Tether made a $13B profit in 2024, propelled by Bitcoin, gold, and U.S. Treasuries, as it plans to diversify its operations into AI and telecom in 2025.

Tether, a stablecoin issuer, reported a $13 billion net profit in 2024, primarily due to the increasing prices of gold and Bitcoin. In the year’s final quarter, the organization that distributes the largest stablecoin, USDT, generated $6 billion in profits. Tether’s total assets were $143.7 billion, with excess reserves increasing to $7 billion.

The company’s most recent financial attestation, verified by the accounting firm BDO Italy, indicated that a substantial portion of the profits were derived from unrealized gains on Bitcoin and gold holdings and U.S. Treasuries. By the conclusion of 2024, Tether’s Bitcoin holdings had also increased to nearly 84,000 BTC.

Bitcoin and gold fuel Tether’s profits

Tether, a stablecoin issuer, has disclosed that its $13 billion profit was generated from various sources, with Bitcoin and gold appreciation as significant contributors.

The increasing value of these assets was responsible for approximately $5 billion of the total profit. The remaining $7 billion was derived from repurchase agreements and returns on U.S. Treasuries.

In the fourth quarter of 2024, the organization increased its Bitcoin holdings, which was its initial action since March. Tether held approximately 84,000 BTC, valued at roughly $7.8 billion, by the end of the year. Additionally, the organization’s asset reserves were reinforced by an increase in its U.S. Treasury holdings to $94.5 billion.

USDT Issuance and Expanding Market Presence

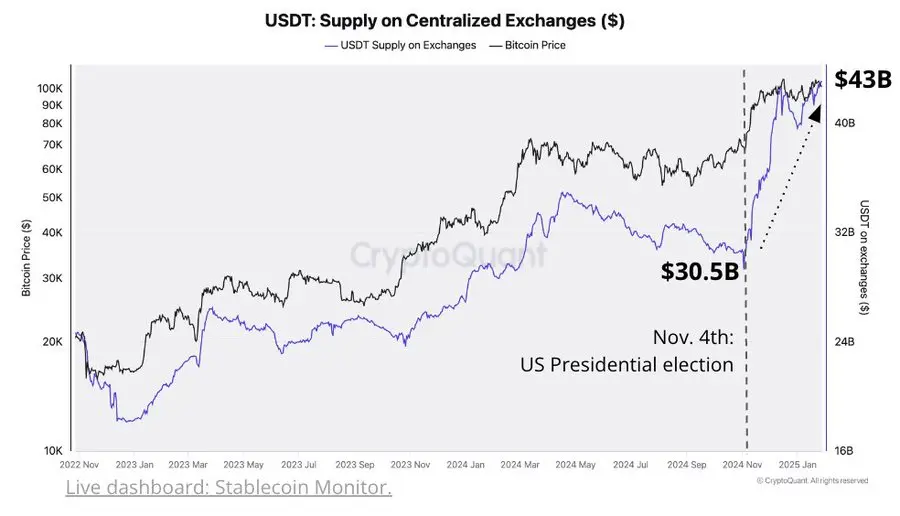

In 2024, USDT, Tether’s stablecoin, experienced substantial issuance, totaling $45 billion. The company issued $23 billion in new USDT tokens in the fourth quarter alone.

USDT is the fourth-largest cryptocurrency, with a total market capitalization of $140 billion.

Particularly in emerging economies, USDT continues to be an indispensable component of the cryptocurrency market. Tether disclosed that its stablecoin has garnered 400 million users globally, most of whom reside in developing regions. The organization is further developing USDT’s involvement in deposits, remittances, and payments.

European Market Restrictions and Regulatory Challenges

Despite its expansion, Tether, a Stablecoin issuer, faces regulatory obstacles, particularly in Europe. USDT has been delisted from numerous exchanges due to the European Union’s Markets in Crypto-Assets (MiCA) regulations. Crypto.com has recently disclosed that it intends to eliminate USDT and nine additional tokens from its European platform by January 31, 2025.

Stablecoins must possess an e-money license to operate within the European Economic Area (EEA) by MiCA regulations.

Tether has not been granted such authorization, resulting in an elevated scrutiny level. In 2024, USDT was delisted by numerous other exchanges, such as Coinbase, for comparable reasons. Users of affected platforms must convert USDT into assets that comply with MiCA by March 31, 2025.

Tether’s Plan for Expansion into New Sectors

In 2025, the USDT issuer intends to expand beyond stablecoins by entering new industries. The organization disclosed forthcoming financial services, telecommunications, and artificial intelligence initiatives. Tether also wants to improve crypto payments and remittances by integrating USDT with Bitcoin’s Lightning Network.

The company’s emphasis on innovation was underscored by Tether CEO Paolo Ardoino, who stated,

“Our goal is to offer practical solutions for remittances, payments, and other financial applications that demand both speed and reliability.”

The Lightning Network integration is anticipated to enhance the pace of USDT transactions and reduce fees, which will benefit all users worldwide. By previous reports, Tether has recently disclosed its intention to relocate its headquarters to El Salvador as part of its expansion strategy.