Tether, a cryptocurrency company, announced on Wednesday that it would introduce a new stablecoin that is pegged to the United Arab Emirates (UAE) dirham

The company is attempting to meet the demand for Gulf currency and provide alternatives to the U.S. dollar.

Stablecoins are digital tokens intended to maintain a consistent value and are supported by conventional currencies, such as the euro or the U.S. dollar. They have experienced significant growth in popularity as a payment method and among speculators who wish to purchase and sell cryptocurrencies like bitcoin outside of the regulated banking system.

Tether’s eponymous dollar-pegged token (USDT) is the world’s largest stablecoin, designed to preserve a value of $1.

The majority of the $169 billion stablecoin market comprises approximately $117 billion in circulation, as CoinGecko data indicates.

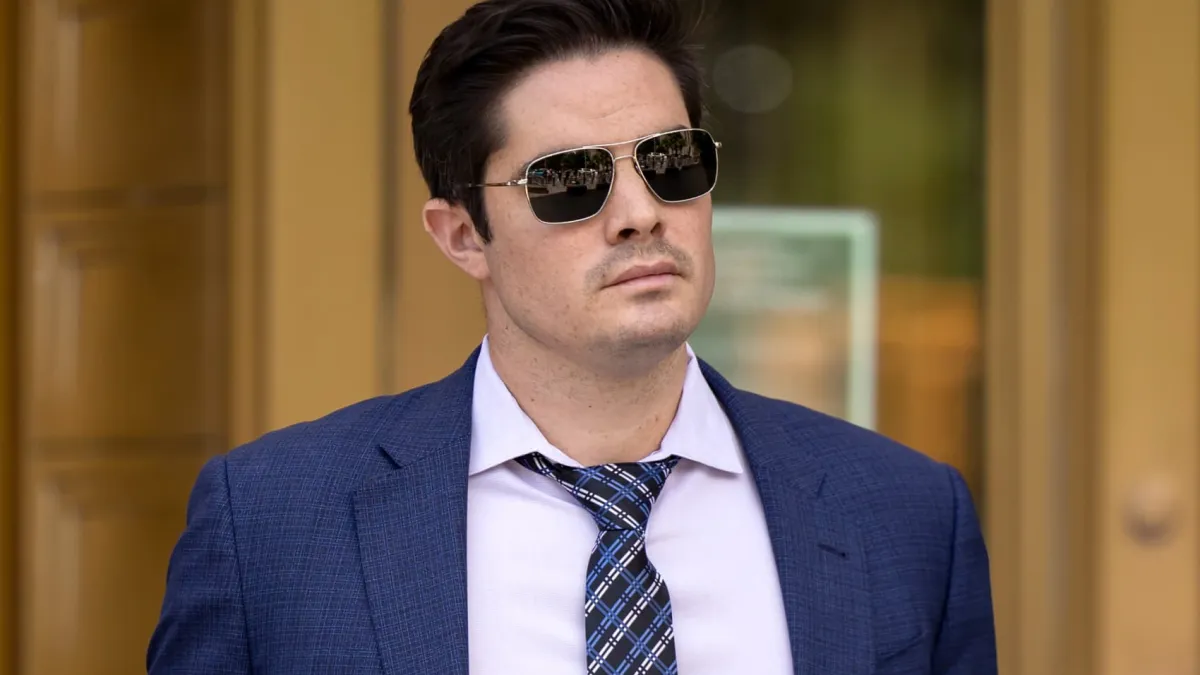

During an event in Dubai, Tether CEO Paolo Ardoino stated that the primary objective of the proposed dirham-pegged unit is to establish an optionality concerning the U.S. dollar. He also expressed his conviction that the dirham would become the preferable currency as global trade evolves.

“We observe a significant amount of interest in storing AED (dirham) outside of the UAE,” he stated, referencing the stability and security of the country and its balance sheet.

The dirham, like the majority of Gulf currencies, is linked to the U.S. dollar.

As economic competition intensifies in the Gulf region, the United Arab Emirates strives to establish itself as a global centre for the cryptocurrency industry.

It has been swift in facilitating cryptocurrency payments in sectors such as real estate and school fees, thereby increasing the rate of adoption and transaction volumes. Additionally, it has contributed to developing virtual asset regulation in the capital, Abu Dhabi and Dubai.

Additionally, Tether offers stablecoins that are linked to the euro, the yuan of China, the Mexican peso, and gold.

Regulators have issued cautionary statements regarding the potential market risks associated with adopting crypto assets for an extended period. They are concerned that expanding stablecoin reserves may expose the broader financial system to greater risks. The United States has stated that a rapid outflow could occur if holders hurry to return tokens to traditional currencies.

Concentrate on emerging markets.

In April, Ardoino informed Reuters that Tether’s recent expansion was fuelled by its utilisation as a substitute for the dollar in emerging markets, including Argentina, Brazil, Turkey, Vietnam, and certain regions of Africa, where the dollar is occasionally in short supply.

According to a statement issued by Tether on Wednesday, the dirham stablecoin will be “fully backed” by liquid UAE-based reserves.

It will be launched in partnership with Phoenix Group, an Abu Dhabi-listed crypto mining and blockchain conglomerate, and “with support” from investment firm Green Acorn Investment, Tether, and Phoenix.

According to the statement, the objective of the new stablecoin is to “reduce transaction fees, streamline international trade and remittances, and offer a hedge against currency fluctuations.”

The two companies did not specify a launch date; however, Ardoino stated that the UAE Central Bank would require a few months to complete the licensing process.

Phoenix Group Co-founder and CEO Seyed Mohammad Alizadehfard also stated that the blockchain platform that would enable the stablecoin had not yet been selected.