Tether buys 31.9% of Elemental Altus Royalties, acquiring 78.4M shares for $121.6M to bolster gold-backed crypto infrastructure.

Tether, the issuer of the USDT stablecoin, has announced the acquisition of a substantial 32% stake in Elemental Altus Royalties Corp, a gold mining firm based in Canada. This acquisition is part of Tether’s ongoing efforts to diversify its investments across asset classes and mitigate its exposure to certain risks. In recent months, the stablecoin firm has aggressively increased its investments in Bitcoin and Gold. The company aims to fortify its reserves and support the USDT stablecoin through this investment.

Gold bets are doubled down by Tether

USDT stablecoin issuer acquired a 31.9% stake in Elemental Altus Royalties Corp., a gold extraction firm based in Canada, earlier today. Tether’s purchase of 78,421,780 shares is consistent with its overarching strategy of incorporating Bitcoin and gold mining into its portfolio as a financial hedge and decentralized infrastructure.

The announcement was made within two weeks of CEO Paolo Ardoino’s declaration that the organization had acquired 100,000 Bitcoins and 50 tons of gold.

Furthermore, after October 29, 2025, the stablecoin firm has executed an option agreement with AlphaStream Limited to acquire 34,444,580 additional shares, contingent upon Elemental’s sanction. In the future, this acquisition would assist the stablecoin company in further consolidating its gold investments. Ardoino commented on the development, stating:

“Tether’s growing investments in gold and Bitcoin reflect our forward-looking strategy to build a more resilient and transparent financial system. Just as Bitcoin provides the ultimate decentralized hedge against monetary inflation, gold continues to be a time-tested store of value”.

Elemental Altus Royalties Corp., which is headquartered in Canada, is a company that specializes in gold royalty streams. It offers exposure to gold production without the operational hazards associated with direct mining.

In addition to BTC and Gold, the stablecoin firm also holds its own Tether Gold (XAUT), a token guaranteed by physical gold, as part of its risk management strategy and product portfolio.

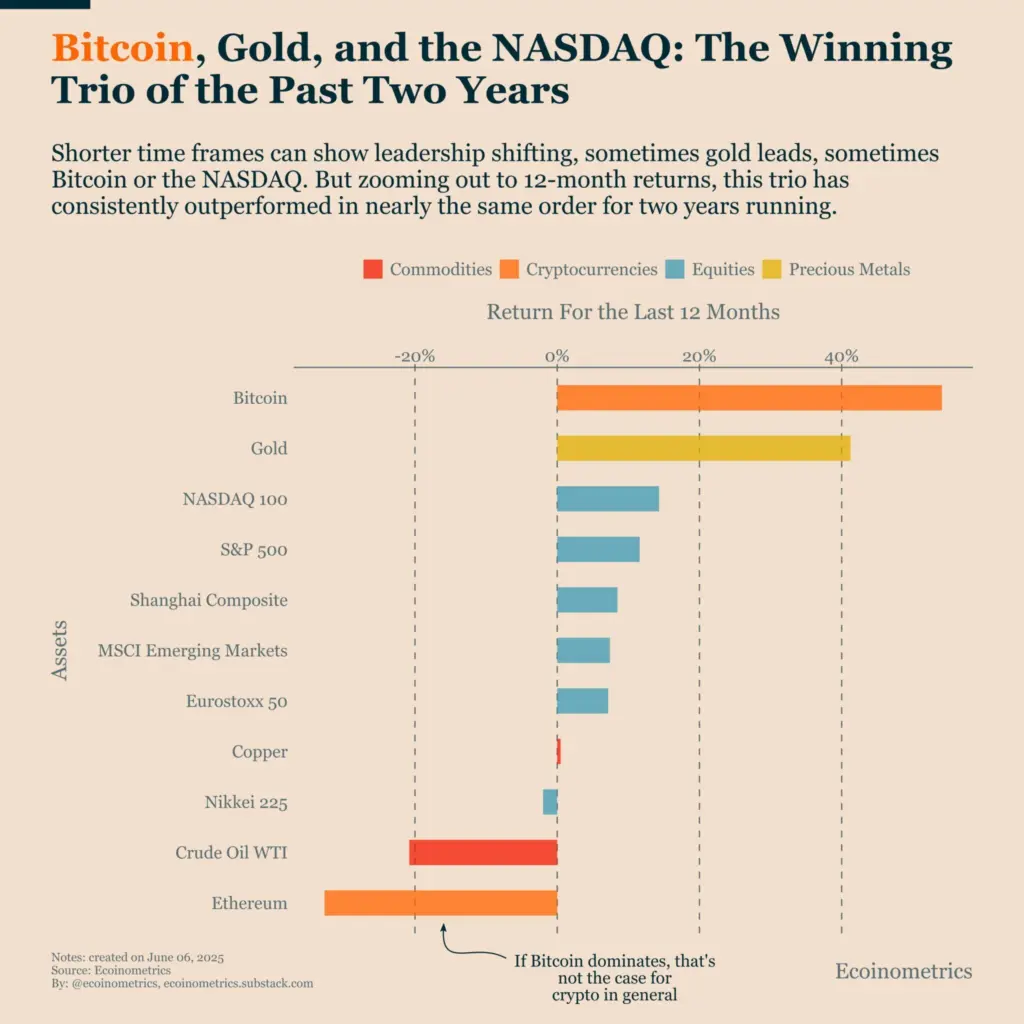

Gold Maintaining Its Pace with Bitcoin’s Advances

Bitcoin and Gold are the only assets that have generated returns exceeding 40% in the past year, and institutional investors are increasing their investments in these assets. Nevertheless, BTC recently surpassed Gold in US ownership for the first time. Therefore, it appears to be a prudent decision for the USDT issuer to diversify its investments across both of these asset classes.

Tether announced last week that it would open-source its Bitcoin Mining OS (MOS) to revolutionize Bitcoin mining. This initiative aims to ensure that large-scale and minor mining operations are treated equally.