Michael Saylor’s Strategy added more Bitcoin as the price surged past $110K, continuing its position as the top corporate BTC holder.

As the price of Bitcoin momentarily exceeded $110,000 last week, Michael Saylor’s Strategy, the world’s largest corporate Bitcoin investor, acquired a new stash of BTC.

According to a press release issued on May 26, Strategy acquired 4,020 Bitcoin for $427.1 million between May 19 and 23.

The most recent acquisitions were conducted at an average price of $106,237 per coin, with Bitcoin surpassing $110,000 on May 22.

The acquisition was the fourth Bitcoin purchase by Strategy in May, bringing the total BTC holdings of the company to 580,250 BTC.

The acquisition was completed for approximately $40.6 billion at an average price of $69,979 per coin.

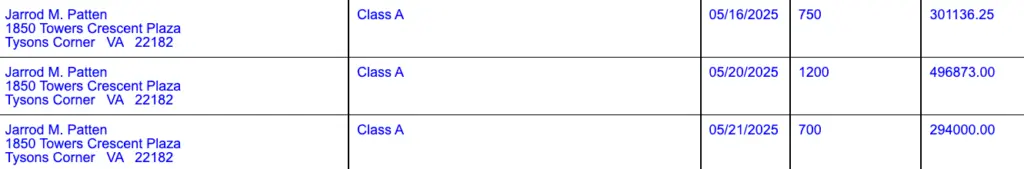

Strategy Director Disposes 2,650 Shares Of MSTR

Michael Saylor’s company recent Bitcoin acquisition resulted from a series of Class A transactions by Strategy Director Jarrod Patten.

Patten sold 2,650 MSTR shares between May 16 and 21, which are valued at nearly $1.1 million, according to the company’s report of the proposed sale of securities filed on May 22.

Patten has sold 17,050 Class A shares valued at $6.7 million since April 22.

Furthermore, an amended report filed on May 23 indicates that Andrew Kang, Strategy’s chief financial officer, sold 2,185 Class A shares, resulting in a profit of $719,447.

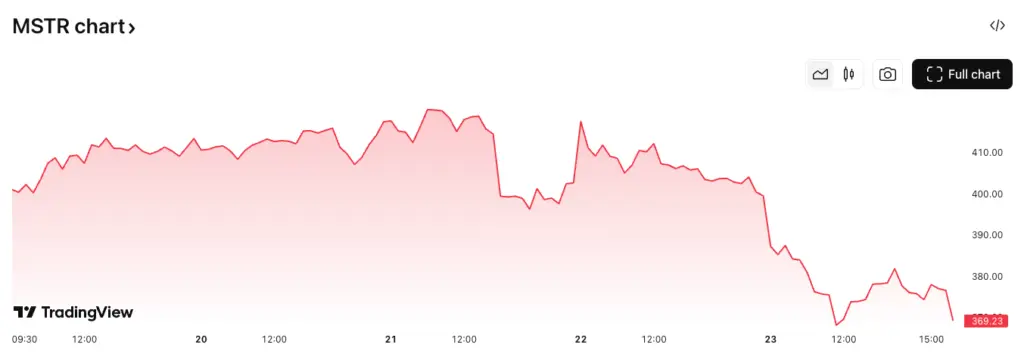

Following Class-Action lawsuit, MSTR Experienced 2% Decline

The company’s recent acquisition of Bitcoin indicates his commitment to purchasing it at the highest possible price, regardless of its current value.

In late 2024, he declared that he would continue to do so indefinitely.

In the interim, Michael Saylor’s company shares have experienced a decline from their all-time highs, with a minimum of 12% loss in the past week.

TradingView data indicates that the price has fallen from approximately $420 to $369.

On November 19, 2024, the most excellent historical closing price for MSTR stock was approximately $474.

The recent decline in the company shares was precipitated by a class-action lawsuit that accused the company of misrepresenting Bitcoin investments.

The lawsuit, which was filed on May 19, is intended to recoup the losses of shareholders allegedly harmed by securities fraud in April 2025.