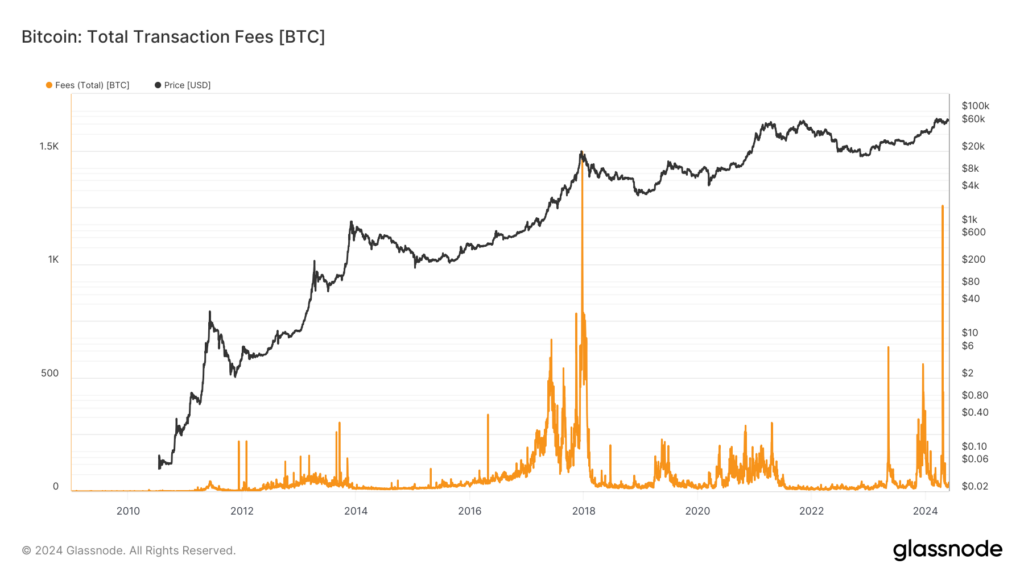

Bitcoin transaction fees surged in early 2024, highlighting miner revenue sustainability post-halving. Fees peaked on April 20, making up 75% of earnings.

An increase in transaction fees suggests that mining revenue sustainability may depend on fees.

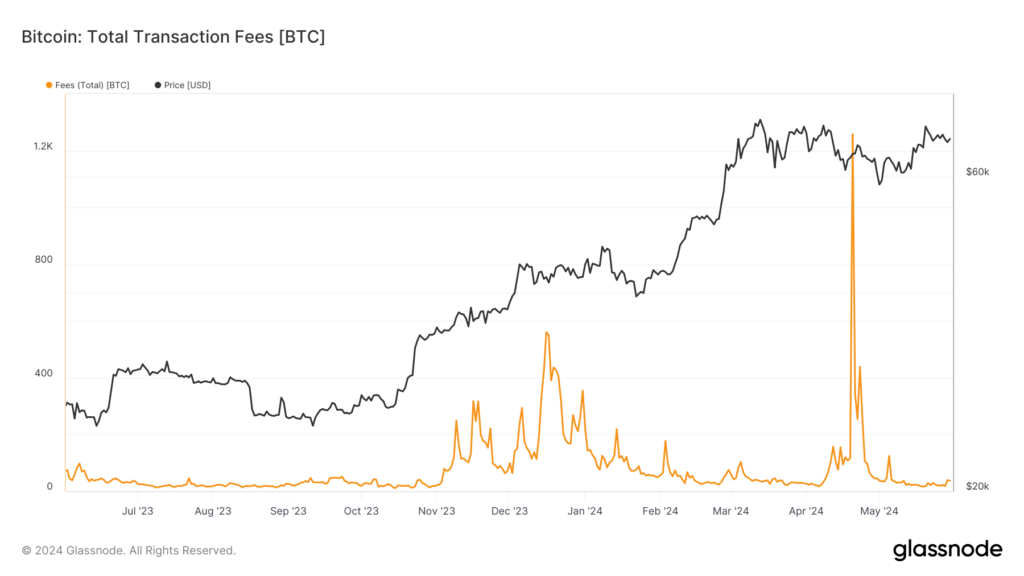

The overall transaction costs for BTC increased much earlier in 2024. Fees have increased significantly since the April halving event and briefly hit record highs. This increase is primarily attributable to the launch of the new protocol Runes, which significantly increased network traffic and congestion and thus raised transaction costs. At its high on April 20, transaction fees comprised more than 75% of the day’s earnings for miners, totaling 1,257.71 BTC.

Since then, fees have decreased, and demand for Ordinals and Runes has declined.

The increased fees had several effects on the Bitcoin ecosystem. For example, the increase in fees has increased the cost of Bitcoin transactions, which has caused the number of active addresses on the network to drop to a three-year low. Even so, the rise in transaction fees illustrates the possibility of a change in the makeup of miner revenue in the future, as costs will be necessary for the sustainability of Bitcoin once all of it has been mined.

Although rates have since fallen to levels akin to those of mid-2023, there has been a recent upsurge, and any revival in the popularity of inscriptions may cause fees to rise once again.

As the year progresses, it will be essential to track how these fee conditions affect miner profitability and Bitcoin’s usability. The long-term effects of these modifications will significantly shape future Bitcoin transactions and network participation.