Nvidia lost a Supreme Court challenge to block an investor-led lawsuit claiming it understated GPU sales to crypto miners.

Nvidia will be required to respond to a class-action lawsuit that alleges it deceived investors regarding the volume of sales to crypto miners. The United States Supreme Court rejected the chip manufacturer’s appeal to dismiss the lawsuit.

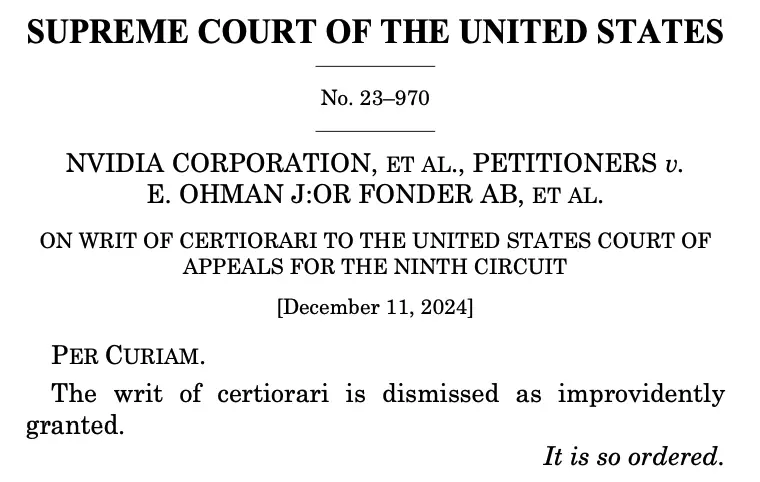

On December 11, the justices dismissed Nvdia’s appeal in a single-line order without explanation. The petition was initially dismissed by a California district court in March 2021; however, an appellate court’s decision to revive it has now been reinstated.

Nvidia, an American multinational corporation and technology company sought to reverse the Ninth Circuit appeals court ruling from August of last year, which revived a 2018 lawsuit filed by a group of Nvidia shareholders.

The shareholders claimed that the company concealed more than $1 billion in GPU sales to crypto miners and that CEO Jensen Huang understated the volume of sales to the industry.

“We would have preferred a decision on the merits that affirmed the trial court’s dismissal of the case; however, we are fully prepared to continue our defense,” stated a spokesperson for Nvidia in an interview with Cointelegraph.

“To safeguard shareholders and guarantee a robust economy, it is imperative that securities litigation adhere to consistent and predictable standards.

We are dedicated to their preservation.”

The shareholders claimed in the lawsuit that Nvidia’s GPU sales were artificially inflated by selling to crypto miners.

They cited a period in late 2018 when sales declined in tandem with the declining crypto market, resulting in a nearly 30% decline in Nvidia’s share price over the course of two days.

The suit, Nvidia contended, was founded on an expert opinion that fabricated information regarding its business and income.

The class group received support from the Justice Department and the Securities and Exchange Commission in October, which stated that Nvidia’s argument “is not what occurred here.”

The agencies cited the investors’ case, which is purported to be supported by evidence such as statements from former Nvidia executives and a Bank of Canada report that alleges that Nvidia understated its crypto revenue by $1.35 billion.

After hearing arguments for the case on Nov. 13, the Supreme Court dismissed it.

During the hearing, some justices questioned the court’s decision to consider the case and whether it presented an issue that required a ruling.

Nvidia paid the Securities and Exchange Commission (SEC) $5.5 million in 2022 to resolve allegations that it failed to adequately disclose the effects of cryptocurrency mining on its gaming business.

The company did not acknowledge or contradict the SEC’s findings.