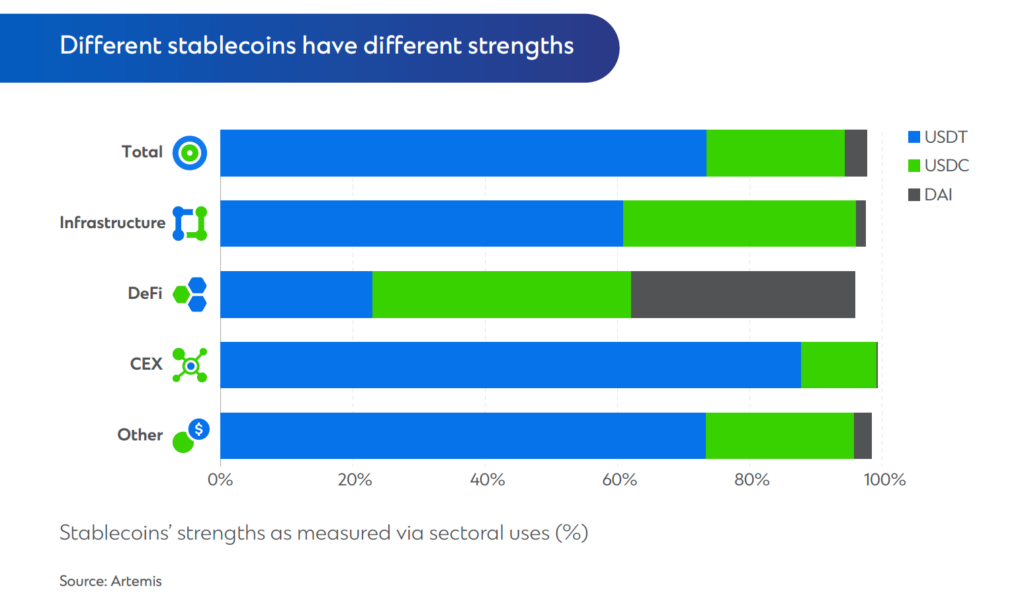

Stablecoins are moving from their original usage in cryptocurrency exchanges to more extensive uses in international finance, per a Standard Chartered analysis.

According to a survey, stablecoins are increasingly used in nations like Brazil and Nigeria for transactions and currency substitution.

According to the survey, stablecoins are increasingly utilized for typical finance-related functions, including cross-border payment facilitation and saving and trading US dollars.

Standard Chartered remarks on the changing major use case for stablecoins.

“There is growing evidence of increasing stablecoin use for a variety of purposes akin to those provided in traditional finance.”

The paper claims that the need for quicker and easier cross-border transactions is a significant driver causing this change. There are drawbacks to traditional correspondent banking arrangements, particularly in developing markets where access is dwindling. By allowing the transfer of digital dollar assets at speeds similar to email, stablecoins provide an alternative to the sluggish and occasionally unreliable existing channels.

According to the report, stablecoins are increasingly used for cross-border USD-to-USD transactions, USD-to-USD transactions, and USD-to-USD savings. According to a survey mentioned in the paper, 69% of respondents in nations including Brazil, Turkey, Nigeria, India, and Indonesia use stablecoins to replace their currency, 39% to pay for products and services, and another 39% to make cross-border payments.

Although 99.3% of the market capitalization comprises US dollar-pegged stablecoins, interest in non-USD stablecoins is growing. The rise of stablecoins tied to other currencies, like the Turkish lira, suggests that the ecosystem may move toward more varied offers.

Additionally, the paper points out that the stablecoin market cap is currently $163 billion, which is minor compared to the size of the financial markets as a whole but has a lot of potential for expansion. Regulation developments are linked to the possibility of expansion. According to the report,

“We expect this use case to continue to grow, particularly if U.S. stablecoin regulation is passed, as now looks likely under a Trump administration.”

According to Standard Chartered, stablecoins’ increasing use in practical applications emphasizes their status as a “first killer app” for digital assets. They give the unbanked an alternative and offer cross-border transaction efficiency that traditional systems have not yet been able to match.

According to the Standard Chartered analysis, stablecoins have a bright future ahead of them, with the potential for growing acceptance in established and developing countries. Stablecoins may become essential to the global financial system due to governmental support and technological innovation.

Regardless of this month’s election outcome, Standard Chartered has recently expressed optimism about Bitcoin and the larger cryptocurrency market, advising investors to buy the cryptocurrency below $60,000. Investors who took this advice have seen significant gains quickly as Bitcoin has rallied toward $100,000.