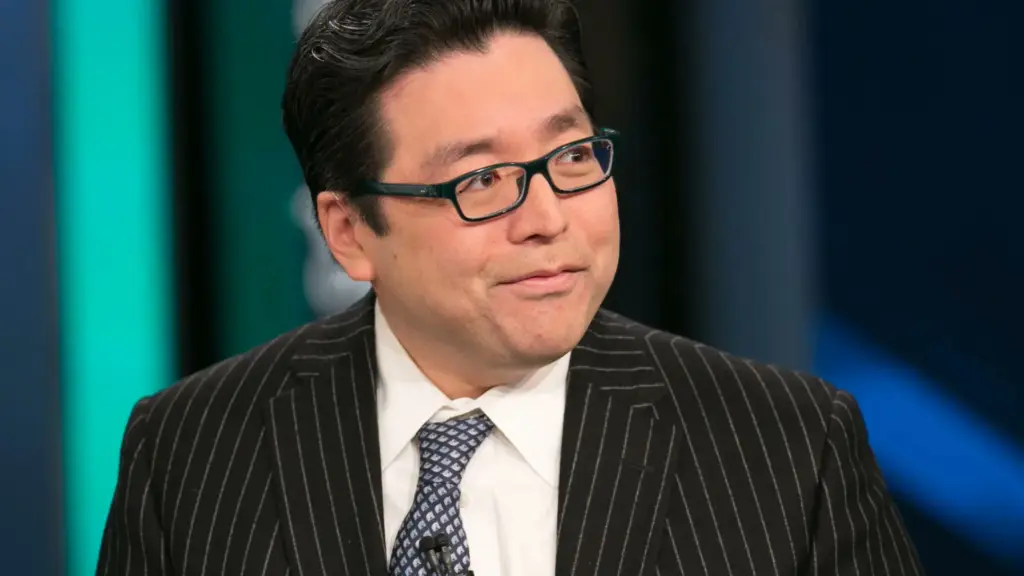

Tom Lee, BitMine Chairman, predicts Strategy could be the largest stock exchange company if Bitcoin hits $1M, citing its 628,791 BTC holdings.

According to Tom Lee, the Chairman of BitMine, Michael Saylor’s Strategy has the potential to become the largest company on the stock exchange at some point. Given the company’s exposure to the premier cryptocurrency, he hinted at the potential for Bitcoin to contribute to this significant accomplishment.

A Bold Prediction for Strategy and Its Bitcoin Bet by Tom Lee

The BitMine Chairman recently predicted in a podcast that Strategy could become the largest company on the stock market, particularly if the Bitcoin price reaches $1 million. This occurred as he observed how the company’s founder, Michael Saylor, altered the stock market’s reality.

Tom Lee clarified that Strategy and its founder do not generate gap net income to substantiate their expansion. Instead, they are more concerned with the value of their balance sheet, which is centered around Bitcoin.

The BitMine Chairman also stated that this action is not unprecedented in history, which is why he is confident that the company has the potential to become the greatest public company in the United States. He observed that ExxonMobil was among the top five companies on the S&P 500 for an entire generation; however, the company’s value was derived from the value of its energy rather than its net income.

Tom Lee stated that Strategy superseded ExxonMobil and could become the largest public company. In this scenario, the company’s value will be determined by its Bitcoin holdings, rather than its earnings or any other metric.

Acknowledging that the organization has significant work to do to become the largest public company. Strategy has a market capitalization of $2.52 billion, with the MSTR stock currently trading at approximately $380. Microsoft and NVIDIA are the largest corporations, with market caps of $3.9 trillion and $4.3 trillion, respectively.

Completely invested in Bitcoin

The company, which Saylor owns, currently possesses 628,791 BTC, which it acquired for $46.08 billion. In the interim, it has recently submitted a $4.2 billion STRC offering, to utilize the net proceeds to acquire additional Bitcoin.

Strategy reiterated its commitment to Bitcoin in a recent X post, designating it as its primary reserve asset. At present, the organization maintains $71 billion in Bitcoin. In the interim, it possesses a mere $50 million in fiat currency.

Saylor’s organization is presently among the top 10 largest corporate treasuries in the United States, surpassing PayPal, NVIDIA, and ExxonMobil due to this Bitcoin strategy. The company has an advantage over these other companies in that it holds BTC, which could continue to appreciate due to its volatility, whereas the others hold capital.

In the interim, BitMine, which Tom Lee owns, is considering implementing Saylor’s approach. The organization is employing Ethereum to replicate this model instead of Bitcoin. It is presently the largest public Ethereum holder, with 833,100 ETH, similar to Strategy, the largest public Bitcoin holder.