Dubai’s real estate flourishes, with 2024 rents up 23% and sales up 18%. Stake expands to Abu Dhabi with $14M funding, eyeing Saudi Arabia and global growth.

The UAE has a fortunate issue: abundant purchasers, and the real estate market is flourishing. According to Deloitte, Dubai rents increased by 23% annually in 2024 to reach pre-pandemic levels, and sales increased by 18%. This increasing trend is expected to continue in the upcoming years.

Undoubtedly, some of that demand is also present in Abu Dhabi, which is probably why Mubadala Investment Company, the city’s sovereign wealth fund, recently took part in a $14 million Series A round led by Dubai-based Stake. The stake will introduce its fractional property investment platform to the UAE capital early in 2019.

Middle East Venture Partners spearheaded Series A, involving Wa’ed Ventures of Aramco and Republic, a private investment platform.

Manar Mahmassani, Rami Tabbara, and Ricardo Brizido founded a stake in 2020, and they intend to use the extra money to support their ambitions for global expansion. Specifically, the company expects to use most of the funds to grow into Saudi Arabia over the coming months and into Abu Dhabi the following year. Some funds will also provide additional choices in Dubai, such as commercial real estate investment. To date, the firm has secured $26 million in funding.

Supporting businesses like stake, which facilitates real estate participation by allowing anyone to purchase a portion of a particular property, makes sense for Abu Dhabi in terms of increasing investment in its real estate sector. Over time, the Emirate has developed into a popular residential destination for Dubai workers who find living in the city too expensive. It also fits in well with Abu Dhabi’s long-term strategy to diversify its sources of income beyond the extraction of oil and gas.

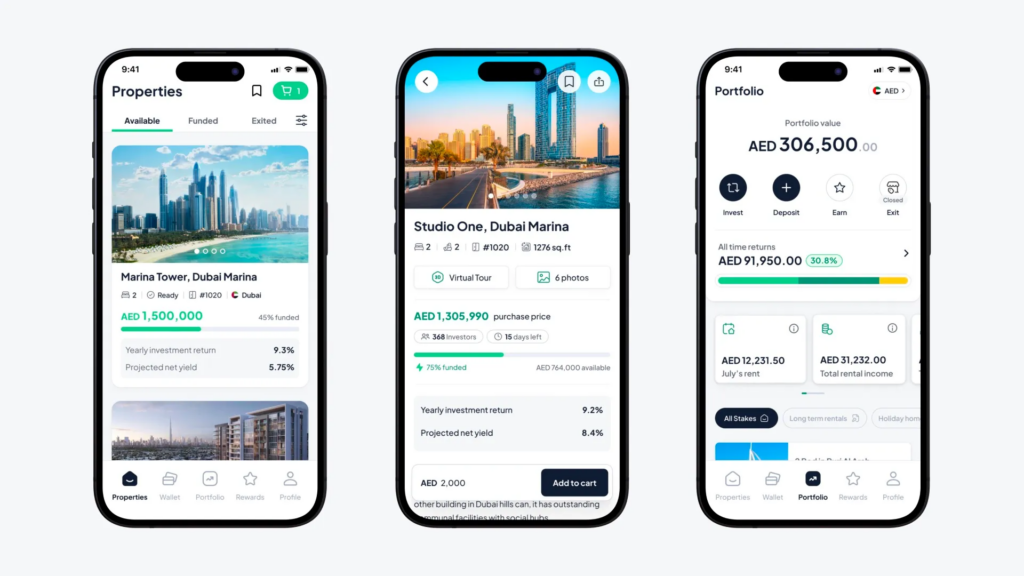

Investing in real estate can be done quickly with stakes. It allows you to own a portion of a property that it maintains for shareholders and receive a portion of the monthly rentals. The investors also receive a portion of the profits if the property is sold. Stake launches a secondary market called Exit Windows every six months, where investors may sell their stake.

Currently, the stake is managing over 200 properties for investors from around the world. The majority of its clients are from the United Arab Emirates, and the majority of its foreign clientele is from Saudi Arabia and Kuwait. Thirteen percent of its clientele are Americans, Canadians, and British.

The stake had previously stated it would enter Saudi Arabia and Egypt in 2022 but postponed those plans due to economic uncertainty. This indicates that the stake has been preparing to grow outside Dubai for some time. The business teamed up with Republic, a U.S.-based private investment platform, to draw in more foreign investors earlier this year.

Additionally, the business is partnering with the Dubai International Financial Centre (DIFC) to provide investors who commit at least AED 2 million (~$545,000) a 10-year renewable residency visa in Dubai, known as a golden visa, to attract more foreign investors. The program was launched in 2019 to lure foreign capital into the area. It is said that such endeavors have aided foreign nationals in propelling real estate investments in the region.

The company gives its clients a rental income return of between 4% and 7%. Co-CEO Tabbara and Mahmassani said that the company has already paid its clients $4.5 million in rental income. He continued by saying that, on average, users invest $5,600 through the program, with $1,500 going toward houses.

Getting into Saudi Arabia

Stake says it has outperformed fractional real estate investing platforms like Smartcrowd, which is situated in Dubai; nevertheless, it will start from scratch in Saudi Arabia.

Companies like Awaed and Aseel, which enable clients to invest in real estate through funds, are already present in Saudi Arabia. Historically, freehold property ownership in Saudi Arabia has only been available to Saudi natives. As a result, real estate investment firms create unique entities that enable investors to purchase real estate.

Saudi Arabia possesses assets valued at billions, both under development and recently completed. We plan to leverage our experience to provide a unified solution within the same comparable app for investment in Saudi Arabia,” Mahmassani stated.

Mahmassani stated that the stake hopes to turn a profit in Dubai by the end of this year and break even by the following one. The business is also looking into joint ventures to enable Middle Easterners to purchase real estate in the United States and other countries.