DeFi), global watchdogs are stepping in to define boundaries, compliance thresholds, and supervisory responsibilities.

This article unveils what you need to know: the key jurisdictions spearheading regulation, how stablecoins are now classified (payment vs. asset-backed vs. algorithmic), new rules that issuers must follow, and the industry’s early reactions. We’ll explore what these changes mean for users, developers, and financial institutions and where things could go next.

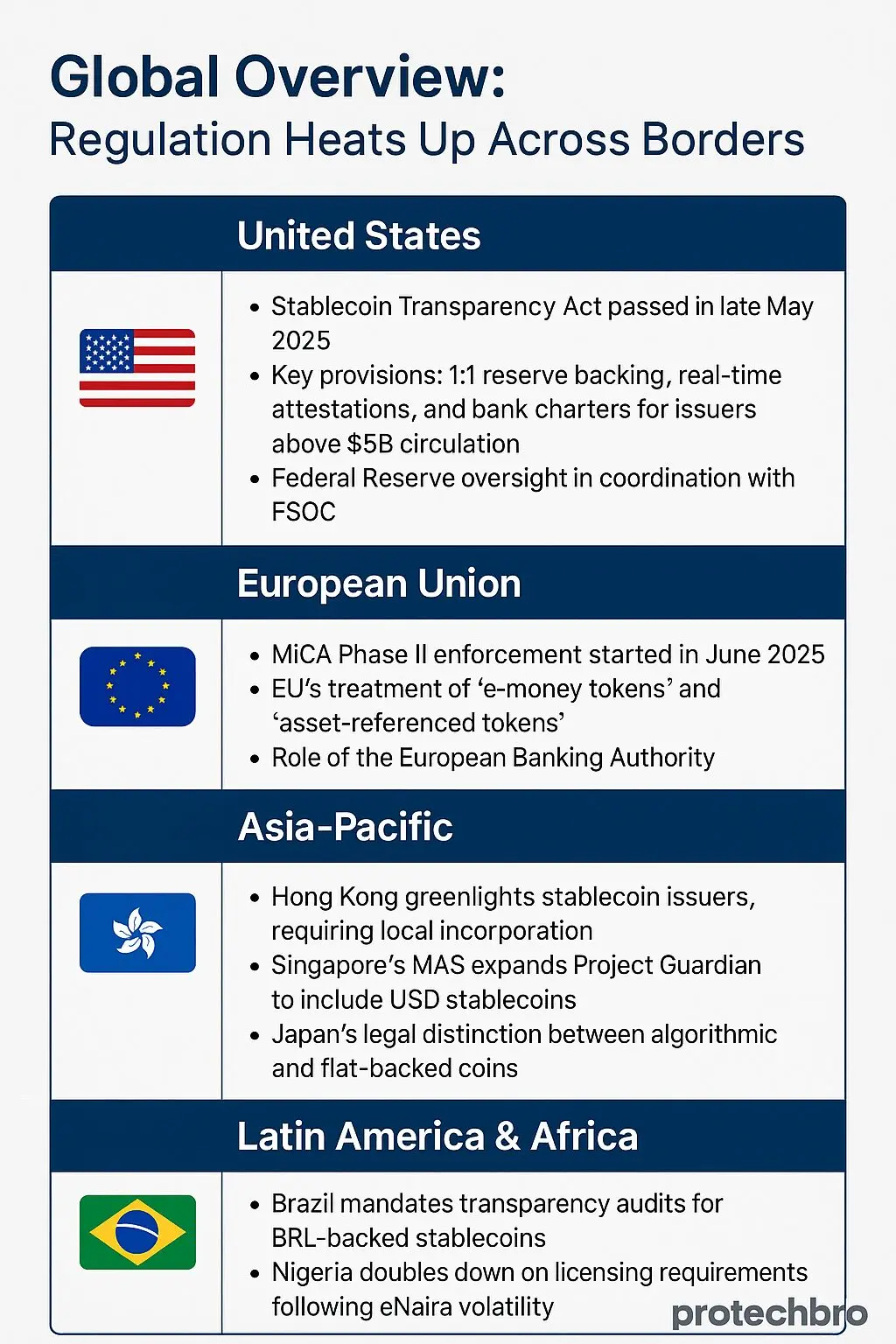

Global Overview: Regulation Heats Up Across Borders

A Global Patchwork of Stablecoin Policy

Stablecoin Regulation in June 2025 is anything but uniform. Jurisdictions are moving at different speeds, often with differing goals.

Some prioritize financial stability and consumer protection; others are focused on boosting innovation or preserving monetary sovereignty. Here’s a snapshot of how key regions are responding.

United States

With the passage of the Stablecoin Transparency Act in May 2025, the U.S. took a major leap toward regulatory clarity. Key requirements include:

- Mandatory 1:1 reserve backing with high-quality liquid assets

- Real-time public attestations of reserves

- National bank charters for issuers with stablecoins in circulation exceeding $5 billion

Oversight now falls under the Federal Reserve, in coordination with the Financial Stability Oversight Council (FSOC).

This reshapes the U.S. stablecoin market, especially for firms like Circle and PayPal.

Stablecoin Regulation in June 2025 marks the beginning of active federal supervision—something long called for by market participants and lawmakers alike.

European Union

The European Union launched MiCA Phase II enforcement in June 2025. Under the framework:

- “E-money tokens” must meet stringent reserve and redeemability standards

- “Asset-referenced tokens” face additional scrutiny over collateral composition and issuer governance

The European Banking Authority (EBA) now plays a leading role in licensing and monitoring issuers. In the EU, Stablecoin Regulation in June 2025 effectively institutionalizes stablecoins under financial law, bridging the gap between crypto-native firms and TradFi compliance structures.

Asia-Pacific

This region remains a hive of innovation and regulatory experimentation.

- In Hong Kong, regulators approved stablecoin issuers contingent on local incorporation and capital adequacy measures.

- Singapore’s MAS expanded Project Guardian to pilot USD-backed stablecoins for tokenized asset settlements.

- Japan issued legal definitions distinguishing algorithmic stablecoins (deemed high-risk) from fiat-backed ones, which are allowed under payment service provider licenses.

Asia’s fragmented but proactive approach reflects the importance of stablecoins in cross-border trade and fintech development.

As Stablecoin Regulation in June 2025 gains momentum here, the region’s regulatory frameworks are becoming models for other emerging markets.

Latin America & Africa

Emerging economies are focused on balancing innovation with monetary control:

- Brazil now requires third-party transparency audits for all BRL-backed stablecoins, targeting fintechs offering on/off-ramp services.

- Nigeria revised its licensing framework, tightening stablecoin operations after volatility around the eNaira undermined public confidence.

These reforms show that Stablecoin Regulation in June 2025 isn’t just a developed world concern.

From São Paulo to Lagos, authorities are drawing clear lines between compliant innovation and financial instability.

Stablecoin Types Under the Microscope

Not All Stablecoins Are Created Equal

As governments rush to define the boundaries of permissible digital assets, the specific type of stablecoin matters more than ever.

From fiat-backed tokens to algorithmic experiments, each category carries unique regulatory implications and risk profiles.

Understanding the distinctions is critical to complying with Stablecoin Regulation in June 2025.

Fiat-Backed Stablecoins

- Tokens like USDC, USDT, and PYUSD—backed by real dollars or high-quality reserves—are receiving the regulatory green light in most jurisdictions. These coins are now often treated like e-money or deposit equivalents. Under Stablecoin Regulation in June 2025, issuers must provide:

- Reserve backing with redeemability guarantees

- Daily or real-time attestations verified by independent auditors

- Clear segregation of client funds and compliance with AML/KYC protocols

This type remains dominant due to its simplicity, transparency, and alignment with traditional financial safeguards.

Algorithmic Stablecoins

Once hailed as the future of decentralized money, algorithmic stablecoins like Frax and the now-defunct TerraUSD are facing global resistance. Their reliance on code rather than collateral has proven too volatile for regulators. In most G20 nations, they are now:

- Heavily restricted or outright banned

- Ineligible for use by regulated financial entities

- Flagged as systemic risk vectors under Stablecoin Regulation in June 2025

Even hybrid models are under review, with central banks demanding contingency plans for depegging events.

Overcollateralized Stablecoins

Projects like DAI and crvUSD fall into a nuanced category. Backed by excess crypto collateral, these coins are designed to withstand volatility, but still face scrutiny. Under current policies:

- Issuers must publish regular, real-time reserve data

- Smart contracts are subject to audit and code disclosure

- Governance models must include risk frameworks and community safeguards

Stablecoin Regulation in June 2025 treats these assets as innovative but potentially opaque, requiring robust disclosure regimes to remain in compliance.

CBDCs: The Not-So-Stablecoin

Central Bank Digital Currencies (CBDCs) like the eNaira or digital euro are not stablecoins in the technical sense, but regulators often lump them into the same policy debates. While their issuance and backing are sovereign, oversight overlaps in areas such as:

- Consumer data protection

- Programmability rules

- Use-case limitations (e.g., cross-border payments vs. retail wallets)

Stablecoin Regulation in June 2025 doesn’t directly govern CBDCs, but parallels in compliance expectations are becoming more common as jurisdictions modernize payment laws.

Issuers, Custodians, and the New Gatekeepers

Who’s Ready and Who’s Scrambling

In the wake of Stablecoin Regulation in June 2025, the race to become a compliant issuer is redefining market leadership.

Regulated stablecoins are now favored by institutions, payment providers, and even governments exploring blockchain settlements.

Circle leads the charge, expanding globally with licenses in Hong Kong and across the EU under MiCA Phase II.

USDC remains the benchmark for compliant issuers, setting the tone for stablecoin audit standards and real-time reserve reporting.

PayPal’s PYUSD has surged into the top five by volume, thanks to transparent disclosures and strategic partnerships.

Its clear regulatory status under U.S. law positions it as a trusted option for fintech apps and cross-border use cases.

Not all players are celebrating. Tether and Binance face mounting pressure over opaque reserve practices.

Despite claims of compliance, neither meets the audit transparency now expected under Stablecoin Regulation in June 2025.

Financial watchdogs continue to probe their operations, citing systemic risk concerns.

Meanwhile, traditional finance is getting involved. JPMorgan quietly launched a programmable stablecoin pilot with the Federal Reserve, integrating blockchain settlement with institutional-grade oversight.

This move signals a new wave of compliant issuers backed by bank-grade custodianship and regulatory coordination.

As the industry matures, the future belongs to those who align with evolving standards. In 2025, surviving means adapting, and thriving means complying.

Technical & Legal Implications for Developers and DeFi

Builders, It’s Time to Lawyer Up

For DeFi builders, Stablecoin Regulation in June 2025 isn’t just legal noise—it’s a new layer of design constraints.

Protocols and developers must now factor in identity verification, reserve transparency, and cross-border data flows when integrating regulated stablecoins.

Smart contract stacks increasingly include compliance APIs and decentralized identity layers.

Tools like Chainalysis KYT APIs and Notabene’s Travel Rule toolkit (now open-sourced on GitHub) are becoming core to stablecoin interoperability. These integrations help projects remain compliant while maintaining composability.

The debate between on-chain vs. off-chain compliance is accelerating. Circle’s USDC now embeds Travel Rule metadata off-chain via verified attestations, while newer projects like OpenFi enable on-chain whitelisting for KYC’d users.

Stablecoin Regulation in June 2025 demands both auditability and user privacy—a balance many developers are still wrestling with.

DeFi protocols are also adjusting. Aave and Curve have shifted pool compositions to prioritize fiat-backed, attested stablecoins, with wrappers like zkPYUSD enabling “regulation-aware” functionality.

Uniswap v4 now supports KYC-gated liquidity pools, separating compliant from permissionless flows via custom hooks.

New developer libraries like StableComply.js and wrappers for Solidity-based compliance checks were introduced this year to ease integration burdens.

GitHub repos from ConsenSys and Circle provide open standards for reserve disclosure and verification modules.

In short, Stablecoin Regulation in June 2025 has forced developers to straddle two worlds: permissionless design and legal interoperability. Ignoring it is no longer an option—especially if you want your protocol to survive.

Risks, Gaps, and Criticism

While Stablecoin Regulation in June 2025 marks a major step forward in legitimizing digital assets, it hasn’t come without backlash. Critics argue the current frameworks risk consolidating power among centralized players while sidelining open innovation.

One major concern: high compliance costs. From legal retainers to reserve audits, new requirements are creating barriers for startups and decentralized issuers.

Smaller projects struggle to meet capital thresholds or navigate multi-jurisdictional licensing, effectively narrowing the playing field to banks, fintech giants, and well-funded platforms.

Privacy advocates also warn of creeping surveillance. Stablecoin Regulation in June 2025 has normalized wallet screening, blacklist enforcement, and real-time transaction monitoring all of which chip away at user anonymity. The debate over civil liberties in programmable money ecosystems is just beginning.

Moreover, enforcement remains a gray zone. Who’s responsible when permissionless smart contracts violate financial laws?

While centralized issuers can be fined or shut down, DeFi protocols operating via DAOs raise uncomfortable questions about legal accountability in code-based finance.

Despite these issues, policymakers argue that ignoring systemic risks is no longer viable.

Yet the current approach may be creating a two-tier stablecoin market: one that’s regulated and centralized, and another that’s decentralized but increasingly excluded from financial infrastructure.

Stablecoin Regulation in June 2025 may bring order, but it also brings hard trade-offs. Whether this framework evolves to support both innovation and oversight remains the question regulators and builders must urgently answer.

What This Means for the Future of Money

Stablecoin Regulation in June 2025 has reshaped the digital economy. What was once a fringe innovation is now a regulated fixture of global finance.

Today, stablecoins account for nearly 10% of all digital asset payments worldwide, a figure projected to double by 2027 according to IMF estimates.

Mainstream adoption is accelerating, driven not just by crypto-native users but by banks, remittance firms, and even governments.

ISO 20022-compliant stablecoins are being piloted across cross-border corridors, creating new bridges between CBDCs and permissioned blockchains. These integrations are laying the groundwork for global interoperability.

New infrastructure is emerging: compliance-focused stablecoin layers now serve as trusted on-ramps into the regulated Web3 economy.

Protocols like Base and Linea have launched “KYC-native zones” where only verified stablecoins can circulate, ensuring both consumer protection and institutional compatibility.

The programmable dollar is no longer theoretical. Smart contract-based disbursements, automated tax withholdings, and interest-bearing stablecoins are being tested in multiple regions.

Stablecoin Regulation in June 2025 has turned stablecoins into programmable financial instruments with real policy teeth.

Yet this legitimacy comes with trade-offs, reduced privacy, higher compliance costs, and regulatory gatekeeping. Still, the benefits are clear: greater trust, reduced volatility, and integration with the broader financial system.

In short, the stablecoin has graduated. It’s no longer just a tool for crypto—it’s a cornerstone of the future of money.

Conclusion

Stablecoin Regulation in June 2025 has drawn a bold line between the experimental past and the institutional future of digital finance.

Across jurisdictions, we’ve seen major shifts: the U.S. implementing strict reserve and licensing rules, the EU activating MiCA Phase II, Asia pushing integration through sandbox pilots, and emerging markets tightening oversight to curb volatility.

The implications are profound. Stablecoins are no longer operating in legal limbo—they’re becoming foundational components of a new financial stack.

Developers must now build with compliance in mind. Issuers face stricter audits, and users must balance convenience with privacy trade-offs.

Yes, regulation limits some of the ideological freedoms that made stablecoins appealing. But in exchange, it unlocks something bigger: scale, credibility, and mass adoption.

The programmable dollar is here—and it’s no longer just for the crypto-native crowd.

So what’s next? Stay informed. Stay compliant. And build for the new regulated frontier of programmable finance. Because the stablecoin era didn’t end in 2025, it just grew up.

Frequently Asked Questions (FAQs)

What is the Stablecoin Regulation in June 2025 all about?

It’s a global regulatory shift introducing mandatory reserve backing, audits, and compliance standards for stablecoin issuers.

Which countries have introduced stablecoin regulation in 2025?

The U.S., EU, Hong Kong, Singapore, Japan, Brazil, and Nigeria rolled out stablecoin frameworks as part of Stablecoin Regulation in June 2025.

Are algorithmic stablecoins banned in 2025?

Yes, most are restricted or banned due to instability risks under Stablecoin Regulation in June 2025.

What does stablecoin regulation mean for crypto developers?

It requires integrating compliance features like KYC, reserve attestations, and smart contract transparency.

How can a startup comply with new stablecoin rules?

Ensure 1:1 backing, use audited reserves, obtain licenses, and follow KYC/AML protocols to meet Stablecoin Regulation in June 2025.