From major token unlocks to global summits, July 2025 is brimming with token unlocks and events. This July presents significant opportunities and risks for crypto investors.

As your go-to guide for fully understanding token unlocks and events, this article helps you stay one step ahead, whether you’re preparing for unlock-related dips, hunting trading signals, or positioning for long-term growth opportunities.

What are Token Unlocks, and why are they important?

Definition and Mechanics

Token unlocks are the scheduled release of previously locked or vested crypto tokens into circulation. Most projects adopt a token vesting schedule to spread out their supply over time, rather than flooding the market at launch.

These schedules usually include:

- Cliff periods: A defined time after token generation where no tokens are released.

- Linear or gradual vesting: Tokens unlock periodically (e.g., monthly or quarterly).

Allocation Categories:

- Team tokens (often locked for 12 to 48 months)

- Investor allocations (such as seed or Series A rounds)

- Ecosystem funds for community rewards, partnerships, and stake incentives

This structure ensures transparency and long-term alignment of stakeholders and project success.

Investor Impact

Understanding crypto token unlocks in July 2025 is critical for both short-term traders and long-term investors. Here’s why:

- Price Volatility: Token unlocks introduce more tokens to the market, affecting supply-demand dynamics and causing sharp price movements, particularly for tokens with low liquidity.

- Sell Pressure: Large unlocks for early investors or insiders may result in sell-offs, as these holders frequently seek profits after long lockup periods. Monitoring unlock dates helps predict potential downturns.

Strategic Opportunities:

- Buyers may accumulate before an unlock if they anticipate a bullish trend post-dip.

- Short sellers may position themselves to profit from potential declines.

- Hodlers can use unlock schedules to decide whether to hold or reallocate funds.

Smart investors monitor unlock data to make informed decisions about how unlocks affect token price in the spot and derivatives markets.

July 2025 Token Unlock Calendar: Key Projects to Watch

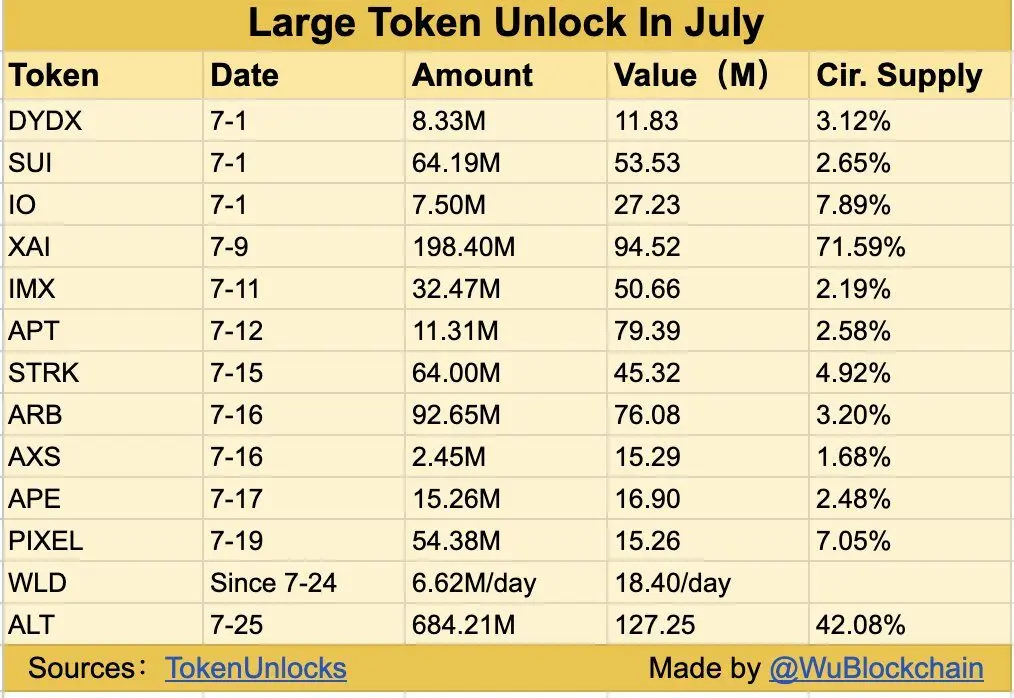

As crypto investors brace for a volatile Q3, token unlocks in July 2025 are expected to have a significant impact on market sentiment.

With several high-profile projects set to release millions of tokens into the market, tracking these unlocks is critical for predicting price swings, investor behavior, and strategic entry or exit points.

Below is a curated calendar of major July 2025 token unlocks, including project details, percentages relative to circulating supply, and why they matter.

Token Unlock Overview

| Date | Token | Amount Unlocking | % of Circulating Supply | Reason to Watch |

| July 5 | APT (Aptos) | 11.3 M APT ($45–50 M) | ~1.8% | Team, foundation & community vesting |

| July 10 | ARB (Arbitrum) | 92.65 M ARB (~$33 M) | ~1.9% | DAO treasury + investor unlock |

| July 13 | SUI (Sui) | 44 M SUI (~$77–122 M) | ~1.3–1.7% | Ecosystem, Series B, reserve & early contributors |

| July 20 | OP (Optimism) | 31.3 M OP ($17 M) | ~1.8% | Community & partner incentives |

| July 25 | IMX (Immutable X) | 24.5 M IMX ($10 M) | ~1.3% | Foundation & early investor tranche |

Analysis and Commentary

1. Aptos (APT): July 5

Aptos released approximately 11.3 million APT to the team, foundation, and community pool as part of its regular unlock cycle.

Although the release represents less than 2% of the circulating supply, Aptos unlocks in previous months have resulted in mild sell pressure, particularly from foundation-linked wallets. Investors will closely monitor on-chain movements to determine whether these tokens will be traded on exchanges.

2. ARB (Arbitrum): July 10

This unlock is worth approximately $33 million and will be used for DAO treasury and early investor allocations. Previous ARB unlocks have been neutral to slightly bearish, but sentiment is split this time due to recent DAO proposals and increased Layer 2 competition.

A sharp unlock, combined with pending governance votes, may increase the volatility risk for short-term holders.

3. SUI (Sui): July 13

Sui’s July unlock is one of the largest in dollar value, potentially injecting over $100 million worth of tokens into circulation.

Historical SUI unlocks have often coincided with significant price corrections, though this month’s tranche includes a mix of contributor and reserve fund tokens. If a large portion of the supply remains in cold wallets, as seen in past months, the sell pressure may be reduced.

4. OP (Optimism): July 20

Optimism’s community and partner-related unlock reflects its long-term ecosystem incentive model. While the unlock size is moderate, previous rounds saw modest dumps followed by rapid recovery, especially when OP grants were used to increase liquidity or support Layer 2 development grants.

5. Immutable X (IMX): July 25

The IMX unlock for foundation and early backers is routine but important. Although the supply percentage is low (~1.3%), low liquidity on some centralized exchanges can magnify price swings if large holders sell.

Immutable’s growing interest in NFT gaming, as well as recent partnerships, might contribute to a positive sentiment.

Investor Insights: Dump or HODL?

The main question around token unlocks is always the same: Will large holders sell or wait? Here’s what you should consider:

- On-chain behavior is more important than unlock size. For example, if whales transfer funds to exchanges close to the unlock date, expect immediate downside risk.

- Token utility and ecosystem growth can mitigate price impact. Because of their continuous development, active projects such as Optimism and Arbitrum may experience fewer negative price reactions.

- Market context is important. If Bitcoin or Ethereum is rising, minor unlocks may be easily absorbed. However, in sideways or bearish markets, even a 1-2% unlock can trigger a mini-dump.

The July unlock calendar is essential for both short-term traders and long-term holders. Projects such as SUI and ARB deserve special attention because of their unlock magnitude and investor distribution.

Crypto investors can use unlock data with on-chain analysis, sentiment tracking, and price alerts to strategically position themselves.

Top On-chain and Governance Events to Track

As part of your crypto governance proposals, July 2025 radar, here are major month-end votes and network upgrades that deserve investor attention. These on-chain events can influence token prices, protocol direction, and sentiment.

Major DAO Proposals Closing in July

Uniswap V4 Vote → Fee Switch Proposal

The Uniswap community is voting on the final piece of the “Uniswap Unleashed” initiative, which allocates ~$165M for Unichain layer-2 and V4 liquidity programs—and crucially reopens the controversial fee switch, a mechanism to divert protocol fees to UNI token holders.

Why it matters: If approved, UNI holders could begin receiving a portion of protocol revenues, a paradigm shift expected to increase governance engagement and UNI value.

Aave V4 Roadmap and Funding Discussion

Aave’s DAO is reviewing its long-term V4 roadmap as part of the “Aave 2030” initiative. This includes modular architecture, GHO stablecoin integration, and unified liquidity layers. The community is considering a funding proposal of about $17 million GHO, plus stkAAVE grants, to support initial V4 development.

Why it matters: Approval indicates Aave’s commitment to capital efficiency and scalability, which are critical for user growth and long-term relevance in the competitive DeFi market.

Key Upgrades/Launches

Starknet Mainnet Upgrade (v0.13.6 → v0.14.0)

Starknet is rolling out significant upgrades this July:

- v0.13.6 mainnet deployment set for July 8, transitioning to S‑Two compatibility and enhanced resource counting.

- v0.14.0 likely launching on testnet by July 7 and mainnet by July 28, introducing Tendermint-style multi-sequencer decentralization.

Why it matters: These upgrades lower transaction costs, speed up finality, and advance decentralization, all of which can lead to more developers and smart contract deployment on STRK.

EigenLayer Restaking Expansion

EigenLayer’s rapid growth as a restaking hub continues, having recently surpassed $20 billion in TVL and expanding integrations with Mantle and zkSync.

Why this matters: The expansion of restaking broadens Ethereum’s security network and supports composable DeFi, potentially increasing demand for the EIGEN token while also contributing to overall ecosystem security.

Governance votes by Uniswap and Aave could redirect future revenues and define development paths.

Upgrades to the Starknet and EigenLayer networks bring significant technical improvements as well as the potential for ecosystem growth.

Stay informed through on-chain monitoring and token-activity tracking tools during July to anticipate sentiment shifts and actionable market opportunities.

Crypto Conferences and Community Events in July 2025

In July 2025, there are numerous crypto conferences offering investor insights, networking opportunities, and potential alpha signals, in addition to token unlocks.

Highlighted Events:

ETHCC (Paris/Cannes, June 30–July 3)

Europe’s largest Ethereum-focused conference features over 6,400 attendees, 390 speakers, and 580+ side events, including technical discussions on L2s, privacy, and the Ethereum roadmap.

Focus: Layer 2 scaling, privacy protocols, developer tooling, and future Ethereum upgrades.

TOKEN 2049 Dubai (Satellite Meetup)

Although the main Dubai event happened April 30 to May 1, side meetups and satellite events continue through July, especially for networking around DePIN and emerging layer-2s such as Aptos. The sold-out event attracted 15,000 people and used its momentum for ongoing community gatherings.

Focus: Investor networking, DePIN innovation, and exclusive alpha reveals.

Aptos World Tour: Lagos, Nigeria (July 27)

Aptos will host a World Tour stop in Lagos on July 27 as part of its global expansion strategy, with a focus on localized developer outreach and African ecosystem development. This is a significant step toward entering the rapidly growing regional crypto market.

Why These Events Matter for Investors

- Alpha leaks and protocol insights: ETHCC deep dives and workshops are often utilized to make subtle announcements or developer reveals.

- Airdrop or whitelisting opportunities: Attendees at TOKEN2049 satellite meetups usually gain access to upcoming airdrops or private betas.

- Early access to project updates: The Lagos session could yield Africa-specific ecosystem grants, tooling reveals, or localized rollouts.

Investors should:

Attend or watch ETHCC sessions virtually to spot early protocol signals and track DeFi and L2 trends.

Engage in TOKEN2049 satellite events to gain first-mover investor insights and networking edge.

Keep an eye out for Aptos Lagos announcements regarding regional partnerships or DeFi initiatives aimed at Africa.

Monitor official channels and use conference tools such as app agendas to set alerts for important presentations and workshop announcements.

Airdrops, Incentive Campaigns, and Whitelist Opportunities

July is heating up with crypto airdrops. Here are the top live campaigns and how to participate:

Live Campaigns

zkSync Quest and Interaction-Based Campaign

- Campaign timing: Ongoing since early July (likely mid-July continuation following initial airdrop).

- What it is: Task-based rewards, such as swapping, providing liquidity, bridging, and staking within zkSync projects like PancakeSwap, are similar in structure to previous initiatives aimed at increasing engagement.

- Why participate: Prior airdrops (such as the March 2024 snapshot) rewarded active users with ZK tokens, and ongoing quest activity increases eligibility for future drops.

LayerZero Snapshot (late July)

- What’s happening: A community snapshot is expected to take place late in July, indicating eligibility for upcoming token distributions.

- Why is it important: LayerZero’s omnichain messaging model and strong ecosystem support (e.g., a16z’s investment and >1.5 M monthly cross-chain messages) offer attractive airdrop incentives for early users.

How to Participate

Position yourself for whitelist tokens July opportunities:

- Connect your wallet (MetaMask or another EVM-compatible wallet) to the zkSync Era network and LayerZero DApps.

- Complete tasks: trades, LPs, or bridge interactions on zkSync; send cross-chain messages or engage in partner DApps via LayerZero.

- Stay active in the official Discord and Telegram channels to receive any last-minute snapshots or eligibility notifications.

Investor Tips:

Maximize your chances with DeFi incentives in July 2025:

- Track quests using DeBank, Galxe, and Layer 3: These aggregators highlight eligible dApps and Quests in real-time.

- Monitor on-chain activity: Watch for sudden increases in wallet interactions and transactions as early warning signs of upcoming snapshots.

- Diversify efforts: Engage across ecosystems (zkSync, LayerZero, and others) to increase eligibility and stack airdrop opportunities.

zkSync relies on active participation post-March 2024; ongoing quests may result in additional ZK token rewards. LayerZero snapshot invites participation across its omnichain network; early adopters stand to benefit from upcoming rewards.

Optimize your exposure by completing required tasks, monitoring snapshots, and tracking campaigns with DeBank or Galxe.

How to Build a Personalized Crypto Calendar

Creating your own crypto event calendar allows you to stay on top of important milestones such as token unlocks, airdrops, and network upgrades. Here’s a concise guide to creating a personalized toolset.

Tools to Use

- TokenUnlocks.com

Provides real-time updates on token vesting schedules, unlocks, and emission insights, including zoomable charts and post-unlock analytics ideal for a “how to track token unlocks” workflow.

- CoinMarketCal

The go-to “crypto event calendar template” for crowdsourced and expert-verified events ranging from hard forks to token unlocks, complete with mobile apps and calendar sync via Google, Outlook, and RSS feeds.

- Notion or Google Calendar Integrations

Use platforms like Pipedream to automatically sync CoinMarketCal events to your personal calendar, ensuring that you never miss an upcoming vote or unlock.

Pro Tips for Traders

Set Price Alerts Before Token Unlocks

Import token unlock dates from TokenUnlocks or CoinMarketCal to your portfolio’s alert system. Flag any 24-48 hours beforehand to track price swings or whale movements.

Pair Token Unlock and Event Data with Social Sentiment

Use tools like LunarCrush (real-time social volume) or Santiment (on-chain metrics + sentiment) to gauge market sentiment ahead of events.

| Date | Event | Tool | Alert Type |

| July 5 | APT token unlock | TokenUnlocks.com | Price & wallet inflow |

| July 10 | ARB token unlock + governance vote | CoinMarketCal | Calendar + Discord alerts |

| July 12 | Uniswap V4 fee-switch vote closes | My Notion or Google Calendar | Push notification |

| July 20 | OP unlock & Starknet mainnet upgrade | TokenUnlocks & CoinMarketCal | Email alert + sentiment watch |

- Step 1: Gather all July events (token unlocks, governance, upgrades).

- Step 2: Import using CSV or API into Notion/Google Calendar.

- Step 3: Tag alerts for 24–48 hours ahead and link sentiment sources.

- Step 4: Review weekly, adjust as new events are added.

Why This Works

- Captures crypto event calendar template intent with structure and personalization.

- Provides a step-by-step “how to track token unlocks” guide with synced alerts and sentiment.

- Positions you as a “best tools for crypto investors” user by combining research platforms and personalized workflows.

Conclusion

Being early in the fast-paced world of digital assets is more than just an advantage; it’s a strategy. From token unlocks and on-chain governance votes to airdrop campaigns and DeFi incentives, July 2025 is packed with opportunities that reward foresight and preparation.

Using tools such as TokenUnlocks.com, CoinMarketCal, and LunarCrush, investors can stay ahead by building a personalized crypto event calendar based on their portfolio and trading style.

Whether you’re tracking crypto airdrops in July 2025, whitelist tokens in July, or simply setting up alerts before unlock dates, timing your moves around key events can significantly improve your results.

In crypto, those who prepare win. Make your calendar your edge.