Strategy, formerly MicroStrategy, paused its weekly Bitcoin buys after 12 straight weeks, as MSTR stock slips amid broader market pressure.

After accumulating Bitcoin for 12 weeks, Strategy, formerly MicroStrategy, disclosed that it made no purchases last week.

The business also disclosed an unrealized gain on its Bitcoin investment for the second quarter.

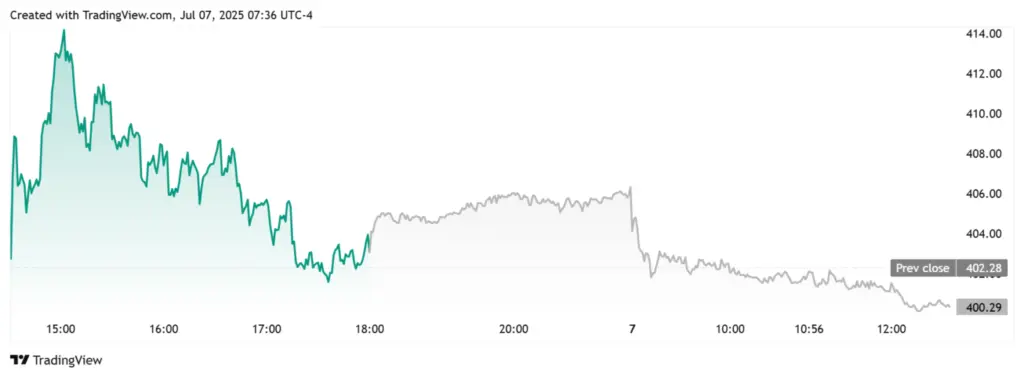

The MSTR stock is down in premarket trade on this development, having fallen from its close of $404 last week.

Strategy Postpones Purchasing Bitcoin

According to an SEC filing, the corporation did not sell shares or purchase any Bitcoin last week.

With an average price of $70,982 per Bitcoin, the company paid $42.40 billion for 597,325 BTC, which it still possesses.

Nonetheless, Strategy said that during the quarter ending on June 30, 2025, it realized an unrealized gain of $14.05 billion on digital assets.

The company’s digital assets were worth $64.36 billion as of June 30.

After 12 weeks, the company’s inability to purchase Bitcoin last week stopped its weekly purchases, missing a new milestone.

The company paid $531.9 million for 4,980 BTC last week, matching a previous record set between November 2024 and early February, when it bought BTC for 12 weeks.

It was thought that Michael Saylor, one of the company’s co-founders, was hinting at another acquisition when he shared Strategy’s Bitcoin portfolio tracker.

“Some weeks you just need to HODL,” he wrote as the caption for the photo, which, looking back, suggests that they chose to hold onto what they already had rather than buy anything.

Saylor and Strategy have indicated they intend to keep owning and amassing as much Bitcoin as possible.

Saylor said that Bitcoin is the coin he will never sell in a recent X post.

In Premarket Trading, MSTR Is Down

Meanwhile, MicroStrategy’s stock remains down in premarket trade despite the most recent development, dropping from its close of $404 last week.

According to TradingView data, the MSTR stock is currently trading at about $400 and could lose this psychological threshold.

Nonetheless, it is essential to note that on July 3, the price of MSTR stock rose by up to 8%, regaining the psychological $400 level.

Reports that Strategy was expected to disclose $14 billion in Q2 gains preceded this stock rise.

According to MarketWatch data, the MSTR stock is up a little more than 39% year-to-date (YTD). In the past year, the stock has also increased by 215%.

In an X post, Saylor discussed the one-year return of MSTR, BTC, and STRK (the company’s perpetual preferred shares).

The co-founder of Strategy defined STRK as “structured Bitcoin,” BTC as “pure Bitcoin,” and MSTR as “amplified Bitcoin.”

Bitcoin has increased by 89% in the past year, whereas STRK, which debuted this year, has increased by 51%.