Strategy’s 11th weekly Bitcoin buy adds to its $41.84B stash, but MSTR stock dips with BTC’s decline, trading at $362.75.

Despite the recent adverse price action, Strategy, formerly MicroStrategy, is not abandoning its plans to acquire Bitcoin. The decline has been purchased by Michael Saylor’s organization, which has now made its eleventh consecutive weekly BTC purchase. In the interim, the MSTR stock has experienced a decline of approximately 2% in premarket trading.

Strategy Purchases 245 BTC for $26 Million

The company disclosed in a press release that it acquired 245 BTC for $26 million, with an average price of $105,856 per Bitcoin. It has also attained a BTC yield of 19.2% year-to-date (YTD). The company currently possesses 592,345 BTC, which it acquired for $41.87 billion at an average price of $70,681 per BTC.

This purchase is Strategy’s least significant Bitcoin acquisition this year, succeeding the 705 BTC acquisition that the company executed at the conclusion of May last year.

Yesterday, Michael Saylor, in his customary manner, indicated that they had made another Bitcoin purchase when he shared Strategy’s Bitcoin portfolio tracker. This acquisition was made despite the Israel-Iran conflict, which resulted in Bitcoin’s first decline below $100,000 in 45 days.

Nevertheless, Strategy and Saylor persist in demonstrating that they are unconcerned by the decline as they continue accumulating Bitcoin at an unprecedented rate. Saylor recently reaffirmed his confidence in the premier crypto by predicting that BTC will reach $21 million in 21 years.

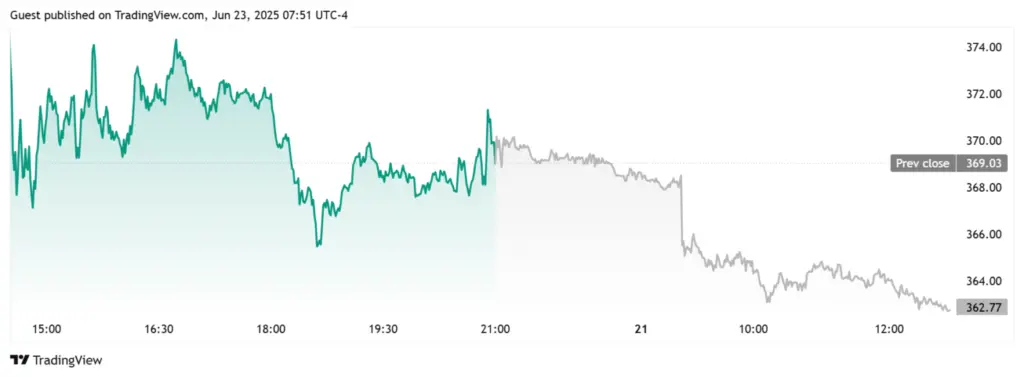

The stock of MicroStrategy and Bitcoin have both declined in response to the recent acquisition announcement. According to TradingView data, the MSTR stock price is currently trading at approximately $363, a decrease of roughly 2% in premarket trading.

MSTR has lost some of its year-to-date gains due to its recent decline and has been up just over 27% since the year began. Nevertheless, MarketWatch data indicates that the Strategy stock has experienced a gain of more than 169% in the past year.

It is important to mention that the most recent acquisition represents the organization’s eleventh consecutive weekly acquisition. The firm’s record of twelve consecutive weekly Bitcoin purchases, which it achieved between November of last year and early February of this year, will be matched by another weekly purchase this week.