Exchange coins are types of cryptocurrencies issued by a cryptocurrency exchange to fulfill various utility functions within the exchange’s ecosystem

These coins, occasionally referred to as exchange tokens, offer users a variety of advantages, including trading fee discounts, staking rewards, and access to exclusive features or services.

Various categories of cryptocurrencies are described using a variety of vocabulary. Native coins, utility tokens, governance tokens, stablecoins, altcoins—the list is endless. Nevertheless, the “exchange coin” is a type of cryptocurrency that you may not be acquainted with.

A cryptocurrency exchange issues an exchange coin, a specific form of cryptocurrency. These currencies occasionally referred to as exchange tokens, fulfill utility functions within the ecosystem of the issuing exchange.

For instance, numerous exchange coins offer users discounts on trading fees when they are utilized to settle transactions on the exchange. For example, BNB (BNB) provides reduced trading fees on the Binance platform.

Staking is another frequently used utility where users can stake their exchange coins to receive rewards, such as additional coins or tokens, or participate in various exchange activities, such as voting on new token listings.

Holding exchange coins frequently provides users access to exclusive features or services on the exchange, such as premium customer support or participation in token sales, known as initial exchange offerings (IEOs).

Some exchange coins are employed for other purposes, such as a base trading pair for other cryptocurrencies, as collateral for loans, or in cross-platform transactions. However, this is an uncommon application.

Key distinctions between exchange tokens and exchange currencies

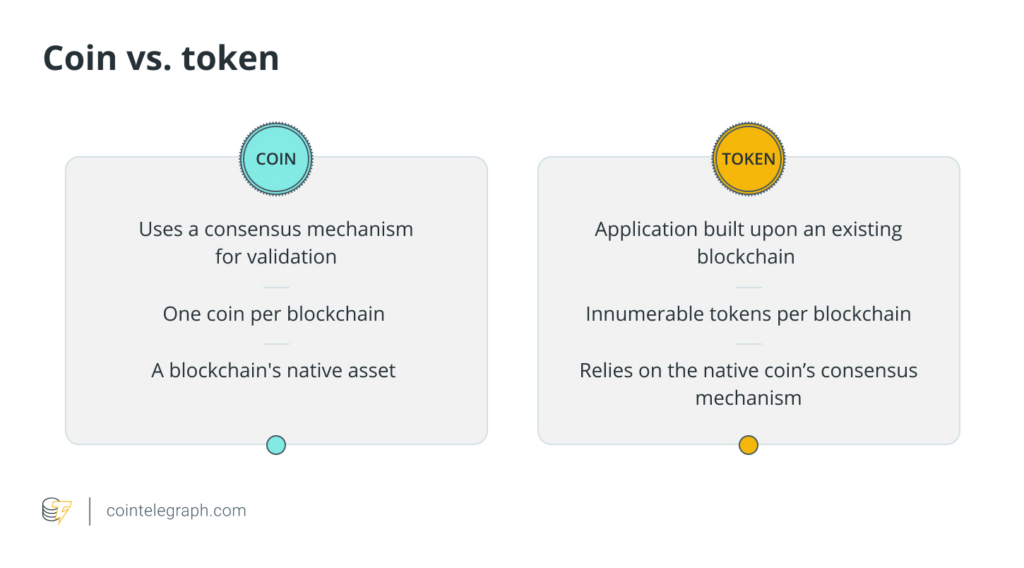

Although the terms “token” and “coin” are frequently used interchangeably, the reality is that their precise applications differ slightly.

The fundamental question is whether a cryptocurrency is the native coin of a blockchain or is constructed upon it by a predetermined token standard.

For instance, BNB is the native cryptocurrency of the BNB Smart Chain, the blockchain that underpins the Binance exchange. The exchange coin should be appropriately classified as an “exchange coin” due to its Native to the network status and use in paying gas fees.

The KuCoin Token (KCS) is the exchange “coin” of the KuCoin exchange. KCS should be accurately classified as an “exchange token” due to its status as an ERC-20 token that operates on Ethereum.

The project’s team may develop its blockchain and migrate its existing exchange token to the native network later in its life cycle. For instance, the Cronos (CRO) exchange coin on Crypto.com was initially an ERC-20 token on Ethereum. Nevertheless, the token was migrated to the Cronos blockchain in November 2021, now functioning as a native coin.

This dichotomy characterizes the crypto industry. For instance, Ethereum is a coin that functions as the native currency of the Ethereum network and is used to pay gas fees. Tether (USDT) is an Ethereum token that operates as a tenant on the network.

Let us proceed after we have resolved the main differences between coins and tokens.

What is the rationale behind investing in exchange currencies and tokens?

Digital gold is not quite the same as exchange coins but provides financial incentives and strategic advantages. These assets are essential to the ecosystems of their respective platforms, offering substantial demand-side support.

Discounts on trading fees

This can be a substantial cost-saving measure for day traders, as holders of an exchange coin frequently receive reduced trading fees on the exchange in question. For example, the Binance platform offers discounted trading fees to BNB consumers, reducing transaction costs.

Similarly, the Huobi Token (HT) and KuCoin Token offer fee reductions on their respective exchanges, especially appealing to active traders looking to reduce their expenses.

Mechanisms of token waste

In addition to fee discounts, these tokens frequently participate in token burn mechanisms, which involve the periodic destruction of a portion of the tokens to decrease the overall supply. This deflationary strategy can potentially enhance the token’s scarcity and, theoretically, its value over time.

For instance, Binance consistently implements token burns for BNB to increase its long-term monetary value. Holders receive a tangible return on investment due to these mechanisms, which generate potential appreciation in token value.

Governance

An additional compelling feature of exchange tokens is their involvement in governance. Numerous platforms allow token holders to partake in governance decisions by voting on proposals that can potentially influence the future of the exchange.

This democratization of decision-making has the potential to empower investors by providing them with a voice in critical matters, including protocol enhancements, fee structures, and new listings. The Huobi Token and Uniswap’s (UNI) are two prominent examples of tokens that allow holders to vote on significant changes and influence the platform’s direction.

In addition to fostering a sense of community and shared purpose, this participatory role also aligns investors’ interests with the growth and development of the exchange.

Yield generation

Investing in exchange coins and tokens can also be a practical method for generating yield through staking and other DeFi activities. Staking programs are available on numerous exchanges, which allow token holders to secure their assets in exchange for staking rewards, thereby supporting network security and operations.

For instance, Aave (AAVE) and Synthetix (SNX) tokens can be staked to generate interest or additional tokens, thereby generating a passive income stream. This ability to generate yield enhances the overall value proposition of holding these tokens, enabling investors to earn returns that surpass ordinary price appreciation.

Coins and tokens that are frequently exchanged

Although BNB remains the top exchange coin on Binance due to its extensive use, other coins, such as GateToken, OKB, and Bybit’s BYT, acquire traction by providing exclusive investment opportunities, trading fee discounts, and governance roles. This indicates their potential for future growth.

BNB is the most widely used exchange coin in the market. It is a native of the Binance exchange, the largest crypto exchange in the world, and its 24-hour trading volume is quadruple that of its nearest competitor, Bybit.

The value proposition is comprehensively represented by incorporating trading fee discounts, participation in exclusive investment opportunities, and increasing adoption as a payment method and integration into various financial services.

BNB is a promising option for investors seeking a digital asset that is both well-rounded and potentially lucrative, with a strong foundation for future development. Nevertheless, it is not the sole exchange coin available.

Although it is still eclipsed by Binance, the Bybit Token is one of the fastest-growing exchanges and is the native ERC-20 token of the Bybit exchange. Bybit’s success is ascribed to its innovative trading products, robust security measures, and user-friendly interface. High-frequency traders experience substantial cost savings due to the reduced trading fees that BYT holders receive.

Bybit also organizes promotional events and trading competitions, which provide BYT holders with supplementary incentives and benefits. BYT will serve as an essential governance component in the evolution of Bybit, enabling holders to participate in the voting process for critical decisions and protocol enhancements, thereby promoting community engagement.

GateToken (GT) is the native ERC-20 token of Gate.io, renowned for its innovative products and extensive trading pairs. GT is an appealing option for active traders due to its trading charge discounts.

Holders are granted access to exclusive token sales, which offer early investment opportunities with the potential for substantial returns. Additionally, GT permits holders to vote on critical decisions through platform governance.

OKB, the native commodity of OKX, was initially issued as an ERC-20 token on the Ethereum blockchain, similar to Crypto.com. However, it has since been migrated to OKX’s blockchain, the OKT Chain.

OKB holders are granted substantial discounts on trading fees, and they are also granted early access to new initiatives and investment opportunities through the use of OKB to participate in token sales on OKX’s Jumpstart platform.

Like Binance, OKX periodically implements token fires to diminish the total supply of OKB. This practice can potentially increase the token’s value and scarcity over time.

OKX’s strategic initiatives to enhance its product offerings and expand its global presence indicate an expanding user base and increased adoption of OKB.

Increasing the utility of exchange currencies

Initially utilized within their respective platforms, exchange coins such as BNB and OKB are increasingly acknowledged as payment methods, offering alternative alternatives to traditional cryptocurrencies.

Although exchange coins are not as prevalent in the payments ecosystem as digital currencies like Bitcoin (BTC) and USDT, they still have their place.

For instance, BNB is widely recognized beyond the Binance platform. Through integration with cryptocurrency payment processors such as CoinPayments, numerous Shopify merchants accept BNB as a form of payment. Additionally, Takeaway.com (a subsidiary of Just Eat) accepts BNB for food deliveries in specific regions.

Similarly, various merchants and services accept OKB as a form of payment. It is frequently employed to purchase products, services, and even travel reservations. Furthermore, ecosystems such as Binance, OKX, and Crypto.com provide Visa cards that allow users to expend their exchange coins and tokens at any merchant that accepts Visa.

However, the primary function of numerous exchange tokens and coins is to facilitate transactions within their respective ecosystems rather than as a medium of exchange. For instance, BYT is predominantly intended for use within the Bybit crypto ecosystem to facilitate platform-related activities and trading fee discounts.

Similarly, GT is primarily employed within the Gate.io platform for trading fee discounts, participation in token sales, and governance. The tokens can be always exchanged for other more freely used currencies when paying for products and services.