The Battle for Blockchain Interoperability: Cosmos vs Polkadot, vs Avalanche, three competing visions for a multi-chain world.

Blockchain interoperability is more than a buzzword in today’s rapidly evolving Web3 landscape; it serves as the foundation for scalable DeFi, seamless NFT transfers, and enterprise-grade blockchain adoption across regulated jurisdictions and real-time applications.

Comparison Framework: How We Judge Interoperability

To effectively compare Cosmos, Polkadot, and Avalanche, we evaluate each using six critical lenses:

Architecture and Messaging Model

Examines how chains communicate, whether through IBC (Cosmos), XCM/XCMP (Polkadot), or Subnet-native messaging, such as Avalanche Warp Messaging. Measures include cross-chain call support, bridge reliance, and messaging flexibility.

Security Model

Considers shared vs. sovereign security (e.g., Polkadot’s pooled Relay Chain security, Cosmos’s independent zones, and Avalanche’s validator-set subnets) and their trust trade-offs.

Composability and UX

Examines how assets and logic can flow seamlessly across chains—whether developers use universal messaging, unified tooling, or encounter fragmented UX.

Developer Experience and Tooling

SDK maturity, language support (Cosmos SDK, Substrate, and AvalancheJS/Subnet SDK), onboarding friction, and deployment time are all factors considered.

Ecosystem Maturity and Liquidity

Measures real-world scale using connected chains (e.g., 115+ via IBC), parachain count, subnet adoption, and cross-chain TVL.

Real-World Examples & Bridges

Reviews production-grade integrations, native messaging protocols (vs. bridges), and cross-chain deployments (e.g., Osmosis, Hydra DEX on Polkadot, Avalanche subnets).

Key Metrics for Ranking

Ranking metrics include finality and latency of cross-chain messages. Avalanche provides sub-3-second finality, while Polkadot requires longer confirmations.

- Gas / Cost Efficiency: Measures the expense of messaging and asset transfers; native messaging (IBC, XCM, AWM) typically outperforms bridge-based alternatives.

- Native Cross-Chain Messaging: Built-in protocols (IBC, XCM, and AWM) reduce risk and improve user experience when compared to third-party bridges.

- Proven Deployments: Measures ecosystem robustness using metrics such as IBC’s 35 million cross-chain transactions per year and cross-chain volume dominance.

This framework provides a balanced, data-driven foundation for evaluating the battle for blockchain interoperability: Cosmos vs Polkadot vs Avalanche, allowing developers and investors to see through the hype and select the best architecture for their needs.

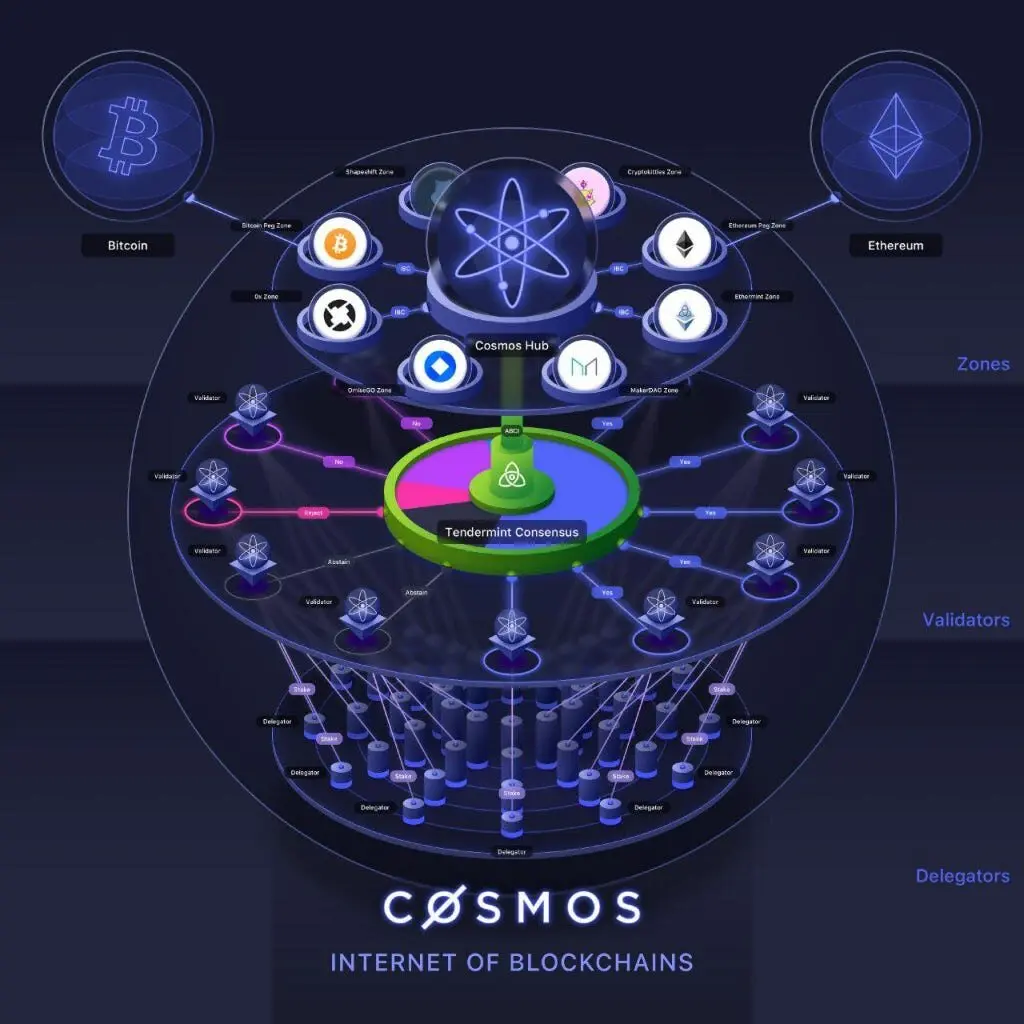

Cosmos: IBC and the Internet of Blockchains

Cosmos brands itself as the “Internet of Blockchains”, a modular, permissionless stack based on zones and hubs, Tendermint consensus, and the Inter-Blockchain Communication protocol (IBC).

Whereas Polkadot relies on a relay chain for cross-chain security and Avalanche on subnets, Cosmos’ design focuses on sovereign chains that communicate with one another via a standard messaging layer.

This architecture prioritizes autonomy, composability via native messaging, and the gradual on-ramping of heterogeneous chains.

How it works at a glance: Individual blockchains (zones) run their own application logic and validator sets (typically built with the Cosmos SDK and Tendermint BFT). Hubs, such as the Cosmos Hub, serve as routing and settlement layers to which chains can connect via IBC.

IBC is a general-purpose, provable messaging protocol that transfers bytes (tokens, data, and arbitrary application messages) between chains via light-client verification rather than trusted bridges. This approach achieves permissionless interoperability without the use of custodial intermediaries.

Recent upgrades have significantly improved Cosmos’ cross-chain story.

IBC v2 (marketed as “IBC Eureka”) offers faster-than-finality routing, richer relayer metadata, and canonical connectivity options (including a native, light-client-based Ethereum <> Cosmos path powered by ZK succinct proofs).

Range, a tooling and analytics provider, has announced day-one support for Eureka, indicating broad ecosystem readiness and reduced onboarding friction for non-Cosmos chains.

Strengths

- Permissionless IBC connections: Any chain that implements IBC (or integrates ibc-rs) can interoperate with the interchain without requiring any special permissions, allowing for rapid app composability.

- Sovereign-chain model: Each zone determines its own security parameters and economic design, which appeals to teams that require complete governance autonomy.

- Predictable light-client security: IBC relies on provable state via light clients, which reduces trust assumptions relative to centralized bridges.

Limitations

Implementation requirement: For native IBC interoperability, each chain must implement (or support) IBC clients and the necessary semantics. Chains that do not adopt IBC must use bridges or adapters, which reintroduces trust trade-offs.

Composability patterns vary from shared-security networks.

Because each zone is sovereign, cross-chain composability (e.g., atomic application calls) can be more complex than in tightly coupled shared-security models; developers may require additional coordination or middleware for multi-step cross-chain logic.

Operational overhead for relayers: Relayer economics and gas on destination chains can have an impact on UX; governance proposals (such as fee grants) have aimed to address relayer sustainability.

Real-World Examples

- Osmosis: A native IBC AMM and liquidity hub that routes tokens across IBC-connected chains and has been a major source for cross-chain value in Cosmos. Historical IBC flows into Osmosis show how native messaging can unlock liquidity without custodial bridges.

- Ecosystem growth and tooling: ibcprotocol.dev, ibc-go docs, and implementations such as ibc-rs provide the developer primitives required to extend IBC to non-Tendermint chains, thereby increasing adoption.

This section focuses on Cosmos IBC, Cosmos Hub, zones and hubs, and IBC interoperability, the core concepts that define why Cosmos is still a leading architecture in the battle for blockchain interoperability. Cosmos versus Polkadot vs Avalanche.

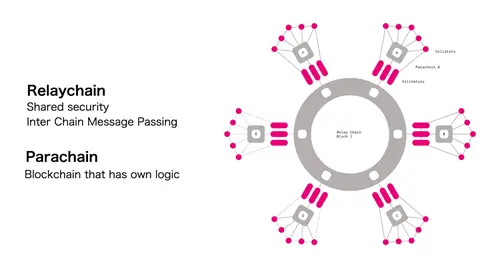

Polkadot: Relay Chain, Parachains, and XCM

Polkadot presents a layered architecture designed for interoperability using shared security and parallel chains. The relay chain, parachains, and cross-chain messaging protocol (XCM) are the foundation of its design.

Architecture Primer: Relay Chain, Parachains, and Shared Security

The relay chain is Polkadot’s backbone: it provides consensus, governance, and pooled security for all connected parachains. These are independent, application-specific Layer-1 blockchains built on Substrate.

Parachains delegate their security to the relay chain using Nominated Proof of Stake (NPoS), allowing for robust, decentralized validation without the need to bootstrap their own validator set.

Access to parachain slots is determined through parachain auctions. Projects bid using DOT, which is frequently supported by crowdloans from their communities; winners receive leases ranging from six months to two years. This competitive model ensures only committed teams are on board.

Parathreads are a more cost-effective option: chains can participate on demand by paying per block, without a dedicated slot.

Cross-Chain Messaging: XCM Explained

XCM (Cross-Consensus Messaging) is Polkadot’s native parachain messaging protocol. It facilitates data, asset, and command transfers natively within the network, eliminating the need for bridges.

XCM enables composable, trustless interoperability using shared security. Projects are also exploring ways to improve XCM by adding light-client support and extending it to chains with weaker finality models.

2024-2025 Evolution: Agile Coretime and Polkadot 2.0

Polkadot is moving beyond fixed-slot auctions. The Polkadot 2.0 roadmap introduces scalable features such as Agile Coretime, Asynchronous Backing, and Elastic Scaling.

Agile Coretime replaces long-term auctions by allowing builders to rent “cores” (computation slots) on demand or in bulk (as NFTs), lowering entry barriers and stabilizing costs. This has increased scalability and developer flexibility, resulting in positive DOT price action.

Asynchronous backing and elastic scaling enable multiple cores and parallel validation, potentially resulting in thousands of parachains and increased throughput.

Strengths

- Shared security model: Parachains inherit relay chain security, so they do not need to secure their own networks.

- Native composability: Contracts and runtime logic can call across parachains using XCM, improving usability.

- Deterministic messaging: XCM ensures cross-chain communication through the relay, which includes trusted execution paths and security inheritance.

Limitations

- Onboarding complexity: Winning a slot requires significant DOT and community support; even parathreads require operational expertise.

- Economic friction: The high entry cost prevents many smaller projects from launching parachains.

- Cross-ecosystem gaps: Connections to non-Polkadot chains continue to rely on external bridges, which raises trust concerns.

Example Use Cases

Composable Finance, an asset management protocol, takes advantage of Polkadot’s shared security and parachain architecture to enable frictionless capital deployment across parachains.

Other asset-hub parachains (e.g., Moonbeam, Statemint) show Polkadot’s interoperability in real-world deployments, though specific TVL or transaction metrics should be added for more detail.

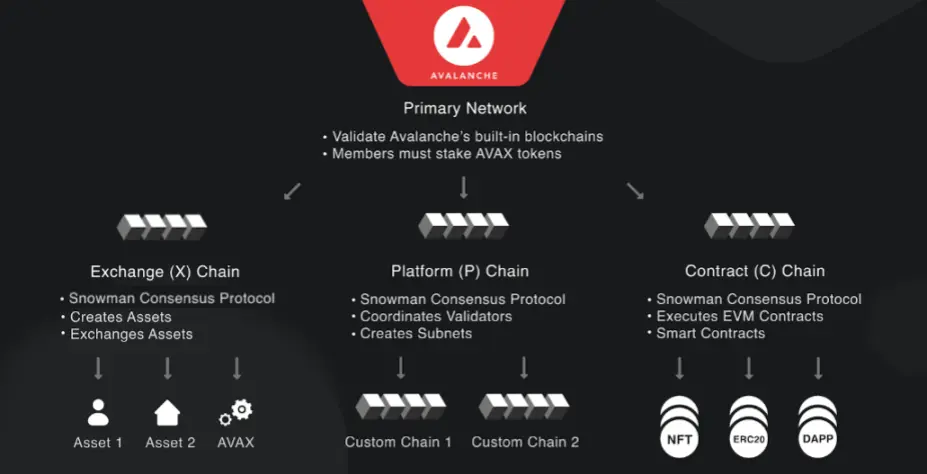

Avalanche: Subnets, Custom L1s, and Interchain Messaging

Avalanche challenges traditional multi-chain models with a unique approach based on Subnets, customizable, high-throughput blockchains that are powered by interoperable messaging tools and enterprise-grade performance.

Architecture Primer: Primary Chains and Subnets

Avalanche’s consensus network natively supports three core chains: Exchange (X-Chain), Contract (C-Chain), and Platform (P-Chain). These are linked to the primary validator set that protects the network.

On top of this framework, Avalanche introduced Subnets, which are independent chains with their own validator sets, consensus rules, and performance parameters.

Each Subnet operates as a sovereign L1, capable of supporting custom gas tokens, virtual machine runtimes, and permissioning logic ideal for regulatory environments or customized use cases.

Developers can spin up permissioned or permissionless subnets with tailored compliance and throughput.

Interoperability Toolkit: Avalanche Bridge and Interchain Messaging

To facilitate seamless value transfers between Subnets and the main chains, Avalanche provides two key interoperability layers:

Avalanche Bridge: Allows for secure, tokenized asset transfers between Avalanche’s C-Chain and other blockchains, such as ETH or ERC-20s. It prioritizes speed and low fees by utilizing high-performance cryptographic validators.

Interchain Messaging (ICM): A framework that handles cross-subnet and cross-chain communication while abstracting over consensus layers.

Developers can send messages with or without tokens between Subnets or between a Subnet and native chains (X, C, and P). ICM is powered by lightweight, staking-enabled relayers that provide dependable end-to-end delivery.

Strengths

High Customization: Subnets empower developers to configure consensus, gas economics, privacy settings, and VM types to their needs, enabling bespoke, domain-specific chains.

Low Latency and High Throughput: Avalanche’s consensus protocol (Snowman++ and Avalanche consensus) enables sub-2-second finality and high transaction throughput, making it ideal for gaming, enterprise, and real-time financial apps.

Enterprise Compliance: Permissioned Subnets can enforce regulatory and KYC/AML logic, making the platform appealing to institutions looking to deploy blockchain technology in a controlled environment.

Limitations

Sovereign “Islands”: Subnets have their own validator sets and rules; cross-subnet interoperability frequently relies on ICM or bridges, which can introduce new complexity or trust considerations compared to unified shared-securit builds.

Security Tradeoffs: Unlike Polkadot’s pooled security or Cosmos’ interoperable light-client model, Avalanche delegated security management to each Subnet’s validators; smaller Subnets may have lower security guarantees.

Operational Overhead: Setting and managing validator infrastructure for each Subnet can increase DevOps demands and costs, particularly for smaller-scale projects.

Real-World Subnet Examples

- Avalanche Rush Subnetwork: It is optimized for DeFi rewards and high throughput, with fast settlement and native token incentives.

- Gaming Subnets: Studios use Subnets to isolate high-velocity gaming logic, resulting in low latency and customizable transaction fees.

- Enterprise/Regulatory Subnets: Organizations that deploy permissioned Subnets with custom compliance rails (e.g., KYC-gated access, private transactions) show how flexibility enables broader institutional adoption, though specific usage metrics are evolving.

Avalanche’s interoperability model is based on its Subnets, customizable, sovereign blockchains with their own validators, and a toolkit that includes the Avalanche Bridge for asset transfers and Interchain Messaging (ICM) for cross-Subnet communication.

This architecture provides low latency, high throughput, and enterprise-ready compliance features, making it ideal for gaming and regulated applications.

However, due to its “sovereign island” design, cross-chain operations frequently rely on bridges or ICM, with security varying according to Subnet size and validator strength.

Head-to-Head Comparison Table

Here’s a head-to-head comparison of Cosmos, Polkadot, and Avalanche, followed by a brief analysis. The comparison is grounded in known architectural properties, latencies, and messaging models.

| Feature | Cosmos | Polkadot | Avalanche |

| Messaging Protocol | IBC (Inter-Blockchain Communication) | XCM (Cross-Consensus Messaging) | ICM (Interchain Messaging) + Avalanche Bridge |

| Security Model | Sovereign security per zone | Shared security via Relay Chain | Subnet-based; each Subnet self-secured |

| Native Cross-Chain Calls | Yes (light-client verification) | Yes (Relay-based peer messaging) | Yes, via ICM; assets via Bridge |

| Developer UX | SDK-driven; zones + Hub onboarding | Substrate-based; parachain slots | Subnet SDK; flexible but more operational |

| Finality / Latency | Fast BFT (seconds) | Relay-based finality (seconds–minutes) | Rapid consensus (~1–2 s finality) |

| Opt-In for Assets | Yes, each zone chooses IBC options | Yes, via parachain integration | Yes, per Subnet or bridge configuration |

| Gas / Cost Pattern | Varies per zone; messaging costs apply | Auction and ongoing slot costs | Gas varies per Subnet; messaging fees apply |

Analysis

- Cosmos favors decentralized sovereignty: each zone is in charge of its own security and economics, and IBC allows for flexible cross-chain communication. Best for chains that value independence and permissionless interoperability.

- Polkadot excels at tight composability with strong shared security: parachains use pooled security and can directly compose logic thanks to XCM and Relay Chain mechanics, making it ideal for complex multi-chain applications.

- Avalanche provides performance tuning and enterprise flexibility: Subnets enable developers to build modular custom blockchains with tailored rulesets and near-instant consensus. Its model is suitable for high-throughput applications such as gaming and compliant regional chains.

This comparison demonstrates how each architecture approaches interoperability while making different trade-offs in autonomy, composability, performance, and operational complexity.

Ecosystem and Composability: Liquidity, DeFi, and NFTs

Interoperability is more than just technical infrastructure; it drives capital efficiency and user experience in DeFi.

Here’s how Cosmos, Polkadot, and Avalanche differ in terms of enabling interoperability for liquidity, yield, and NFTs—and how cross-ecosystem protocols like Axelar, LayerZero, and t3rn improve the landscape.

How Interoperability Fuels DeFi UX and Liquidity

Native messaging protocols (IBC for Cosmos, XCM for Polkadot, and ICM for Avalanche) enable seamless asset transfers, composable DeFi primitives, and improved UX by reducing reliance on bridges.

Inside Cosmos, IBC connectors such as Osmosis combine liquidity across zones. On Polkadot, parachain composability allows for swaps and lending across interconnected chains. Avalanche Subnets provide fast, isolated liquidity layers with customized fee structures.

However, complete DeFi UX frequently necessitates bridging across ecosystems; this is where protocols such as LayerZero, Axelar, and t3rn come into play. They serve as interoperability hubs, connecting siloed chains and improving capital efficiency.

Protocols Enhancing Cross-Ecosystem DeFi

- LayerZero: A lightweight messaging protocol that allows for omnichain tokens (OFTs), cross-chain DEXs, and multi-chain yield aggregators without requiring wrapped assets or complex bridge infrastructure. It powers tools such as Stargate and enables seamless cross-chain interactions. It processes over $684 million in monthly volume and holds a 35% market share among interoperability protocols.

- Axelar: Offers a hub-and-spoke model with interoperable APIs and cross-chain messaging for smart contracts. Its General Message Passing (GMP) protocol allows function calls, wrapped assets, and data to be transferred across chains in a trust-minimized manner.

- t3rn: A modular, protocol-agnostic infrastructure designed for trustless compatibility across blockchains. Its circuits enable secure cross-chain messages and value bridges, facilitating decentralized trading, lending, and arbitrage.

Which Stack is Best for Cross-Chain Composability?

- Cosmos (IBC) excels at liquidity aggregation in a modular, permissionless environment. It’s ideal for DeFi teams that require sovereign chains with native messaging.

- Polkadot (XCM) excels in tightly integrated ecosystems, where parachains can instantly share logic and liquidity, resulting in low-friction composability.

- Avalanche (Subnets + ICM) offers lightning-fast execution and customizable chain configurations, making it ideal for performance-critical and enterprise use cases.

However, for cross-ecosystem DeFi in yield aggregation, one-click bridges or omnichain assets are important. LayerZero and Axelar are emerging as best-in-class infrastructure due to their developer-friendly APIs, low-latency throughput, and widespread adoption.

Interoperability shapes DeFi’s liquidity and composability.

While each platform (Cosmos, Polkadot, Avalanche) has unique advantages in UX and integration, complementary protocols such as LayerZero, Axelar, and t3rn connect ecosystems, improving capital efficiency and enabling true cross-chain DeFi experiences.

Security and Trust: Attack Surface, Bridges, and MEV

Interoperability increases utility, but it also expands the attack surface.

Bridges remain the most significant security story in cross-chain infrastructure: historically, they have been the easiest, most lucrative target for attackers, resulting in billions of dollars in losses and a long list of high-profile exploits.

Modern analyses identify common bridge vulnerabilities (custodial key exposure, Oracle manipulation, replay attacks, validator collusion, and faulty verification logic), which is why projects are increasingly using native messaging when possible.

Bridge the gap between risks and native messaging. Bridges require both on-chain and off-chain components (relayers, guardians, or multi-sig/validator sets).

That hybrid model multiplies failure modes: a single compromised oracle or bridge contract can drain liquidity even if both source and destination chains are stable.

Native messaging layers (IBC, XCM, and ICM) use light clients, relay proofs, or shared consensus semantics to reduce trust assumptions, so when native options are available, they generally lower systemic risk compared to third-party bridges.

However, native stacks are not immune: incorrect client implementations, relayer economics, or misconfigured governance can all result in exploitable gaps.

Security Trade-Offs: Shared vs Sovereign Security

Polkadot’s shared-security model provides parachains with strong inherited protection from the Relay Chain’s validator set, lowering the cost of securing a new chain while also reducing bridge dependence for intra-ecosystem composability.

The trade-off: a critical fault at the relay level or a coordinated attack on multiple parachains could have systemic consequences.

Cosmos and Avalanche prioritize sovereign security (zones or subnets manage their own validators). This provides autonomy and fault isolation, but smaller validator sets may result in weaker security guarantees unless projects invest heavily in staking and decentralization.

MEV and Cross-Chain Execution

MEV (maximal extractable value) is becoming a cross-chain phenomenon, with arbitrage, sandwiching, and liquidation opportunities spanning chains and bridges, and the timing/latency of cross-chain messages generating new extraction vectors.

Recent research indicates that cross-chain arbitrage and MEV strategies rely on bridge latency, bridge slippage, and token depreciation while assets are in transit, implying that bridges and cross-chain routers may unintentionally enable large, time-sensitive MEV events.

Regulators and market risk teams have taken notice.

Practical mitigation steps: prefer native messaging where available; harden bridge code and multisig/guardian setups, designing relayer incentives and fee grants to avoid stale/failed relays, monitoring for cross-chain MEV, and implementing protocol-level MEV mitigations.

As multichain DeFi matures, the best defense is to combine strong on-chain primitives with rigorous off-chain operations.

Who Should Choose Which? Practical Decision Guide

The choice between Cosmos, Polkadot, and Avalanche comes down to your project’s priorities, whether sovereignty, composability, or performance. Here’s a useful rule of thumb guide:

When To Choose Cosmos

Build a sovereign chain with maximum control.

Ideal for teams that prioritize configurability and decentralized governance.

Cosmos provides complete control over consensus rules, tokenomics, validator selection, and upgrade cadence, making it ideal for chains that require unique compliance or regional autonomy.

With a battle-tested IBC messaging layer, it’s ideal for projects that require permissionless interoperability.

Best suited for: Sovereign application or enterprise-specific chains requiring compliance and bespoke logic.

When to Choose Polkadot

Requires tight composability and pooled security

Polkadot’s shared-security model, via the Relay Chain, instantly secures new parachains, reducing the overhead associated with bootstrapping cryptoeconomic security.

Its XCM messaging enables seamless cross-chain logic, asset movement, and combined runs using a single shared consensus.

Best for: Teams that require layered complex applications, cross-chain DeFi primitives, or multi-module dApps that benefit from high-speed composability while minimizing security risks.

When To Choose Avalanche

Need high-performance and custom rulesets (enterprise, gaming, etc.).

Avalanche Subnets provide L1-like chains with customized economics, permissioned access, and compliance logic.

The network offers ultra-low latency (1-2 seconds) and high throughput, making it ideal for gaming, real-time finance, and regulated workloads.

Best for: Enterprises or apps that require highly performant chains, customizable policy layers, and speed-first infrastructure.

Quick Checklist for Key Decision Factors

| Factor | Cosmos | Polkadot | Avalanche |

| Cost to Secure Chain | High (own staking needed) | Lower (relay-chain shared) | Medium (own Subnet provisioning) |

| Time to Market | Fast via SDK & Ignite | Moderate (parachain auction slot) | Fast once infrastructure is ready |

| Regulatory Compliance | High (permissioned zones) | Moderate | High (permissioned Subnets) |

| Finality Speed | Seconds (Tendermint) | Seconds–Minutes (Relay phase) | Sub-2 seconds (Snowman ++ consensus) |

No one-size-fits-all platform exists. Choose Cosmos for autonomy, Polkadot for synergy and security, and Avalanche for performance and specialized functionality.

Conclusion

In The Battle for Blockchain Interoperability: Cosmos vs Polkadot vs Avalanche, there is no clear winner, only the right tool for the mission. Cosmos is ideal for teams seeking sovereign chains with maximum flexibility and control.

Polkadot provides tightly coupled composability while maintaining shared security, making it ideal for interoperable DeFi and multi-chain dApps. Avalanche is the preferred choice for enterprise and gaming applications that require low latency and tailored rulesets.

As interoperability matures, the true winners will be those who can leverage each network’s strengths while remaining adaptable to new cross-chain protocols and tooling. The decision isn’t about choosing a single chain; it’s about positioning for a multi-chain reality in 2025 and beyond.