Standard Chartered raises Ethereum’s year-end target to $7,500, driven by staking demand, ETF inflows, and strong market momentum.

The price of Ethereum (ETH) increased as Standard Chartered increased its year-end target. This prediction was founded on the firm’s assessment of robust market momentum and the increasing demand for stablecoins.

The bank cites stablecoin growth and staking demand in a bullish Ethereum outlook

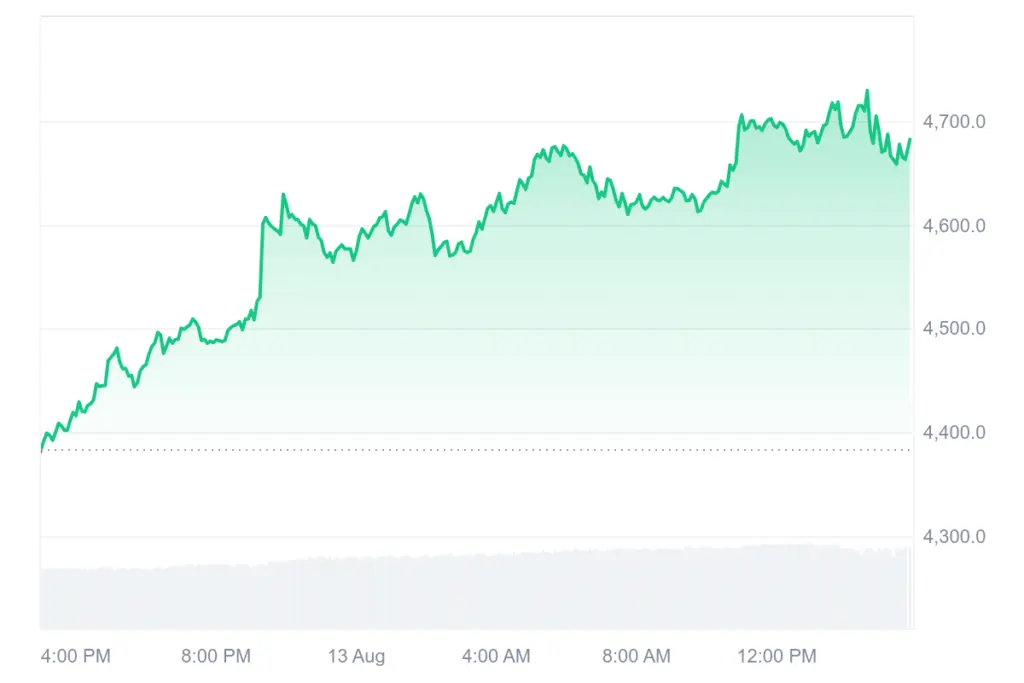

According to a report by Reuters, Standard Chartered has raised its year-end prognosis for Ethereum from $4,000 to $7,500, citing a surge in ether holdings and stronger industry participation. Wednesday’s multi-year peak of $4,700 is nearly 60% exceeded by the bank’s new projection.

Ethereum has gained popularity among investors interested in active returns, as it is the second-largest cryptocurrency globally. In contrast to Bitcoin, it is possible to stake Ethereum, which allows holders to lock their balance and contribute to the network’s profitability.

The token’s price has increased by more than 50% due to the Genius Act being signed by the US president. This legislation establishes a regulatory framework for stablecoins, encouraging their widespread adoption. Other digital assets have also experienced growth amid expectations that the bill will foster broader acceptance.

Geoff Kendrick, the director of digital assets research at Standard Chartered, stated that the bank anticipates that the stablecoin market will expand by approximately eightfold by the conclusion of 2028. As most stablecoins are issued and transacted on Ethereum’s blockchain, he observed that this would directly increase Ethereum network fees. For transaction costs, these transactions necessitate ETH.

Kendrick emphasized that Ethereum’s long-term expansion will be contingent upon utilizing its primary Layer 1 blockchain for high-value transactions, particularly in traditional finance. In addition, he stated that this objective could be accomplished through substantial enhancements in Layer 1 capacity.

In light of this outlook, Standard Chartered also increased its ETH projection for 2028 to $25,000. Contrary to the $7,500 forecast for the end of the year, this signifies a 233% increase. In the future, Kendrick projected that Ethereum treasury firms will likely hold 10% of the total ETH supply.

Increased confidence in Ethereum’s function in the crypto economy and the broader financial markets is indicated by this upward trend. The price of ETH is expected to continue increasing throughout the remainder of 2025 and into the future due to the increasing activity of stablecoins, regulatory clarity, and staking rewards.

The price of Ethereum has increased by 5.56% in the past 24 hours to $4659.12. The greatest price recorded during this trading session was $4,682.10. Trading activity also increased, with the 24-hour volume rising by 36.81% to $65.29 billion.

The price rises steadily throughout the day. Since trading at $4,232.10, the coin has been consistently moving upwards, as demonstrated by the chart.