MicroStrategy insiders, including Carl Rickertsen, sold $MSTR stock worth millions in 2025, with no buys, signaling bearish sentiment.

According to reports, a significant number of insiders at Microstrategy (now Strategy) are selling their shares, with director Carl Rickertsen liquidating his entire MSTR stock, which is valued at $10 million. In October 2022, Mr. Rickertsen acquired $700K of the company’s stock after joining Michael Saylor’s firm. At that time, the MSTR stock price was trading at under $25 and has since appreciated by 16 times in less than three hours.

MicroStrategy insiders are purportedly selling MSTR stock in 2025

According to the most recent report from Protos, Michael Saylor’s Bitcoin holding company is experiencing substantial insider selling. According to the platform, Carl Rickertsen, a board member, has liquidated all of his shares in the company, resulting in a profit of more than $10 million. This action is taken even though Strategy continues to pursue an aggressive Bitcoin accumulation strategy, which has caused concerns among insiders regarding investor confidence.

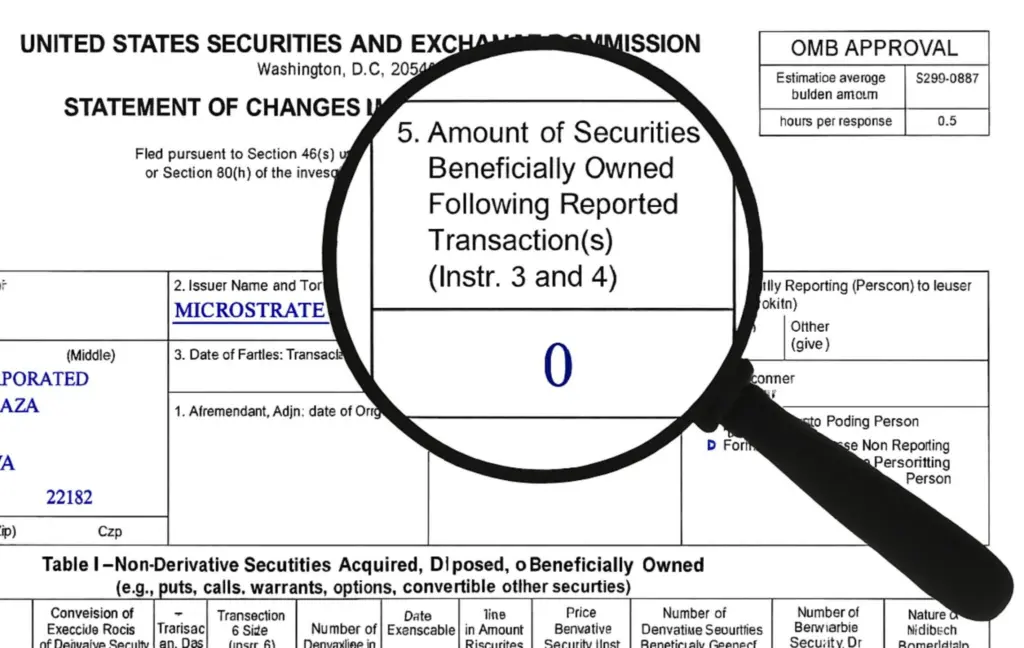

The report also emphasizes that Rickertsen acquired $700,000 in MSTR shares in 2022. Subsequently, in 2023, he divested himself of his partial holdings and has since liquidated the remaining stake. The Protos report also indicated that Rickertsen exercised stock options and sold shares on the same day, a decision that some interpret as a lack of long-term confidence.

In 2025, there were no insider purchases of MSTR

There have been no insider purchases of the MSTR stock, despite Michael Saylor’s aggressive Bitcoin purchases for Microstrategy this year, 2025. Conversely, Protos reported that 26 insider transactions have occurred year-to-date, surpassing the purchases by $864 million.

Existing retail investors are skeptical regarding the most recent insider trading. MSTR’s share price has declined by 10% in the past month despite Strategy’s acquisition of Bitcoin. Conversely, Metaplanet and other Bitcoin holding companies have experienced substantial stock price increases, with Metaplanet’s stock price increasing by 152% in the past month.

Peter Schiff describes the Strategy business model as a complete fraud

An economist and Bitcoin critic, Peter Schiff, has condemned Michael Saylor’s Bitcoin treasury company, Microstrategy, as a complete fabrication. Saylor shared a Bloomberg article that noted the company’s current holdings of 582,000 BTC, which are valued at $63 billion. Schiff responded with his comments.

“The business model of MSTR is a complete sham.” Bankruptcy is inevitable. Shiff wrote, “The only question is when.” Peter Schiff, a seasoned Bitcoin critic, has consistently questioned the rationale behind adopting Bitcoin as a strategic reserve, a stance he reaffirmed in March following its announcement. Interestingly, Schiff admitted that he regrets not purchasing Bitcoin.

Schiff contends that this action will accelerate the depreciation of the U.S. currency, positing that gold, rather than Bitcoin, will be the “ultimate victor.”