According to USDT stablecoin operator Tether, MiCA-driven cryptocurrency reforms in Europe may result in a “disorderly” market.

While exchanges like Crypto.com are preparing to delist their USDt stablecoin in Europe tomorrow, stablecoin operator Tether responded to European cryptocurrency rules.

Tether voiced dissatisfaction with European market developments in the context of shifts brought about by implementing the EU’s Markets in Crypto-Assets (MiCA) framework.

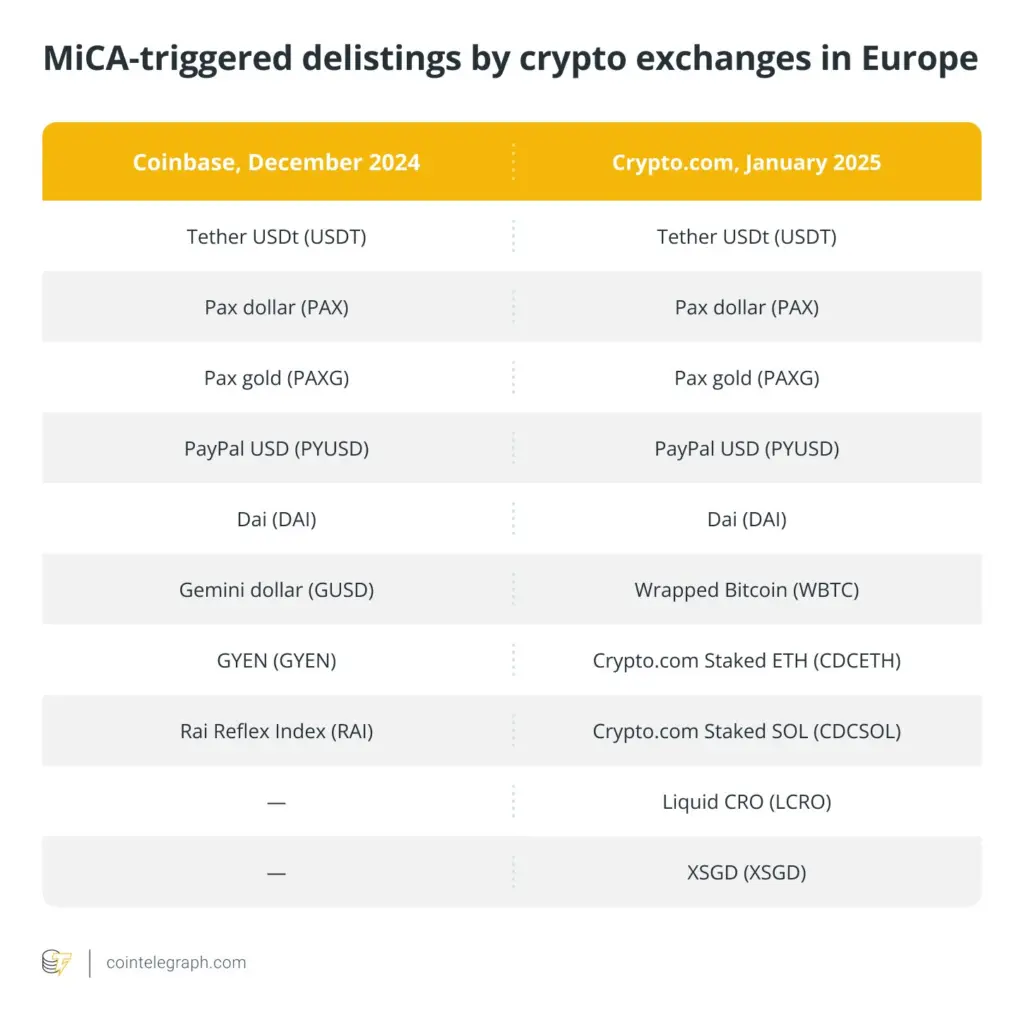

Global cryptocurrency exchange Crypto.com announced on January 29 that, according to MiCA requirements, it will begin delivering USDt USDT$0.9998 stablecoin and nine more tokens on January 31.

A representative said, “It is disappointing to see the rushed actions brought on by statements that do little to clarify the basis for such moves.”

EU customers are at risk from a “disorderly” cryptocurrency market.

Tether claims that MiCA-caused developments present serious hazards to local cryptocurrency markets and EU consumers, as exchanges such as Crypto.com are planning to delist several currencies.

According to a Tether spokesman, “These changes affect many tokens in the EU market, not just USDt, and we fear that such actions will lead to further risk being placed on consumers in the EU.”

Tether claims that while MiCA is still in its early phases of implementation, such legislative developments in the EU could result in a “disorderly” market.

As previously stated, ten tokens in total—including Wrapped Bitcoin WBTC$101,956.52, Dai DAI$0.9999 stablecoin, and others—will be impacted by Crypto.com’s MiCA-forced delisting procedure.

To comply with MiCA, Coinbase, an exchange that delisted USDT in December 2024, announced that it would delist six coins. On December 19, 2024, the exchange delisted WBTC from the Coinbase platform for other reasons.

On January 30, a Coinbase spokesman said, “We regularly review the assets we make available to customers on our platform to ensure we are meeting regulatory requirements, and we will assess re-enabling services for stablecoins that achieve MiCA compliance on a later date.”

By MiCA, Coinbase has delisted eight tokens to date, the representative added.

Tether completes its USDt European strategy.

Tether emphasized that MiCA has detrimental effects on stablecoins regulated in the EU, in addition to the increased consumer dangers that could result from ecosystem changes brought on by MiCA.

“Some aspects of MiCA make the operation of EU-licensed stablecoins more complex and potentially introduce new risks, as we have consistently expressed,” Tether stated.

The official from Tether also emphasized the distinctions between stablecoin use cases in emerging markets, where USDT is immensely well-liked, and Europe. The spokeswoman said, “The USD stablecoin market is almost negligible in Europe.”

However, the spokesperson added that Tether continues to praise EU authorities for their efforts in creating a structured environment, which is crucial for promoting industry growth.

“As Tether finalizes its European strategy for USDt, it remains committed to ensuring compliance with evolving regulations while introducing groundbreaking technologies such as Hadron and investments in transformative projects such as Quantor, designed to be MiCA compliant.”

Tether’s remarks follow pressure from the European Securities and Markets Authority (ESMA) for European crypto asset service providers (CASP) to begin limiting stablecoins that do not comply with MiCA by the end of January.

The regulator has requested that CASPs entirely ban non-compliant stablecoins by the end of the first quarter of 2025, but they can still market the tokens in sell mode until March 31.