MicroStrategy’s $786M Bitcoin buy boosts unrealized gains to $21.3B, with Saylor’s 592,345 BTC vision driving massive returns.

Michael Saylor’s bold investment in Bitcoin (BTC) has captured significant attention in the cryptocurrency space. His company, Strategy, now holds a Bitcoin portfolio valued at approximately $63.24 billion.

Strategy’s Bitcoin Approach Generates Over $21 Billion in Unrealized Gains

Data from saylortracker.com indicates that their Bitcoin investments have yielded unrealized profits of $21.3 billion, representing a gain of roughly 50.99% since the company began its aggressive acquisition strategy.

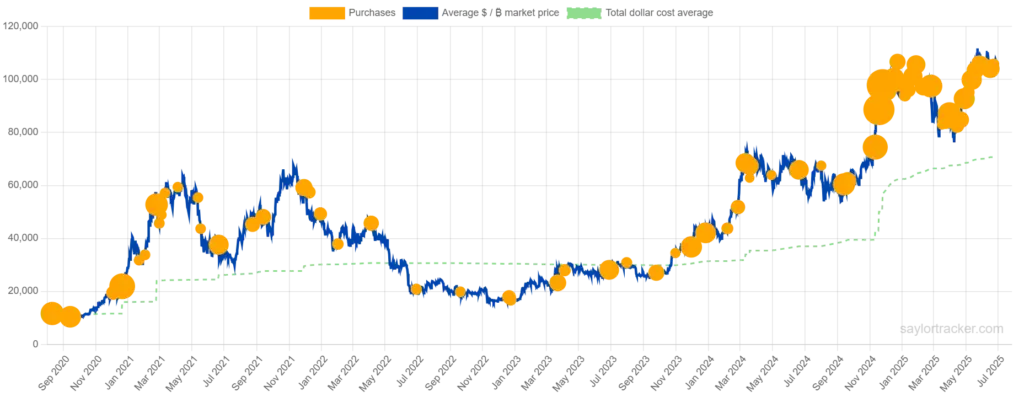

The company’s purchase history, illustrated by large orange circles on a chart, highlights significant Bitcoin buys across various market cycles. Saylor initiated substantial purchases in late 2020 when Bitcoin prices ranged between $10,000 and $20,000. Although Bitcoin surged past $60,000 and experienced sharp corrections, they continued accumulating.

This week, the company further bolstered its holdings by acquiring 11,931 BTC for approximately $786 million, reinforcing its “buy and hold” philosophy. This purchase increased their total Bitcoin holdings to over 592,000 BTC.

Consistent Accumulation Establishes Strategy as a Bitcoin Leader

The chart’s blue line tracks Bitcoin’s price volatility, showing significant peaks and troughs. In contrast, the green dashed line, representing Strategy’s dollar cost average, reflects a steady upward trend.

This approach has allowed them to mitigate risk and navigate market fluctuations effectively. Currently, Strategy’s average purchase price per Bitcoin is approximately $70,702.38, while Bitcoin’s market price stands at around $106,754.06, resulting in substantial unrealized profits.

Rather than engaging in short-term trading, Saylor has prioritized long-term holding and consistent buying.

This approach has positioned him as one of history’s most successful corporate treasury investors. Their holdings of over 592,000 BTC have inspired other companies and sparked discussions among institutional investors. Bitcoin’s climb to new highs in 2025 further validates Saylor’s unwavering commitment.

Saylor’s vision has transformed Strategy from a software analytics company into a prominent Bitcoin powerhouse. Recently, their Bitcoin securities reached a record $3.3 billion, reflecting growing investor enthusiasm. These products are steadily gaining traction, positioning them as emerging competitors to traditional gold ETFs.