The first half of 2024 has been another whirlwind in global markets, with the unstoppable march of the mega caps, sloth-like central bank pivots, political palpitations abounding, and the return of M&A

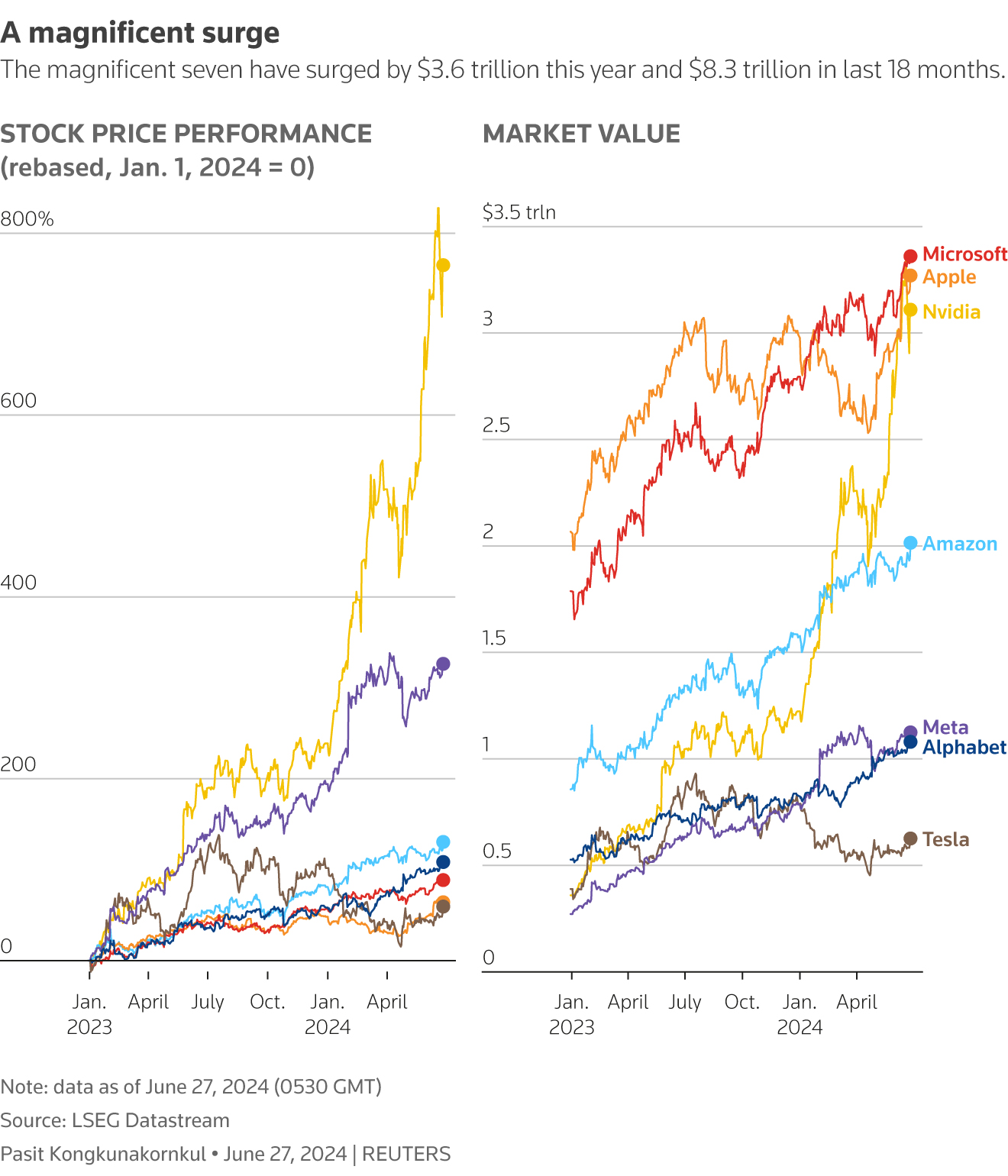

Although the expectation of a global interest-rate-cutting fervor was not realized, the market value of Nvidia and the Magnificent 7 increased by an additional $3.6 trillion.

Since January, the 47-country world equities index of MSCI has experienced a significant increase of 11%. Certainly, but it is not even close to the 30% increase of Team Tech or the genuinely astonishing 150% increase of chip champion Nvidia.

Chris Metcalfe, the chief investment officer of IBOSS Asset Management, stated that Nvidia has contributed thirty percent of the S&P’s returns this year. He also noted that it is the most costly stock on the most expensive market in the world.

Milestones have been established in markets other than equity markets

The yen of Japan has reached a 38-year low against the dollar in the currency markets. The first round of the snap parliamentary election was conducted on Sunday.

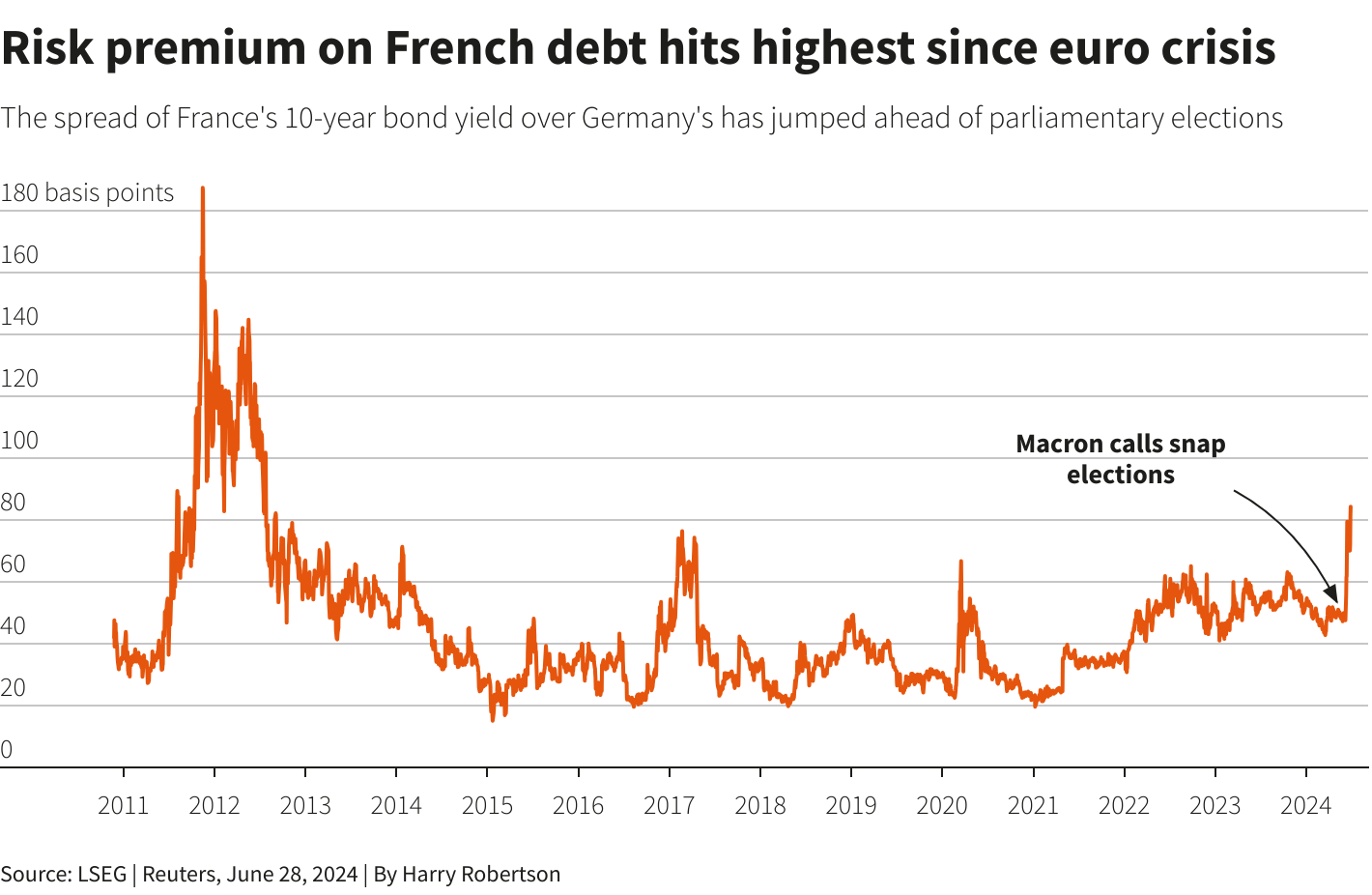

French bond risk has exploded to its highest level since the euro crisis following French President Emmanuel Macron’s defeat by the far right in EU elections. Cocoa experienced one of its best-ever runs.

In any case, government bonds were experiencing significant problems. In a few regions of Europe and emergent markets, predictions of many rate cuts have been reduced to a mere trickle, and they have yet to materialize in the United States.

Consequently, individuals with a portfolio of benchmark bonds have experienced a loss of approximately 1.5% of their capital.

“The markets anticipated seven (U.S.) rate cuts after last year; however, they are now anticipating only one or two,” said Nadege Dufosse, the director of multi-asset at Candriam.

“That has been the big driver and explains the (poor) performance.”

The uncertainty surrounding the November U.S. election has been significantly increased by the shaky performance of U.S. President Joe Biden in his most recent television debate with Donald Trump.

Also, on July 4, Britain will hold a general election; however, it is unlikely that there will be a significant market reaction even though this will be the first change of government in 14 years.

According to Georgina Hamilton, the Polar Capital fund manager, the two primary candidates for the position of Prime Minister in the United Kingdom are centrist, in contrast to those in France and the United States.

“Having had quite a lot of turmoil in recent years … you can’t underestimate that calmer political backdrop,” according to her.

GOLD GLOWS

Cocoa has experienced a nearly 85% increase in value due to shortages, the second-largest annual increase in history. However, this is undoubtedly disconcerting news for chocolate enthusiasts.

In May, gold reached a record high of just under $2,450 per ounce. Oil is up a respectable 12%, while bitcoin has surpassed $70,000 and reached a series of new highs following U.S. regulators’ approval of bitcoin exchange-traded funds.

The value of global M&A activity has increased by 5% compared to last year’s first half.

That is primarily due to a pair of $35-billion transactions that saw credit-card firm Capital One (COF.N) acquire Discover

Financial (DFS.N) and chip designer Synopsys (SNPS.O) acquire rival Ansys (ANSS.O). However, it could have been significantly more if BHP’s (BHP.AX) gripping $49-billion pursuit of Anglo American (AAL.L) had been successful.

Frustrated by the necessity to impress

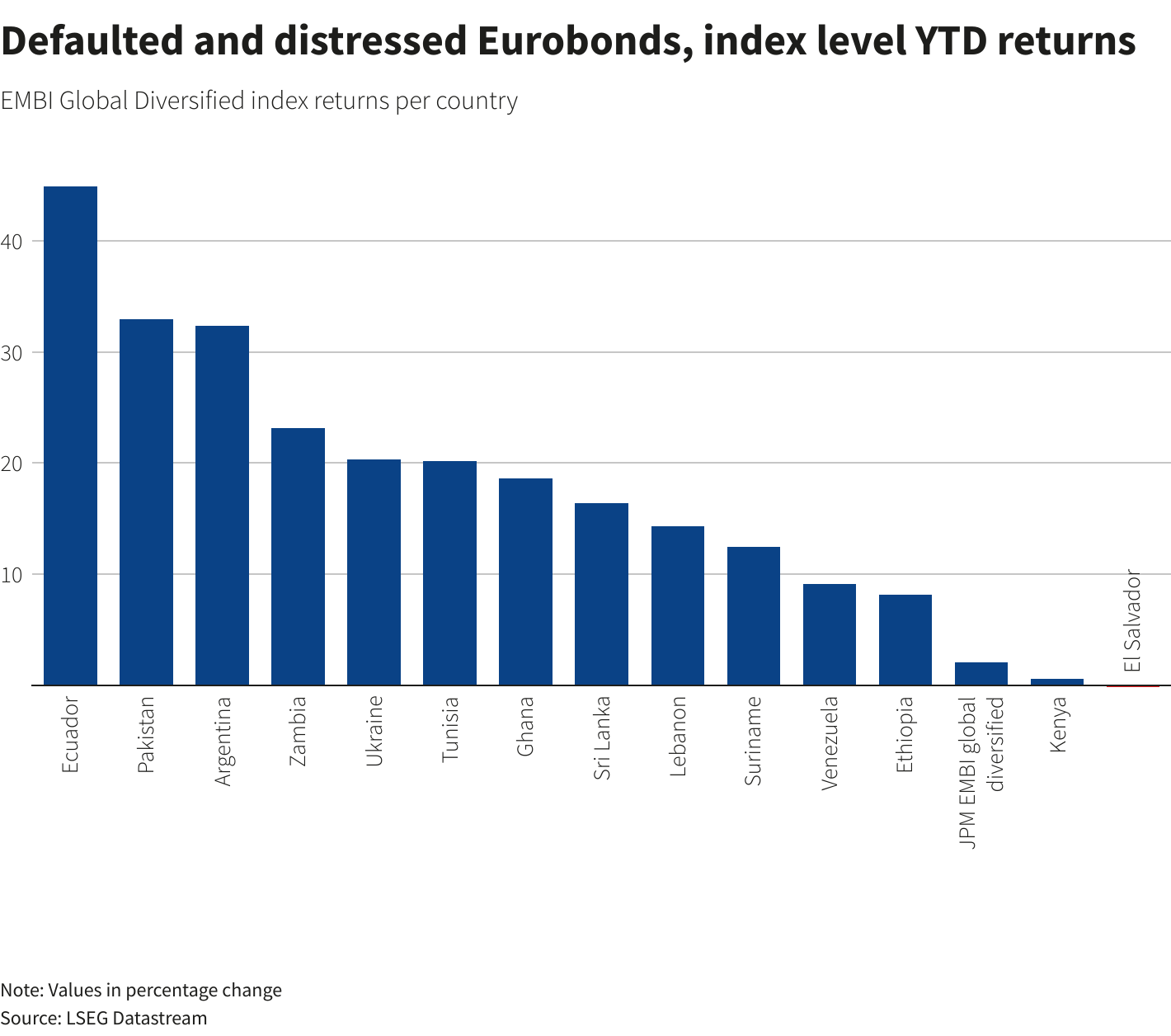

Ecuador’s bonds have increased by 46% despite persistent debt concerns, and Argentina’s bonds have risen by 32% under the leadership of the new chainsaw-wielding President Javier Milei.

The bonds of crashed countries such as Zambia, Ghana, and Sri Lanka have all rallied between 16%-23% as their years-long debt restructurings have neared a conclusion, according to emerging-market veteran Kevin Daly at Aberdeen. He calls this a “distressed to impress” move.

However, emerging markets have also experienced numerous downturns, as is customary.

For the ninth consecutive quarter, Chinese property stocks have experienced a decline. Nigeria’s and Egypt’s currencies have experienced a 42% and 36% decline, respectively, due to devaluations.

Mexico’s peso has fallen by nearly 8% this month following a resounding presidential election victory that has raised concerns about its future trajectory.