The politics of Bitcoin is evolving as Donald Trump’s stance influences market trends and public perception.

Here, we’ll explore how the Politics of Bitcoin intertwines with Trump’s actions and the broader regulatory landscape.

- 1 Politics of Bitcoin: Bitcoin as a Political Asset

- 2 Trump’s Criticism of Bitcoin: A Timeline

- 3 Bitcoin’s Role in the Trump Administration

- 4 The Politics of Bitcoin: How Trump’s Stance Is Shaping the Current Market

- 5 Bitcoin, the 2024 Elections, and Trump’s Role

- 6 The Politics of Bitcoin Beyond Trump

- 7 Conclusion

Politics of Bitcoin: Bitcoin as a Political Asset

Bitcoin has become a powerful political asset, surpassing its roots as a decentralized digital currency. Its potential to disrupt traditional financial systems has pushed it to the forefront of political debates and international policymaking. Here are the main ways the politics of Bitcoin enable Bitcoin to serve as a political asset:

A Challenge to Traditional Monetary Policies

Bitcoin functions independently of central banks and government control, posing a direct challenge to traditional monetary systems. Its decentralized structure threatens national currency monopoly by providing individuals and nations with a viable alternative to fiat money.

This has spurred debates regarding sovereignty in monetary policy, particularly in countries with hyperinflation or unstable currencies.

A Tool for Financial Sovereignty

Bitcoin is widely regarded as a tool for financial autonomy. It allows individuals in regimes to bypass capital controls and censorship. Countries like El Salvador have adopted Bitcoin as a legal tender to lessen reliance on the US dollar and achieve financial independence.

Rising Political Interest

Politicians throughout the world are taking positions on Bitcoin as its popularity grows. Proponents argue that it can equalize wealth distribution and stimulate innovation, while opponents raise concerns about volatility, regulation, and its usage in illegal activities.

Bitcoin’s divergence has polarized political discourse, particularly in the United States, where politicians like Donald Trump have criticized it as a threat to the dollar.

A Geopolitical Power Play

Bitcoin’s borderless nature has also made it a geopolitical asset. Countries such as Russia and Iran have considered utilizing Bitcoin to bypass sanctions, while others view it as a strategic reserve similar to gold.

The United States is under pressure to adopt a more crypto-friendly stand to maintain its leadership in financial innovation.

Bitcoin’s capacity to operate outside of traditional frameworks has solidified its status as a political asset. Whether considered as a threat or an opportunity, its impact on governance and global power dynamics is growing.

Trump’s Criticism of Bitcoin: A Timeline

Donald Trump has consistently expressed skepticism against Bitcoin, mirroring his broader fears about cryptocurrency. His stance, which is based on a preference for the supremacy of the US dollar, sheds light on Bitcoin Politics. Here is a brief account of his historical position:

2019: Bitcoin is “Thin Air”

In July 2019, Trump publicly stated on Twitter that he was “not a fan of Bitcoin,” describing it as “not money” and criticizing its volatility and potential to facilitate illegal activities.

He stressed the strength and dependability of the US dollar as the dominant global currency, claiming that cryptocurrencies created unnecessary competition for traditional monetary systems.

2021: Bitcoin is a “scam”

During a Fox Business interview in June 2021, Trump reaffirmed his negative stance, calling Bitcoin a “scam.”

He expressed concern that Bitcoin directly competes with the dollar, undermining the latter’s status as the world’s reserve currency. He also advocated for more stringent regulations to minimize Bitcoin’s influence.

2022-2024: Strategic Shift

Despite previous criticism, Trump’s perspective shifted once he entered the 2024 presidential contest. He launched an NFT collection in 2022, indicating a cautious entry into the crypto market.

By 2024, he had begun portraying himself as a crypto-friendly candidate, campaigning for domestic Bitcoin mining and incorporating the growing impact of digital assets into his campaign strategy.

This evolution demonstrates the delicate link between political goals and emerging technologies such as Bitcoin. While Trump’s early remarks reflected traditional economic conservatism, his recent actions suggest a recognition of crypto’s potential role in shaping the future of finance and governance.

Bitcoin’s Role in the Trump Administration

During Donald Trump’s presidency, Bitcoin’s growing significance as a decentralized asset sparked regulatory scrutiny and political debate.

Despite Trump’s open criticism of Bitcoin, his administration paved the way for pivotal debates about cryptocurrency legislation. Here’s an overview of Bitcoin’s role in this era:

1. Trump’s Skepticism Toward Bitcoin

Throughout his administration, Donald Trump publicly condemned Bitcoin on several occasions. In 2019, he described it as “not money” and expressed concern about its volatility and potential usage for criminal purposes.

He also reaffirmed his preference for the US dollar, underlining its position as the world’s reserve currency. These remarks underscored his administration’s cautious approach to digital assets.

2. Regulatory Developments Throughout Trump’s Administration

While Trump personally disapproved of Bitcoin, his administration has played a critical role in advancing debates about its regulation:

CFTC Oversight: Trump’s administration has leaned toward expanding the Commodity Futures Trading Commission’s (CFTC) control over the Bitcoin and Ethereum markets, resulting in a more lenient regulatory environment than the SEC’s strict standards.

This transition reflected greater acknowledgment of the need for regulatory clarity.

Treasury Department’s Focus: Treasury Secretary Steve Mnuchin focused on monitoring Bitcoin’s use in illicit activities such as money laundering and fraud. Mnuchin advocated for stricter compliance measures for crypto businesses, particularly around AML and KYC requirements.

3. Key Figures in Crypto Policy Development

Some personnel in the Trump administration backed the expansion of blockchain and cryptocurrency innovation despite Trump’s negative stance:

Hester Peirce (SEC commissioner): Peirce, also known as “Crypto Mom,” was a strong supporter of cryptocurrency-friendly regulations. She suggested the “Token Safe Harbor Proposal,” aiming to provide blockchain startups with a three-year grace period to comply with securities laws.

Mnuchin’s Dual Stance: While advocating for stricter regulation, he also encouraged regulatory clarity to minimize confusion for enterprises engaged in the crypto space.

4. The Broader Impact of Trump’s Administration on Bitcoin

Trump’s administration has highlighted the political polarization around Bitcoin. His public skepticism contrasted with several administration officials’ efforts to encourage innovation and support blockchain technologies.

The administration’s cautious approach to regulation and enforcement underlined Bitcoin’s rising impact on financial institutions and policymaking.

The last election saw a trend towards bipartisan recognition of the need for clearer cryptocurrency regulation, laying the foundation for future debates under the following administrations.

The Politics of Bitcoin: How Trump’s Stance Is Shaping the Current Market

Donald Trump, a polarizing figure in American politics, has considerable sway over public opinion and financial markets, including Bitcoin. His evolving stance on crypto and the growing traction of the politics of Bitcoin have a direct impact on Bitcoin’s market dynamics in the following ways:

Trump’s Political Rhetoric Shapes Market Sentiment

Trump’s shift toward a more pro-crypto-friendly stance has impacted the market perception of Bitcoin. Initially criticizing Bitcoin as a “scam” and a threat to the US dollar, Trump has recently positioned himself as an advocate of blockchain innovation and crypto growth.

At events such as the 2024 Bitcoin Conference, he vowed to transform the United States into a “Bitcoin superpower,” in line with the larger Republican trend of supporting digital assets. Such rhetoric instills confidence among crypto proponents and fosters market optimism.

Correlation between Trump’s Statements and Bitcoin Price Movements

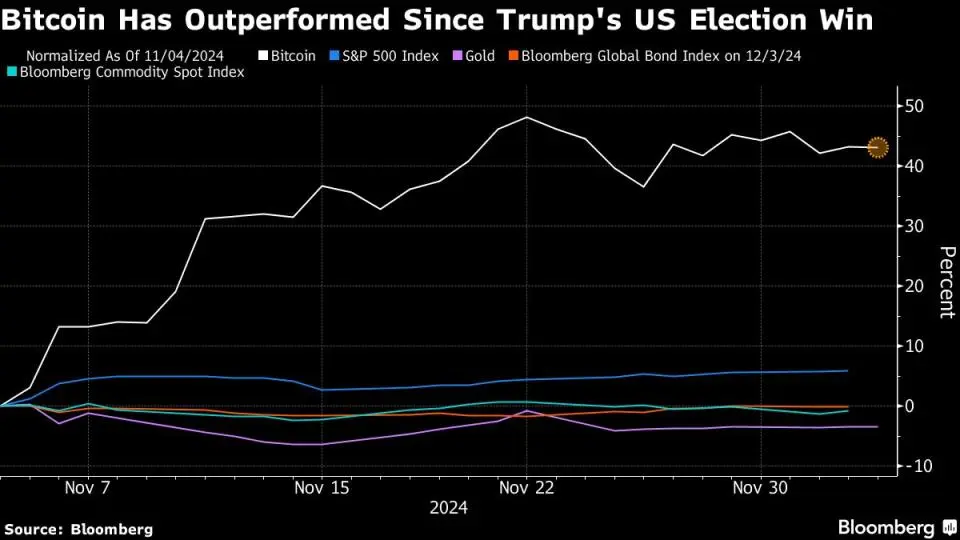

The crypto market is extremely sensitive to political developments. Bitcoin’s price soared by more than 12% in late 2024 as Trump’s chances of winning the forthcoming presidential election increased.

Investors see a future Trump administration as pro-crypto, with expectations of clearer regulations and lower obstacles to adoption. Some analysts predict Bitcoin might reach $90,000 if Trump regains power, fueled by his supporting rhetoric and pledges of deregulation.

Speculative Investor Behavior Related to Trump’s Political Comeback

Trump’s growing political momentum has sparked speculative activity in Bitcoin markets. Spot Bitcoin ETFs and futures saw increased activity as investors backed Trump’s pro-crypto policy agenda.

Billionaire investors and market analysts, like Stanley Druckenmiller, have remarked on the “Trump trade,” where crypto assets gain in anticipation of favorable regulatory and policy improvements under his leadership.

Broader Implications for Bitcoin and the Crypto Industry

Trump’s increasing influence on Bitcoin demonstrates the interplay between politics and financial markets. His return to power suggests a shift in US crypto policy from the SEC’s strict regulations imposed during the Biden administration to a more innovative approach.

This potential transition highlights the “Politics of Bitcoin,” where leaders’ attitudes can shape the asset’s trajectory in global markets.

Trump’s political clout, the politics of Bitcoin, and evolving stance on crypto continue to influence Bitcoin market perception and price trends. Investors are keeping a close eye on his political prospects since they will have a significant impact on the future of Bitcoin.

Bitcoin, the 2024 Elections, and Trump’s Role

The 2024 US presidential elections have focused attention on cryptocurrency, with Bitcoin playing an important part in political narratives. Here’s how the interaction of Bitcoin and Donald Trump’s shifting views influenced the 2024 elections:

- Trump’s Evolving Crypto Position

- Crypto as a Key Election Topic

- The Potential Impact of Trump’s Presidency

- Broader Implications for Bitcoin

Trump’s Evolving Crypto Position

Donald Trump, who was historically skeptical of Bitcoin, shifted his stance ahead of the 2024 elections. Previously skeptical of cryptocurrencies, citing concerns about criminal activities and competition with the US dollar, Trump has suddenly taken a more pro-crypto stance.

He has supported Bitcoin-friendly activities like accepting Bitcoin donations for his campaign and advocating for policies that support crypto deregulation. This shift appears to be aimed at younger, cryptocurrency-savvy voters and high-value donors in the digital asset market.

Crypto as a Key Election Topic

Bitcoin and cryptocurrency policies have emerged as major issues for voters concerned about inflation, economic stability, and financial freedom in the 2024 election cycle.

A recent survey found that over half of voters want clearer crypto regulations before investing, with younger demographics exhibiting a greater interest in candidates’ crypto positions.

These findings indicate that cryptocurrencies may affect voter behavior, making it a major concern for candidates across party lines.

The Potential Impact of Trump’s Presidency

If Trump wins a second term, his government is expected to favor deregulation and pro-business policies that might boost Bitcoin adoption and investment.

Analysts believe that his emphasis on reducing government interference will create a favorable environment for cryptos, promoting institutional participation and potentially increasing Bitcoin’s market value.

This contrasts with the Democratic approach, which is viewed as more cautious towards crypto because of concerns about regulation and market stability.

Broader Implications for Bitcoin

As the politics of Bitcoin gains traction in the political and economic debate, Bitcoin’s role in the 2024 elections emphasizes its dual nature as a financial asset and a tool for financial sovereignty.

Regardless of the election outcome, clearer policies on cryptocurrencies are expected to emerge, most likely boosting adoption and dictating its future in global markets.

The Politics of Bitcoin Beyond Trump

The politics of Bitcoin, the intersection of Bitcoin and politics, is rapidly evolving, expanding beyond individual figures such as Donald Trump.

Bitcoin, as a decentralized asset, challenges traditional financial norms, creating a nonpartisan debate about its regulation and adoption. Its future in politics is dependent on developing bipartisan support, avoiding the risks of deep political polarization, and remaining impartial.

A Divisive or Unifying Force?

Bitcoin has often been a point of contention for policymakers. While some conservatives support Bitcoin as a symbol of financial independence and less government intervention, progressive leaders frequently express worries about its environmental impact and potential for financial fraud.

Despite these divisions, there is evidence of growing bipartisan cooperation. Recent U.S. legislation aimed at building a specialized regulatory framework for cryptocurrencies has received support from both sides, demonstrating the prospect of a collaborative approach to Bitcoin regulation.

Global Implications and Trump’s Legacy

The politics of Bitcoin is growing on a global scale. World leaders are closely monitoring US crypto regulations, particularly those shaped by people like Trump, to determine their impact on global financial institutions.

Trump’s prior criticisms of Bitcoin, as well as his subsequent adoption of crypto campaign donations, demonstrate how political attitudes toward cryptocurrencies can evolve in reaction to changing market dynamics and public sentiments.

These shifts could encourage other nations to adopt or reject Bitcoin-friendly policies.

Creating a Sustainable and Inclusive Future

For the politics of Bitcoin to thrive politically, its supporters must prioritize education and inclusivity. Initiatives such as the Bitcoin Voter Project seek to demystify cryptocurrency and raise awareness among a wide range of demographics.

Advocates argue that Bitcoin should transcend partisan divides, establishing itself as a tool for financial inclusiveness and innovation rather than a political weapon.

The politics of Bitcoin’s future depends on maintaining its decentralized ethos while navigating an increasingly complex regulatory and geopolitical terrain. The emphasis should be on ensuring that it serves a wide range of society, moving beyond party politics to realize its transformative potential.

Conclusion

The “Politics of Bitcoin” highlights a deeper ideological struggle between traditional financial control and the disruptive power of blockchain technology.

The politics of Bitcoin has gained political traction as a result of Donald Trump’s efforts. His historical critique, shifting stance, and policy discussions have emphasized the importance of crypto in reshaping governance and economic policy.