“State Street plans to launch a digital asset platform for institutional clients, managing $4.4 million in assets as of August 20.”

“$44.3 trillion in assets under custody and administration and $4.4 trillion in assets under management,” the company disclosed.

In association with Taurus, a provider of digital asset infrastructure, the platform will provide custodial services, node management, and tokenisation services to institutional clients. Lamine Brahimi, co-founder and managing partner of Taurus SA, said the following after the announcement:

“We believe custody and tokenization are the two faces of the same coin, especially when it comes to performing asset servicing of tokenized securities.”

State Street claims that the company will be able to expedite the process of servicing and issuing digital assets, including “digital securities and fund management vehicles,” by utilising Taurus’ Taurus-PROTECT, Taurus-CAPITAL, and Taurus-EXPLORER products.

Organisations Adopting Digital Assets.

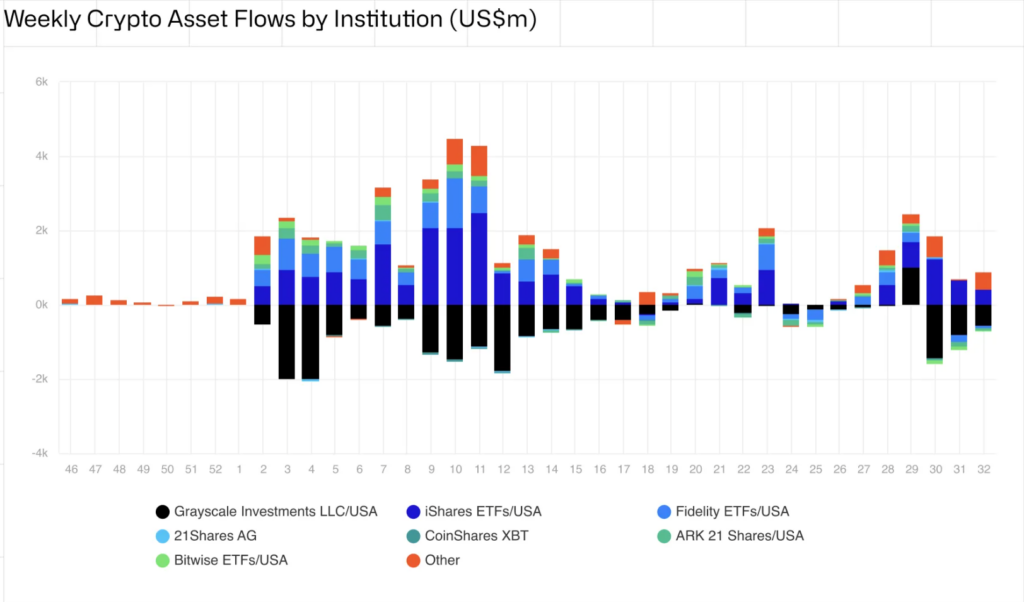

In the aftermath of BlackRock’s spot Bitcoin ETFs, which debuted at $60,682 in the US, institutional interest in digital assets and their investment vehicles skyrocketed.

According to recent Bitwise data, in the second quarter of 2024, 66% of institutional Bitcoin investors either held or increased their holdings of BTC. To be more precise, 22% of those investors held their investments without earning additional Bitcoin, while 44% increased their exposure to the scarce digital asset.

Head of investment research at Sygnum Bank Katalin Tischhauser recently saidthat during the first year of the ETF’s live trading, capital invested in Ethereum ETFs might rise to $10 billion in assets under management.

According to an unidentified source, Morgan Stanley has allowed its 15,000 advisors to suggest Bitcoin ETF options to customers starting on August 7. According to the source, Morgan Stanley only made pitches for Fidelity’s Wise Origin Bitcoin Fund (FBTC) and BlackRock’s iShares Bitcoin Trust (IBIT).

Despite the recent market turbulence of the past week, inflows into Bitcoin ETFs are still strong, with about $11 million flowing into the investment funds on August 15.