Strong ETF Demand Aids Bitcoin Stability with massive BTC outflows from crypto exchanges and inflows into the spot Bitcoin ETF market.

A growing bullish sentiment is associated with Bitcoin investments, driven by rising inflows into spot Bitcoin exchange-traded funds (ETFs) and advantageous trading conditions.

Bitcoin BTC tickers, currently down $70,340, are believed by Bitfinex researchers to have reached a low of approximately $60,000. This conclusion is reached after analyzing weekly market conditions.

This belief was reinforced in a recent report by Bitfinex Alpha, which emphasized three significant developments: persistently high daily closures, substantial outflows of Bitcoin from cryptocurrency exchanges, and inflows into the spot Bitcoin ETF market.

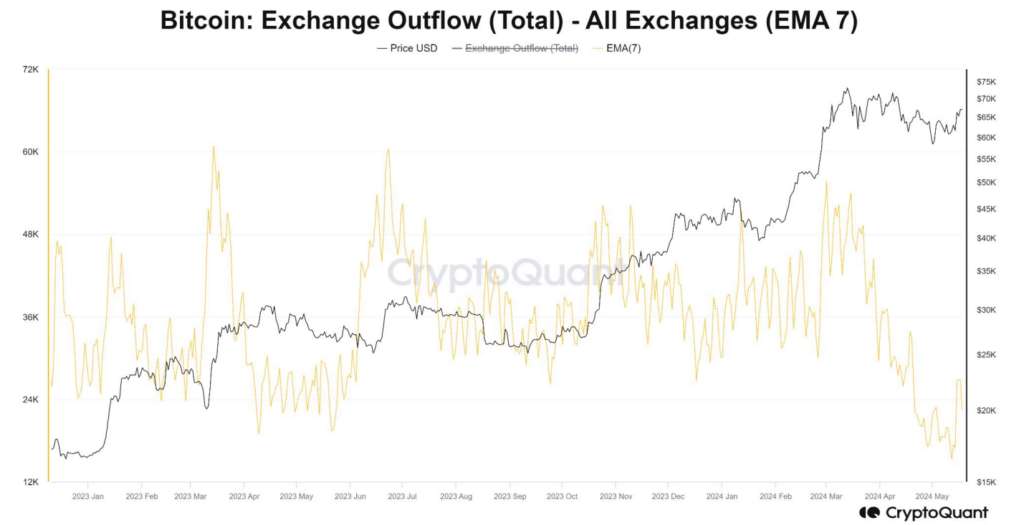

As demonstrated previously, the withdrawal of 55,000 BTC from exchanges on May 15 had no adverse effect on Bitcoin’s ongoing low volatility.

Although significant outflows from exchanges frequently function as adverse market sentiment indicators, Bitcoin maintained its trading above $61,000 despite the $3.85 billion outflow it experienced last week.

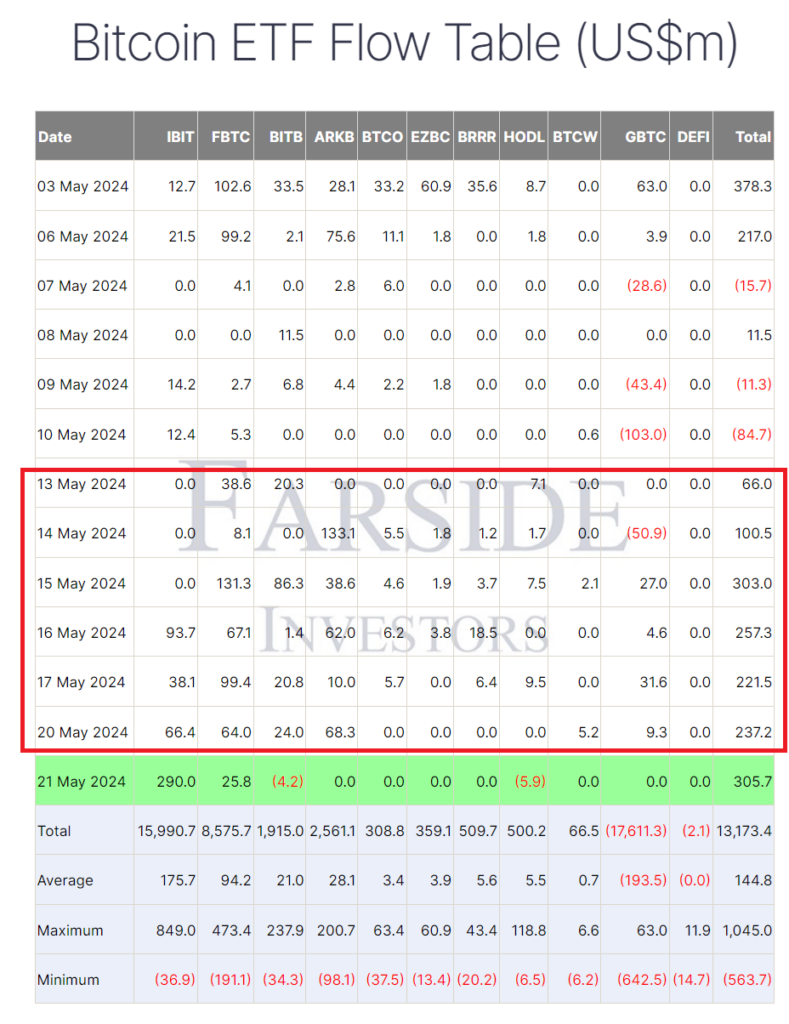

Furthermore, the spot Bitcoin ETF market in the United States has documented net positive inflows for seven consecutive days. Throughout history, Grayscale Bitcoin Trust (GBTC) has borne the brunt of the outflows, resulting in a cumulative loss of more than $17.6 billion.

However, six days out of the last seven in question, GBTC recorded net positive (or zero) inflows. “At present, purchasers of ETFs have a comparable cost basis of approximately $62,000, exclusive of GBTC,” according to a Bitfinex report.

Those merchants who prefer tax advantages and low-cost portfolio diversification frequently invest in ETFs. Consult the crypto guide by Cointelegraph for more information on investing in Bitcoin ETFs.

Currently in first place, BlackRock’s iShares Bitcoin Trust (IBIT) has garnered investments amounting to nearly $16 billion, surpassing the performance of the remaining nine authorized Bitcoin ETFs.

Investments in Bitcoin ETFs provided by Grayscale, ProShares, Bitwise, BlackRock, and Fidelity were disclosed by JPMorgan Chase.

JPMorgan Chase disclosed its possession of approximately $760,000 worth of shares of the ProShares Bitcoin Strategy ETF (BITO), IBIT, Fidelity’s Wise Origin Bitcoin Fund (FBTC), GBTC, and the Bitwise Bitcoin ETF in a filing with the US Securities and Exchange Commission (SEC) on May 10.

Observers should not presume that the information provided by the financial firm was “complete and accurate,” according to the SEC.