Standard Chartered warns Solana that it risks becoming a “one-trick pony,” with memecoin trading fading as its primary use.

Blockchain at the layer one level According to a recent report by Standard Chartered, Solana may be transitioning into a “one-trick pony” for meme coin generation and trading.

Solana’s design prioritizes rapid and inexpensive transaction confirmation, as indicated by a May 27 Standard Chartered research report shared with Cointelegraph, which explains why it “dominates in areas that demand high-volume, low-transaction-cost solutions.”

The report posited that this has resulted in an unintended consequence:

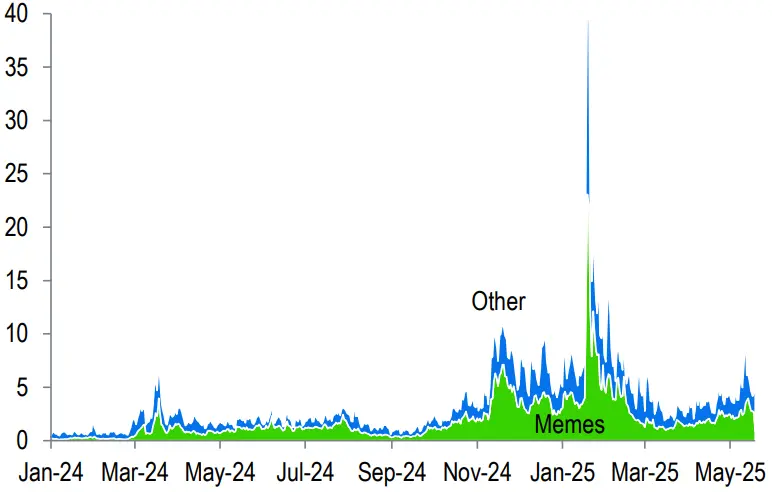

“So far, this has been mostly in memecoin trading, which accounts for the majority of activity on Solana (as measured by ‘GDP’, which is application revenue).”

Standard Chartered stated that the memecoin frenzy was a stress test for Solana’s scalability, but it also had drawbacks due to these assets’ speculative and volatile character.

The bank cautioned that Solana may struggle to maintain momentum as memecoin trading volumes decrease.

Memecoin Trade Has Passed Its Peak

The report stated that the peak of Solana-based meme coin activity has passed and that “declining usage and trading ‘cheap’ are not a good mix.”

The bank recommended that Solana diversify into additional industries that necessitate the efficient and cost-effective processing of substantial volumes of transactions.

According to the report, these sectors may encompass traditional consumer applications, such as social media and high-throughput financial applications.

Nevertheless, the bank has indicated that scaling these applications may require years, which could have severe repercussions for Solana.

“As a result, we expect Solana to underperform Ethereum over the next two to three years, before catching up, at least in real terms.”

Solana’s Edge Is Waning

Solana has long been recognized as a layer-1 blockchain that is both quick and cost-effective, and it supports smart contracts, thereby directly competing with Ethereum.

Nevertheless, that margin may be contracting.

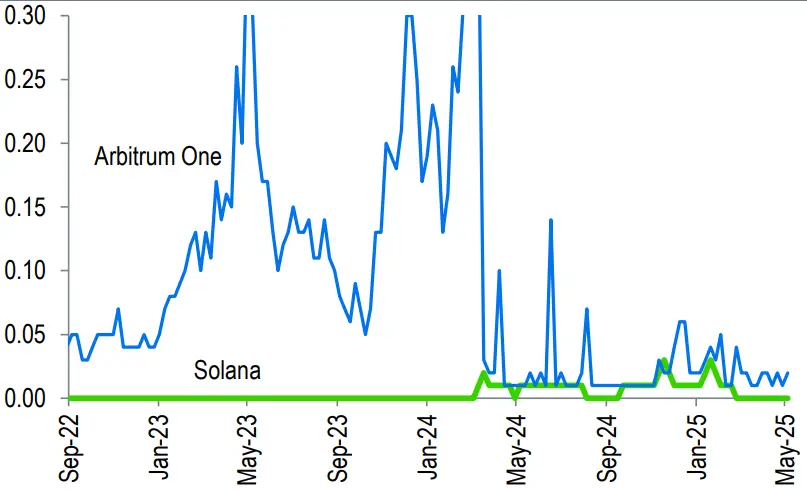

Since the Dencun network enhancement in March 2024, Ethereum layer-2 platforms have surpassed Solana regarding average transaction cost.

This change has pressured Solana’s value proposition as the most cost-effective, high-throughput blockchain.

Standard Chartered recognized that Ethereum’s modular design, which separates data availability, execution, and consensus, has enabled it to scale more efficiently while maintaining decentralization:

“The modular approach allows Ethereum to scale transactions at a low cost (post-Dencun upgrade) while maintaining the security benefits of a highly decentralised mainnet blockchain.”