The Rise of SocialFi marks the convergence of social media and decentralized finance (DeFi), transforming how people engage with online platforms

At its core, SocialFi leverages blockchain technology and Web3 principles to empower users by allowing them to earn tangible rewards for their interactions. Unlike traditional social media, where platform owners retain full control and monetization power, SocialFi platforms distribute value directly to users through tokens and cryptocurrencies.

In this article, we’ll discover how SocialFi could revolutionize how social media users, influencers, and brands operate in the coming years.

What is SocialFi?

The Rise of SocialFi introduces a revolutionary concept that blends social media with decentralized finance (DeFi), creating a new frontier where users can actively earn, trade, and manage wealth through their online interactions.

Key Elements of SocialFi

Let’s break down the elements that define SocialFi:

- Social Networks: At its core, SocialFi platforms operate like traditional social media, where users engage in content creation, sharing, and interactions (likes, comments, and posts).

However, the significant difference lies in how these interactions translate into real value, thanks to blockchain technology and tokenization.

- Decentralized Finance (DeFi): The Rise of SocialFi takes advantage of DeFi’s principles by offering financial services—such as lending, borrowing, and staking—directly on social platforms without intermediaries.

Users can earn rewards in the form of cryptocurrencies or tokens for their participation, enhancing their social engagement with financial benefits.

- Non-Fungible Tokens (NFTs): SocialFi enables the transformation of user-generated content, such as posts, artwork, and videos, into NFTs.

This means that users can own and monetize their content, potentially earning significant income from selling or trading these NFTs. This ownership contrasts sharply with traditional platforms, where content creators rarely receive fair compensation.

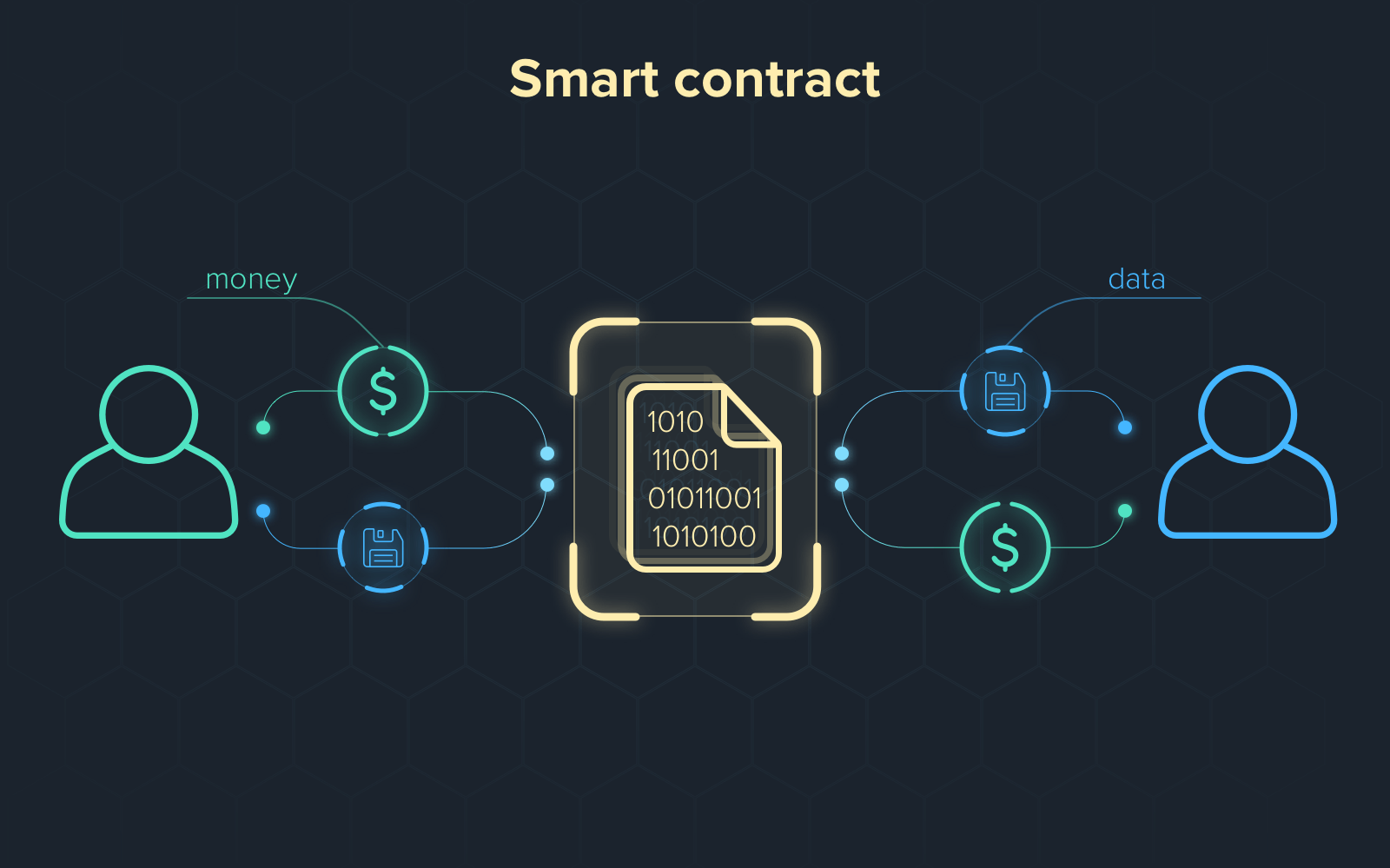

Role of Smart Contracts

Smart contracts are the backbone of The Rise of SocialFi platforms, automating transactions, handling token rewards, and ensuring transparency.

These self-executing contracts eliminate the need for intermediaries, ensuring users are compensated fairly for their contributions and interactions without any delays or disputes.

Earning Tokens Through Social Interactions

One of the most exciting features of The Rise of SocialFi is that users can generate income by simply engaging with the platform.

Every like, comment, or share can earn users tokens, turning regular social media interactions into wealth-creating opportunities.

This democratizes content creation and engagement, allowing everyone—not just influencers—to benefit financially from their social presence.

The Evolution of Social Media Monetization: From Web2 to Web3

The landscape of social media monetization is undergoing a profound transformation, transitioning from the traditional Web2 model to a more user-centric approach in Web3.

This shift is encapsulated in The Rise of SocialFi, a movement that merges social media with decentralized finance (DeFi).

Web2 Social Media Monetization

In the Web2 era, social media monetization primarily relied on methods such as advertising, influencer marketing, and subscription models.

Platforms like Facebook, Instagram, and YouTube profited from their vast user bases by selling advertising space, often prioritizing corporate interests over individual users.

Influencers became pivotal in this ecosystem, using their reach to promote products for brands, but they often saw only a fraction of the revenue generated from their content.

However, several significant issues plagued Web2 platforms:

- Data Privacy Concerns: Users often found their data exploited for profit, with little transparency regarding how their information was used or shared.

- Unequal Revenue Sharing: Content creators typically received a minimal share of advertising revenue, leading to widespread frustration among those who contributed substantial value to the platforms.

- Lack of User Control: Users had limited control over their content and how it was monetized, relying on platform algorithms that often favored certain types of engagement over others.

Web3 and SocialFi Revolution

With the advent of Web3, a decentralized version of the internet, users are beginning to reclaim control over their data and content.

The Rise of SocialFi embodies this revolution by enabling users to monetize their contributions directly and transparently.

In a Web3 environment, individuals can own their content and benefit financially from their social interactions without intermediaries.

The Rise of SocialFi addresses the shortcomings of Web2 by implementing key features:

- Ownership of Content: Users can tokenize their contributions, ensuring they are rewarded for their creativity and engagement.

Unlike in Web2, where platforms control content, SocialFi allows creators to maintain ownership.

- Earning Crypto Tokens: Instead of relying on ad revenue, users earn crypto tokens for their engagement, whether through likes, shares, or posts.

This model creates a more equitable distribution of value.

- Decentralized Environment: Smart contracts automate transactions, ensuring transparency and fairness in revenue sharing.

Users no longer need to rely on platform algorithms to determine their visibility or success.

Key Comparison: Web2 Ad-Based Models vs. Web3 Tokenized Social Media Interactions

In comparing Web2 ad-based models to Web3 tokenized social media interactions, the differences are stark:

Web2 relies on advertising revenue, where platforms profit from users without giving them fair compensation. Users often feel like products rather than participants.

Web3, driven by The Rise of SocialFi, empowers users to earn from their contributions directly, fostering a sense of community and collaboration. Users are not merely audiences; they are stakeholders in their social experiences.

How SocialFi Works: The Role of Tokens and Cryptocurrency

At the heart of The Rise of SocialFi is the innovative concept of tokenization, which redefines how users interact with social media and finance.

Tokenization in SocialFi empowers users to earn tangible rewards for their participation, creating a dynamic ecosystem where every interaction holds value.

The Concept of Tokenization in SocialFi

In The Rise of SocialFi, user participation is rewarded with tokens that serve as the currency of the platform.

These tokens can be exchanged for goods, services, or other cryptocurrencies, allowing users to capitalize on their online activities. The mechanics of tokenization function as follows:

- Earning Tokens for Engagement: Users earn rewards for content creation, sharing, and active engagement—such as likes, comments, and reposts.

This incentive structure encourages users to contribute valuable content and interact with others, fostering a vibrant community.

- Native Tokens: Many SocialFi platforms issue their own native tokens. For example, BitClout has its own token, $CLOUT, which users can earn and use within the ecosystem.

These native tokens often serve multiple purposes, including governance and staking.

Monetizing Content

The Rise of SocialFi also facilitates various monetization strategies for content creators:

- Minting NFTs: Content creators can mint their posts, artwork, or media as Non-Fungible Tokens (NFTs), allowing them to sell these unique digital assets to followers.

This monetization method provides creators with a direct revenue stream while giving fans the opportunity to own a piece of their favorite content.

- Social Tokens: Users can invest in influencers by purchasing social tokens associated with them.

The value of these tokens typically appreciates as the influencer’s popularity and engagement grow, enabling followers to financially support their favorite creators while potentially benefiting from their success.

Passive Income Opportunities

In addition to direct earnings, The Rise of SocialFi offers users passive income opportunities through mechanisms such as staking and yield farming:

- Staking: Users can stake their tokens on SocialFi platforms to earn rewards. By locking up their tokens, users contribute to the network’s security and operations, receiving additional tokens as compensation.

- Yield Farming: Similar to staking, yield farming allows users to provide liquidity to decentralized finance protocols in exchange for rewards.

Users can earn passive income while participating in the ecosystem, further enhancing the appeal of The Rise of SocialFi.

Crypto Wallet Integration

To fully engage with the SocialFi ecosystem, users must connect their cryptocurrency wallets to platforms. This integration allows users to manage their tokens, track their earnings, and interact with various features within the decentralized environment.

By utilizing crypto wallets, users gain full control over their assets and can seamlessly navigate the world of SocialFi.

Top SocialFi Projects

Looking for the top socialfi crypto projects? In this section, we’ll list some of the best SocialFi projects. They includes;

- Pulse

- Cheelee

- CyberConnect

- Friend.tech

- CoinBuck

- Lens Protocol

- Hooked Protocol

Pulse

Pulse, launched by Phemex, is an emerging SocialFi platform that offers a mix of social interaction and financial rewards. Initially a feature within the Phemex ecosystem, Pulse was designed to boost user engagement through a gamified network where participants earn rewards by sharing insights and interacting with the community.

Since its launch, Pulse has continuously evolved, with each season adding new features that enhance user experience. By 2024, Pulse claims to be a leading SocialFi platform amongst others in the rise of SocialFi, attracting a growing user base that values its combination of social networking and financial incentives.

Pulse operates on the Phemex platform and utilizes blockchain technology to ensure secure, transparent, and decentralized transactions. The platform is powered by its native PULSE tokens, which users earn through various activities such as tipping, creating content, or engaging with posts.

Here are some of its top features:

- Tipping System: One of Pulse’s most notable features is its tipping mechanism, where users can tip others for valuable contributions.

This creates a direct financial incentive for sharing quality content and participating actively in the community.

- New asset discovery: Pulse communities enable the creation and discovery of new digital assets, including memecoins, Inscriptions and Runes.

- Seasonal Updates: Pulse operates in seasons, with each new season introducing fresh mechanics and challenges.

This keeps the platform dynamic and engaging, encouraging users to remain active and explore new opportunities for earning rewards.

- Social Mining: Users can earn rewards not just through content creation but also by being active members of the community.

Activities like moderating discussions, referring new users, and engaging with posts all contribute to “social mining,” where users mine tokens through their social interactions.

- Staking and Governance: Pulse also allows users to stake their tokens, providing them with additional earning opportunities and a voice in the platform’s governance.

This means users have a say in how the platform evolves, making them more than just participants—they become stakeholders.

Cheelee

Cheelee targets the short-video content market. Launched with the goal of revolutionizing the way users engage with and monetize their social media activity, Cheelee allows users to earn while they scroll through content, watch videos and engage with posts.

Unlike traditional social media platforms where monetization is often limited to content creators, Cheelee opens up earning opportunities for all users, making it an inclusive platform.

Cheelee is built on the Binance Smart Chain, which allows for fast and cost-effective transactions. Cheelee is powered by its native token, CHEEL, which users can earn and spend within the platform.

Here are the platform’s main features:

- Watch-and-Earn Model: Cheelee introduces a watch-and-earn system where users earn CHEEL tokens simply by watching short videos.

This feature democratizes earning potential, allowing even passive users to benefit financially from their engagement.

- NFT Glasses: Users can enhance their earning potential by purchasing or upgrading NFT glasses.

These digital assets not only serve as a fashion statement within the platform but also boost the rate at which users earn CHEEL tokens while interacting with content.

- Gaming Elements: Cheelee integrates gaming elements into its platform, offering users various challenges and achievements that can lead to additional rewards.

This gamified approach keeps users engaged and encourages consistent participation.

- Staking and Governance: Like other SocialFi platforms, Cheelee allows users to stake their CHEEL tokens.

In return, they can earn rewards and gain voting rights, contributing to platform governance and future developments.

CyberConnect

CyberConnect is a decentralized social graph protocol that has been developing decentralized social networks since 2021. Its primary goal is to empower users with control over their digital identities and social connections.

Unlike traditional social networks, CyberConnect allows users to own their data and transfer it seamlessly across various decentralized applications (DApps).

The platform has gained significant traction, having expanded its monetization capabilities to over 1.6 million users with its V2 release.

The V3 upgrade in 2023 introduced key features like CyberAccount, a self-sovereign digital identity system, and CyberGraph, which records on-chain social data, enhancing scalability and user experience within the Web3 ecosystem.

The platform’s main features includes;

- Decentralized Social Graph: CyberConnect’s social graph stores users’ connections on the blockchain, ensuring data ownership and portability across DApps.

- CyberAccount and CyberGraph: The CyberAccount serves as a unique, self-sovereign digital identity stored on the blockchain, allowing users to manage their profiles and social interactions without the need for separate logins across platforms.

CyberGraph links these identities to social interactions across blockchains, offering secure and transparent data management.

- Multi-Chain Support: Operating on Ethereum, BNB Chain, and Polygon, CyberConnect supports interoperability, enabling a seamless experience across different Web3 platforms.

- CYBER Token: The CYBER token drives the platform’s economy, facilitating governance, transaction fees, and network security.

- Developer Tools: CyberConnect offers extensive APIs and tools, supporting a growing ecosystem of DApps, with over 120 expected by the end of 2024.

Friend.tech

Friend.tech is a decentralized social media platform that allows users to tokenize and trade shares of their social profiles, effectively merging social media with DeFi. Launched in August of 2023, Friend.tech operates on the Base blockchain, a Layer 2 solution developed by Coinbase.

The platform enables users to monetize their social influence by buying and selling “Keys,” which represent shares in a user’s social capital.

This innovative approach allows influencers, creators, and everyday users to engage in a new model of social investing, where the value of shares can increase as a user’s influence grows.

Profile Tokenization: Friend.tech allows users to tokenize their social profiles, creating shares that can be bought and sold by others. This feature enables users to directly monetize their social influence, turning interactions and followings into financial assets .

- Base Blockchain Integration: The platform operates on the Base blockchain, ensuring secure, transparent, and decentralized transactions. This integration provides users with a reliable infrastructure for trading and managing their profile shares .

- Social Investing: Friend.tech introduces a new model of social investing, where users can speculate on the social capital of others by purchasing their shares. As a user’s influence grows, so does the value of their shares, offering financial rewards to both the profile owner and the investors .

- Incentives for Engagement: The platform encourages user interaction by linking financial incentives to social engagement. The more active and influential a user is, the higher the value of their shares, promoting a vibrant and engaged community .

Everything good comes with a disclaimer though, so be sure to check the terms and conditions to see how the platform suits your needs.

CoinBuck

CoinBuck combines the rise of SocialFi and TaskFi elements to boost social media engagement while rewarding users. Users can earn crypto through sign-up, referral, and product purchase bonuses, as well as by participating in campaigns.

It supports various social media platforms like Twitter, Discord and Telegram, making it ideal for influencers and businesses seeking authentic engagement.

- Bonuses: CoinBuck offers multiple earning opportunities through various bonuses. Users can earn a 1,000 BUCK token signup bonus, referral bonuses across 3 levels, product purchase bonuses from their downline team and engagement bonuses, all aimed at growing their community and earnings.

- Grow Your Following: CoinBuck helps influencers elevate their profiles and unlock their potential by growing their following and expanding their online presence.

Users can boost their Twitter followers and access more lucrative opportunities by connecting various social networks and using AI-curated packages.

As their following increases, they can rise through the ranks and earn graduated profile badges, enhancing their influence and earning potential.

- Get Paid in Bitcoin: CoinBucks pays users in Bitcoin, so you’ll need a Bitcoin wallet before joining. Each completed offer earns satoshis, the smallest unit of Bitcoin, which varies in value daily.

- Daily Payouts: A standout feature of CoinBucks is its automatic daily payouts, with no minimum threshold required. Earnings are deposited directly into your Bitcoin wallet every 24 hours.

- BUCK Token: CoinBuck is entirely community-driven, with no tokens reserved for founders — 100% of the project is by and for the community.

The BUCK token’s total, initial, and circulating supply is set at 10 billion tokens. Additionally, 20% of the tokens will be allocated for airdrops, purchased from the circulating supply.

Lens Protocol

Lens Protocol, developed by the Aave team, is a decentralized social graph protocol that empowers users with ownership and control over their digital identities, connections, and content within the Web3 ecosystem.

Launched in 2022, Lens is designed to disrupt traditional social media by making user data portable across various DApps, ensuring censorship resistance and monetization opportunities for creators.

The protocol’s goal is to create a more user-centric social network where individuals truly own their social interactions.

- Profile NFTs: Users mint Profile NFTs that represent their identity within the Lens ecosystem. These NFTs are fully owned by the users, allowing them to manage and monetize their content across different platforms.

This ensures that users have control over their digital presence and can easily transfer their social graph to any supported DApp.

- Decentralized Social Graph: Lens Protocol stores users’ social connections on the blockchain, enabling them to own and control their data.

This decentralized structure ensures that users’ connections and content are not tied to any single platform, preventing censorship and platform lock-in.

- Modular Architecture: Lens is designed with modularity in mind, allowing developers to build custom social experiences.

The protocol’s open and composable nature makes it easy for developers to integrate Lens’s social graph into other Web3 services, enhancing interoperability across the ecosystem.

- Open API: Lens Protocol provides an open API, enabling developers to create diverse social applications.

This API supports seamless integration with various blockchain services, allowing developers to build innovative social dApps that leverage Lens’s decentralized social graph.

Hooked Protocol

Hooked is a platform that aims to accelerate Web3 adoption by offering gamified learning experiences and onboarding solutions tailored for users new to the decentralized web.

Launched with a mission to simplify and enhance the onboarding process, Hooked Protocol provides an ecosystem where users can learn about Web3 concepts through engaging, game-like environments.

The platform also offers a range of tools and services designed to support developers and communities in creating and scaling Web3 applications.

The platform also offers a range of tools and services designed to support developers and communities in creating and scaling Web3 applications. Its first pilot product, Wild Cash, utilizes a Quiz-to-Earn model and has attracted over 2 million monthly active users.

Hooked Protocol operates with a dual-token structure, featuring the HOOK token as its primary governance and utility token, and the HGT (Hooked Gold Token) as an in-ecosystem utility token.

The HOOK token has a fixed supply of 500 million, serving multiple essential purposes within the platform, including governance, transaction fees, and access to exclusive content.

- Gamified Learning: Hooked Protocol uses a gamified approach to educate users about Web3, making complex concepts accessible and engaging.

This learning model encourages participation and retention, helping onboard a broader audience to the decentralized ecosystem.

- Proof of Learning (PoL): Hooked Protocol incorporates a Proof of Learning mechanism that rewards users for completing educational tasks, ensuring a hands-on, incentivized learning experience.

- Onboarding Solutions: The platform provides seamless onboarding solutions for users, developers, and communities, reducing the friction often associated with entering the Web3 space.

This includes various educational modules, interactive tutorials, and rewards systems.

- Ecosystem and Infrastructure: Hooked Protocol’s ecosystem includes tools and services designed to facilitate the development and deployment of Web3 applications.

This infrastructure supports scalability, ensuring that as the user base grows, the platform can handle increased demand without compromising performance.

- Lego System: The Hooked Lego System is a modular infrastructure that provides developers with building blocks to create and scale Web3 applications within the Hooked ecosystem.

It enables rapid prototyping, customization, and seamless integration with the broader protocol, making it a powerful tool for innovation in Web3 development.

- Community Engagement: The protocol promotes community engagement through its Ambassador Program, which empowers users to advocate for and contribute to the growth of the platform.

Ambassadors play a key role in expanding the user base and enhancing the community experience.

How to Choose the Best SocialFi Platform

When selecting a SocialFi platform from the increasing lists relative to the rise of SocialFi, it’s important to consider various factors that will impact your experience and investment. With the growing number of platforms available, understanding what sets them apart is crucial.

Below are key considerations to guide you in choosing the best SocialFi platform for your needs.

1. Evaluating Platform Features

When choosing a SocialFi platform, look for key features like user ownership of data, decentralized governance, and robust tokenomics.

Compare platforms based on these attributes and how user-friendly their interfaces are. A simple, intuitive interface can make or break the user experience, especially for newcomers to Web3.

2. Assessing Community and Governance

An active community is crucial for a thriving SocialFi platform. Look into the governance model—does it allow users to participate in decision-making?

Transparency and accountability are essential, so prioritize platforms with clear, community-driven governance structures.

3. Understanding Tokenomics

Examine the platform’s tokenomics: What are the key metrics like token supply and distribution? Assess the long-term sustainability—how are tokens used and rewarded? Strong tokenomics can enhance user incentives and ensure the platform’s viability.

4. Security and Privacy Considerations

Security and privacy should be top priorities. Evaluate the platform’s security protocols—are they well-established and regularly updated?

Data privacy is also critical; ensure the platform doesn’t compromise user data. Look at case studies of platforms that have successfully protected against breaches as a benchmark.

Challenges of the Rise of SocialFi

As with any innovative technology, SocialFi faces a series of challenges that must be addressed to ensure its growth and sustainability.

1. Scalability Issues

The rise of SocialFi platforms often face network congestion and high transaction fees, especially during peak times. Solutions like Layer 2 scaling, sharding, and optimized consensus algorithms are being explored to improve scalability.

For example, platforms like Lens Protocol are experimenting with modular architectures to handle increased load efficiently.

2. Regulatory and Compliance Hurdles

Navigating the complex regulatory landscape is a significant challenge. The rise of SocialFi platforms must comply with varying data protection laws across regions, which can impact operations. Compliance ensures trust but requires constant updates to meet new regulations, often making the development process more cumbersome.

3. User Adoption and Education

Educating new users about Web3 and SocialFi is challenging due to the steep learning curve. Effective onboarding strategies, such as gamified tutorials and incentives, can help. Community engagement is also crucial, as an active community fosters knowledge sharing and support, easing the adoption process.

4. Security Risks

SocialFi platforms are vulnerable to security risks like smart contract bugs and data breaches. Best practices include regular security audits, implementing multi-signature wallets, and educating users on security hygiene.

Past breaches, like the attack on a major DeFi platform, highlight the importance of robust security measures and rapid response protocols.

5. Sustainability of Economic Models

Many SocialFi platforms rely on generous token rewards to attract users, but these economic models can be unsustainable. The volatility of social tokens, often influenced by influencers’ actions, can deter users and investors.

Sustainable economic models that balance user incentives with long-term viability are crucial for success.

6. Privacy Concerns

The integration of social features with financial platforms raises privacy concerns. Users may be reluctant to share sensitive data due to fears of breaches.

To build trust, SocialFi platforms must prioritize data protection, possibly exploring advanced solutions like zero-knowledge proofs to enhance privacy without sacrificing social interaction.

Conclusion

The Rise of SocialFi paints a vivid picture of a future where money and social relationships are closely linked.

The promise of data ownership, decentralized governance, and the chance to make money off of social impact is very appealing to both users and creators.

The idea is appealing, and it fits with the growing call for social media methods that are more fair and open. While the rise of SocialFi is exciting, it’s also important to be careful.

The rise of SocialFi is still in its early stages and faces big problems like how to grow, how to stay profitable, and how to deal with complicated regulatory settings.

Even though there is a lot of promise, SocialFi platforms will only be successful if they can deal with these problems well. People who are interested in SocialFi need to stay up-to-date and think carefully about the pros and cons of each site.

As the space changes, it’s important to look at the rise of SocialFi with a fair view, understanding both how it could change things and the problems that need to be solved.

Users can then make smart choices and maybe take advantage of the new chances that the rise of SocialFi has to offer.