Particularly in the mining business, the rising impact of Bitcoin mining revenue models is changing the scene of cryptocurrencies

Bitcoin spot ETFs are altering investor behavior with regard to Bitcoin and thereby influencing the income models supporting the Bitcoin mining revenue models as they acquire popularity. These ETFs let investors expose to Bitcoin without owning the asset, therefore entwining financial markets with the distributed architecture of Bitcoin. Especially spot ETFs, Bitcoin ETFs immediately impact market dynamics by affecting demand, liquidity, and price stability.

The several Bitcoin mining revenue models will be discussed in this article together with their significance for maintaining the Bitcoin network and their effects on the more general economic framework of the cryptocurrencies.

Bitcoin Mining: A Brief Overview

The method by which fresh Bitcoin is generated and network validation of transactions is known as bitcoin mining. Operating on a Proof of Work (PoW) mechanism, it uses computational capability to solve challenging cryptographic challenges by miners using their own resources.

Once a problem is solved, a new block is uploaded to the blockchain, and the miner in charge gets newly minted Bitcoin (also known as a block reward) together with transaction fees from consumers who have lately conducted transactions.

Maintaining the security and decentralization of the Bitcoin network depends critically on miners. Miners help stop fraud, double-spending, and other bad behavior by verifying transactions and making sure blocks are accurately entered to the blockchain.

Block rewards and transaction fees award them Bitcoin in return for their work, therefore establishing the cornerstone of Bitcoin Mining Revenue Models.

Maintaining the mining sector depends on these revenue sources. Miners would have minimal incentive to keep helping the network without them.

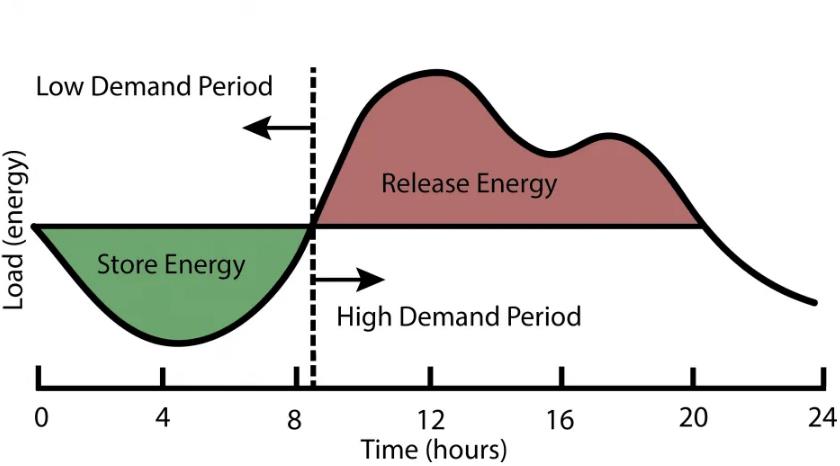

Transaction fees become ever more crucial in Bitcoin Mining Revenue Models to maintain profitability as block rewards drop over time owing to events like halving of Bitcoin.

As the sector adjusts to these changing revenue sources, this dynamic becomes increasingly important in determining the direction of Bitcoin mining.

Revenue Models in Bitcoin Mining

The Bitcoin mining industry has developed several distinct revenue models that sustain its operations. As the market matures, miners must adopt strategies that ensure profitability while securing the network. Here’s a breakdown of the primary Bitcoin Mining Revenue Models. They includes;

- Block Reward Model

- Transaction Fee Model

- Energy Arbitrage Model

- Mergers and Hosting Model

- Bitcoin Mining Pools

Block Rewards Model

The block rewards model is the most well-known revenue stream in Bitcoin mining. Miners earn Bitcoin by successfully validating a block and adding it to the blockchain.

Currently, miners receive 6.25 BTC for each block they validate, a substantial sum that represents the core of mining profitability.

However, Bitcoin’s halving events, which occur roughly every four years, halve the block rewards, cutting miners’ revenue in half.

These halving events are critical because they reduce the new Bitcoin supply, making mining more competitive and increasing reliance on other Bitcoin Mining Revenue Models.

Transaction Fee Model

As block rewards shrink, transaction fees become a vital component of Bitcoin Mining Revenue Models. Each time miners validate transactions within a block, they collect the fees associated with those transactions. While these fees were initially small, they have become increasingly important as block rewards diminish.

Over time, transaction fees are expected to play a more prominent role in supporting the mining economy, especially as the Bitcoin network becomes more congested, driving up fee prices.

Energy Arbitrage Model

Energy costs represent one of the most significant operational expenses in Bitcoin mining. In the energy arbitrage model, miners increase profitability by tapping into low-cost or renewable energy sources.

By minimizing electricity costs, miners can generate higher returns on their Bitcoin earnings. Global examples of energy arbitrage include mining hubs in Texas, where miners leverage surplus wind and solar energy, and Iceland, where geothermal energy powers mining operations.

This model has become an integral part of Bitcoin Mining Revenue Models, as miners seek ways to reduce expenses and maximize gains.

Mergers and Hosting Model

Another innovative addition to Bitcoin Mining Revenue Models is the mergers and hosting model. Large-scale miners often partner with energy companies or offer hosting services to smaller investors. By merging with energy providers, miners can secure more favorable energy rates and increase operational efficiency.

Hosting services allow miners to earn revenue by managing mining rigs for smaller investors who don’t have the infrastructure to mine independently. These partnerships and service offerings provide additional revenue streams, making mining more sustainable and profitable.

Bitcoin Mining Pools

Bitcoin mining pools have become a popular method for smaller miners to participate in the mining ecosystem. In a mining pool, individual miners combine their hashing power to solve blocks more efficiently.

Once a block is validated, the rewards are shared among the pool participants based on their contribution to the pool’s total hashing power. While pool participants must pay a fee to join, mining pools offer a more stable revenue stream, especially for those with limited computational power.

Pool fees vary, but this Bitcoin Mining Revenue Model is especially appealing to smaller miners who might struggle to compete independently.

Economics of Bitcoin Mining

The economics of Bitcoin mining involves balancing the cost of operations against potential revenue. Various factors such as hardware expenses, electricity costs, Bitcoin price volatility, and environmental regulations all influence the profitability of mining. Let’s explore these key areas and how they tie into Bitcoin Mining Revenue Models.

Cost of Operations

Hardware Expenses

Mining Bitcoin requires specialized hardware known as ASICs (Application-Specific Integrated Circuits). These machines are built for maximum efficiency, but they come with a hefty price tag.

The initial cost of ASICs can be a significant investment, often ranging from a few thousand to tens of thousands of dollars per unit.

As newer and more powerful models are developed, older ASICs quickly become obsolete, forcing miners to upgrade regularly to stay competitive.

These hardware expenses are a crucial part of Bitcoin Mining Revenue Models, as miners must factor in the cost of their equipment when calculating profitability.

Electricity Costs

Electricity is one of the largest ongoing expenses for miners. The amount of energy consumed by mining operations varies by location, with regions like China historically offering cheaper energy prices, while miners in the U.S. often pay higher rates.

For example, miners in China previously benefited from abundant hydroelectric power, while U.S.-based operations, such as those in Texas, capitalize on low-cost wind and solar energy. Miners must weigh electricity costs heavily in their Bitcoin Mining Revenue Models, as high energy prices can quickly eat into profits.

Revenue vs. Profitability

Bitcoin Price Volatility

Bitcoin’s price volatility has a direct impact on miners’ revenue. When Bitcoin’s price is high, the rewards miners receive (in terms of fiat currency) are more valuable, boosting their profitability.

However, when the price drops, miners’ revenue can shrink dramatically, even if they continue to earn the same amount of Bitcoin.

This price fluctuation forces miners to carefully plan their Bitcoin Mining Revenue Models, accounting for both the best and worst market conditions.

Breakeven Point for Miners

Miners often calculate their breakeven point to determine when their operations become profitable. This involves balancing the cost of their mining hardware, electricity, and other operational expenses against the revenue they generate from block rewards and transaction fees. If the cost of mining exceeds the revenue generated, miners either operate at a loss or shut down their operations until market conditions improve. The breakeven point is a critical factor in Bitcoin Mining Revenue Models, guiding miners’ decisions on whether to continue or halt their activities.

Environmental and Regulatory Factors

Environmental Concerns

As Bitcoin mining consumes vast amounts of electricity, it has drawn criticism for its environmental impact. Many governments and environmental groups are concerned about the carbon emissions associated with energy-intensive mining operations.

This has led to increasing regulatory pressure, especially in regions with strict environmental policies. Miners must now consider the environmental impact of their operations as part of their Bitcoin Mining Revenue Models, as regulatory changes could impose additional costs or limit their ability to operate.

Regulatory Costs

In addition to environmental concerns, miners face various regulatory costs, such as taxation and compliance with jurisdiction-specific rules. Some countries have imposed taxes on cryptocurrency mining, while others have introduced stringent regulations aimed at curbing energy consumption.

Miners must navigate these regulatory landscapes carefully, ensuring that they comply with local laws while maintaining their revenue flow.

These regulatory costs are becoming an increasingly important consideration in Bitcoin Mining Revenue Models, as failing to comply can result in fines or shutdowns.

Case Studies: Success and Struggles in Bitcoin Mining Revenue Models

The world of Bitcoin mining is filled with both success stories and struggles, as companies adapt their Bitcoin Mining Revenue Models to shifting market conditions, regulatory pressures, and operational challenges.

In this section, we will explore two success stories and two struggles that highlight the diverse approaches and challenges faced by Bitcoin mining companies.

Success Story #1: Marathon Digital Holdings

Revenue Growth

Marathon Digital Holdings has emerged as one of the largest Bitcoin mining companies, known for its aggressive growth strategy. Marathon’s success is rooted in its ability to scale operations quickly by leveraging large mining farms across the U.S.

One of the company’s most effective strategies within its Bitcoin Mining Revenue Models is energy arbitrage. By situating their mining operations in regions with access to low-cost energy, Marathon has been able to minimize operational expenses, maximizing profitability.

Additionally, Marathon has capitalized on periods of Bitcoin price surges, earning significant revenue as the value of Bitcoin spiked. This price sensitivity is a critical element of its revenue model, making it heavily dependent on market conditions.

Success Story #2: Riot Platforms

Strategic Moves

Riot Platforms has strategically diversified its operations by integrating renewable energy sources into its mining infrastructure.

This move has insulated the company from market fluctuations tied to electricity costs, as it can rely on more stable and predictable energy sources, such as wind and solar power.

Riot’s focus on sustainability and cost efficiency has helped strengthen its Bitcoin Mining Revenue Models, making it less vulnerable to regulatory and environmental concerns.

By embracing renewables, Riot has also positioned itself favorably with investors who are increasingly concerned about the environmental impact of Bitcoin mining.

Struggle Case #1: Bitmain and the ASIC Shortage

Challenges

Bitmain, a major manufacturer of ASIC mining rigs, encountered significant revenue challenges due to a global shortage of semiconductors, which affected the production of its mining equipment.

This shortage drove up the cost of ASICs, making it harder for miners to upgrade their hardware and maintain competitive hashing power. Bitmain’s Bitcoin Mining Revenue Models suffered as delays in production and delivery led to revenue losses.

For many miners, the high cost of acquiring new hardware, coupled with increased competition, strained profitability. Bitmain’s struggle highlights the critical role that hardware availability plays in mining success.

Struggle Case #2: China’s Mining Ban

Regulatory Pressures

China’s 2021 ban on Bitcoin mining created a seismic shift in the global mining landscape. Before the ban, China accounted for more than half of the world’s Bitcoin mining hash rate. However, the crackdown forced miners to shut down operations or relocate to more crypto-friendly jurisdictions.

This regulatory upheaval severely disrupted Bitcoin Mining Revenue Models for Chinese miners, as they faced the logistical challenge of moving entire mining farms to countries such as Kazakhstan and the U.S.

This disruption not only reduced miners’ revenue during the transition but also highlighted the risks posed by government intervention in the mining sector.

The success and struggles of these companies demonstrate the complex and evolving nature of Bitcoin Mining Revenue Models. Marathon and Riot have shown how large-scale operations and strategic integration of energy resources can drive profitability, while Bitmain and Chinese miners illustrate the vulnerabilities inherent in hardware shortages and regulatory actions.

Conclusion

To fully appreciate the larger economic structure driving the Bitcoin ecosystem, one must first grasp the complexity of Bitcoin mining revenue models. From block rewards and transaction fees to energy arbitrage and mining pools, every revenue model—from block rewards and transaction fees to mining pools—determines miners’ profitability most importantly.

Furthermore greatly affecting mining economics are outside variables such hardware costs, energy prices, and legal pressure. The development of spot Bitcoin ETFs has also brought fresh factors that indirectly influence demand for Bitcoin and, hence, mining income.

Long-term profitability in the mining sector depends on long-term adaptation to market changes, legal changes, and technological hurdles, as shown by the success stories of Marathon Digital Holdings and Riot Platforms as well as the difficulties of Bitmain and Chinese miners.

Understanding these income models and their effects helps miners and investors to negotiate the changing terrain of Bitcoin mining, therefore guaranteeing sustainability and profitability in this fast changing sector.

FAQs

What is a Bitcoin Mining Revenue Model?

A Bitcoin Mining Revenue Model refers to the various ways miners generate income from mining Bitcoin.

The primary sources of revenue include block rewards (newly minted Bitcoin earned for validating blocks), transaction fees (earned by processing transactions), and strategic energy use (minimizing operational costs through energy arbitrage or renewable sources).

Mining pools and hosting services for smaller miners are also part of this revenue model.

How does Bitcoin price volatility affect mining revenue?

Bitcoin price volatility directly impacts mining revenue. When Bitcoin’s price rises, the value of block rewards and transaction fees increases, leading to higher profitability for miners.

Conversely, if Bitcoin’s price drops, the revenue miners earn from block rewards and transaction fees decreases, often causing a decline in profitability and making it harder for miners to cover operational costs such as electricity and hardware.

What role do spot Bitcoin ETFs play in Bitcoin mining profitability?

Spot Bitcoin ETFs indirectly influence Bitcoin mining profitability by driving demand for Bitcoin. As institutional investors buy into spot ETFs, the fund providers must purchase Bitcoin, which often leads to price increases.

As Bitcoin’s price rises due to increased demand from spot ETFs, miners benefit from higher revenues. Additionally, these ETFs can lead to increased capital inflows into the Bitcoin market, indirectly supporting investments in mining infrastructure and technology.

How do halving events affect Bitcoin mining revenue models?

Halving events reduce the block reward that miners receive for validating transactions by 50%, which occurs approximately every four years.

This reduction in block rewards impacts the Bitcoin Mining Revenue Models, as miners earn less Bitcoin per block, making transaction fees a more crucial source of income.

Miners need to adapt to these changes by either becoming more energy efficient, using better hardware, or relying more on transaction fees to maintain profitability.