Hong Kong leads Eastern Asia in cryptocurrency adoption, with 40% of the region’s value in stablecoins, marking the fastest growth rate in the global market.

In several Eastern Asian nations, fiat currencies are beginning to give way to cryptocurrencies and stablecoins, underscoring the importance of these financial instruments for developing countries.

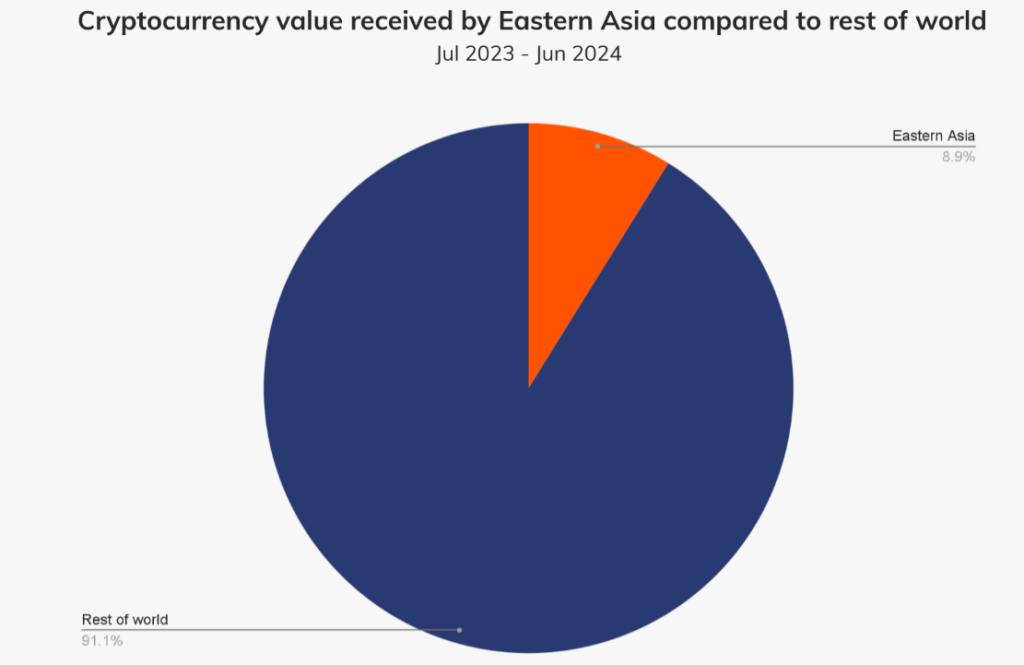

According to a Chainalysis analysis published on September 17, 2024, Eastern Asia became the sixth-largest cryptocurrency economy in 2024, contributing more than 8.9% of cryptocurrencies received worldwide between June 2024 and July 2023.

Maruf Yusupov, co-founder of Deenar, a digital stablecoin backed by actual gold, claims that nations with persistent fiat currency devaluation and high inflation rates contribute to the growing popularity of cryptocurrencies and stablecoins.

In a statement provided to Cointelegraph, Yusupov wrote:

“In most emerging markets, stablecoins are gradually replacing fiat because of lower barriers to entry, low cost, and ease of use. If the current adoption trend is sustained, the asset might fuel lower patronage to traditional banks as we have it today.”

In particular, for cross-border transactions, which can be costly for developing nations, stablecoins are starting to emerge as a quicker and less expensive substitute for conventional bank transfers. According to Statista, if remittance fees were associated with a bank account transfer, they would have cost an average of 7.34% of the transfers made in 2024.

Between June 2024 and July 2023, Eastern Asia received an onchain value of more than $400 billion.

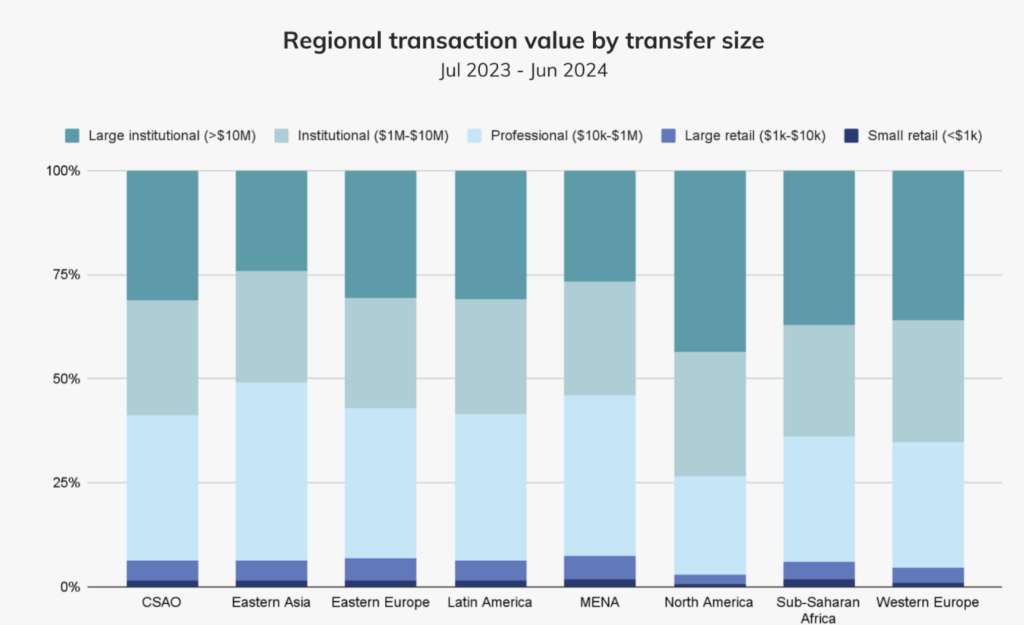

Professional and institutional investors drive the crypto activity in Eastern Asia.

Institutional and professional investors are probably at the forefront of most of the bitcoin activity in East Asia.

Based on the high average amount of digital asset transfers, the majority of the increased activity was driven by institutions, according to the Chainalysis research, which stated:

“Notably, Eastern Asia accounts for the largest share of professional-sized transfers compared to any other region studied in this report.”

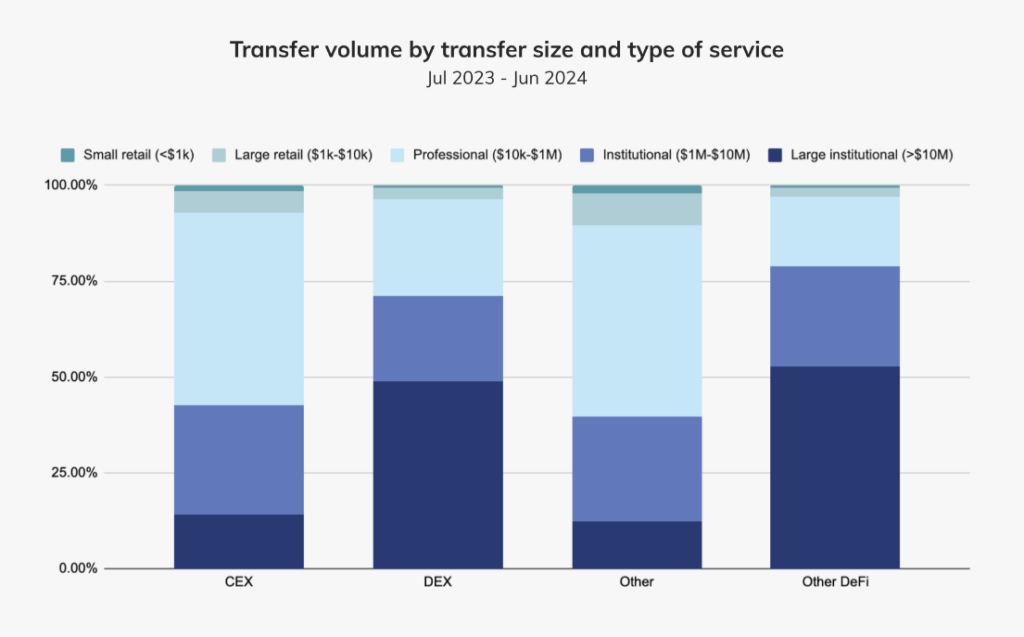

Professional investors, on the other hand, continued to choose centralized exchanges (CEXs), whereas institutional investors mostly used DEXs and other DeFi (decentralized finance) services.

Because of their wide range of asset coverage, DEXs are said to offer “more arbitrage opportunities than CEXs” in the research.

The goal of Hong Kong being a cryptocurrency hub is starting to come true.

Based on the rise in digital asset activity in the area, Hong Kong’s ambitions to establish itself as a global center for cryptocurrencies are beginning to bear fruit.

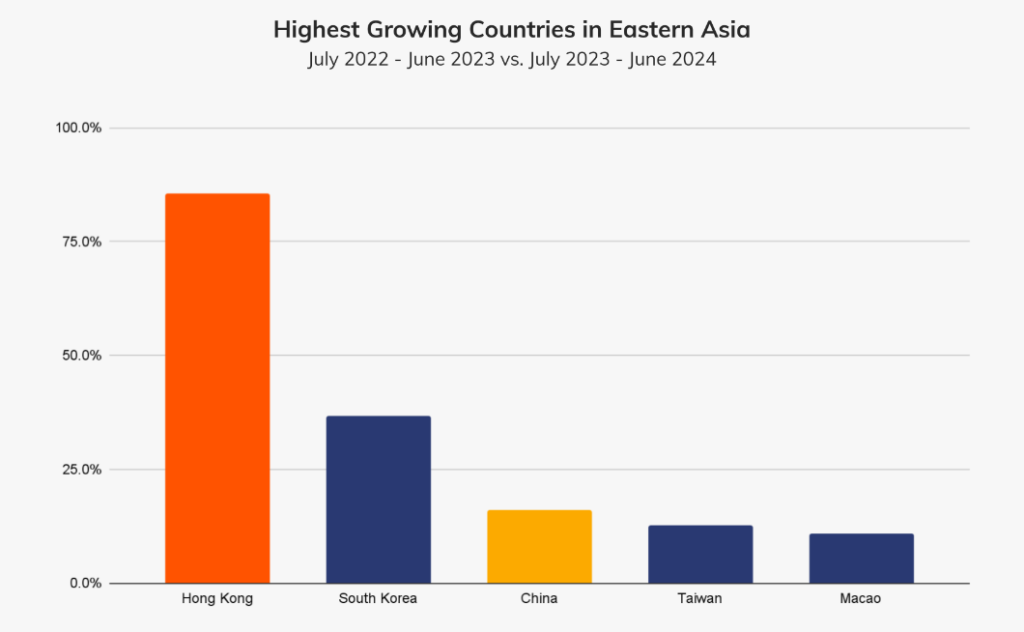

South Korea and Hong Kong are the two Eastern Asian nations with the highest year-over-year growth rates in bitcoin adoption, with Hong Kong experiencing a growth of almost 85.6%.

Statleccoins make up more than 40% of the total value received in Hong Kong and have played a significant role in this notable surge.

However, Yusupov noted that increased regulatory control will result from the expanding use of stablecoins:

“Central Banks will do what they can to limit the impact of stablecoins on fiat dominance. Also, new scam models might arise due to the growth in stablecoin usage globally. While innovators are fixated on the revolutionary tendencies of stablecoins, preparation for headwinds must go hand in hand.”

The increased activity may be related to changes in regulations. Hong Kong’s regulators made public the initial proposal for a new stablecoin licensing system for fiat-backed stablecoin issuers in July 2024.