According to CryptoQuant data, in September, TON’s transaction volume surpassed Ethereum and NEAR, among other Layer-1 solutions.

In recent months, The Open Network has cemented its place as one of the top Layer 1 options.

According to CryptoQuant data, The Open Network accounted for more than 50% of all Layer 1 transactions in September, surpassing rivals like Ethereum (ETH) and Avalanche (AVAX).

Multiple token launches have contributed to The Open Network’s success. One of the network’s initial large-scale projects, DOGS, drew a whopping 28 million monthly active users (MAU). With 18 million MAU apiece, CatizenAI and Rocky Rabbit attracted much interest. Watbird and Hammer Kombat also aided The Open Network’s expansion, attracting an astounding 110 million MAU and Watbird 12 million MAU.

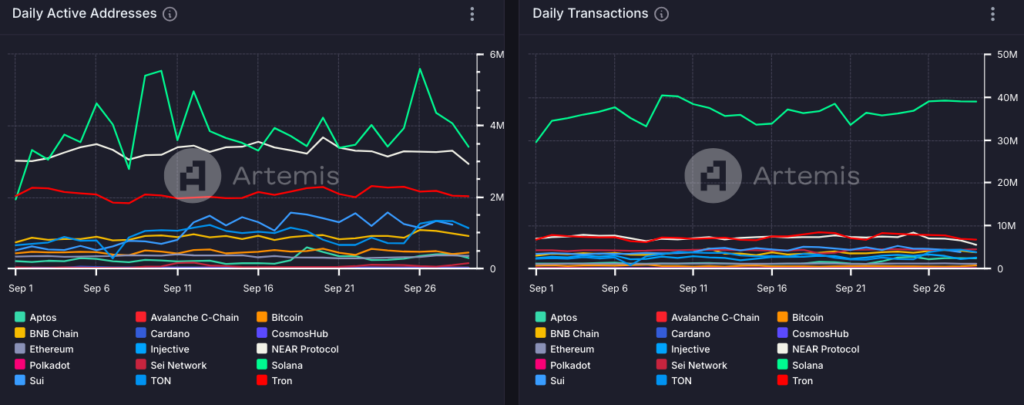

Solana Retains the Lead

However, Solana (SOL), BNB Chain (BNB), and NEAR Protocol (NEAR) have yet to be included in CryptoQuant’s overall analysis.

In terms of transaction volume and daily active wallets, Solana remains the top Layer 1 chain, according to the Artemis statistics and the other chains analyzed. As of September 30, Solana had accumulated 3.9 million daily active addresses and processed over 1.1 billion monthly transactions.

While The Open Network has done well in comparison, Solana has surpassed them in both areas. In September, The Open Network completed 212.5 million transactions, good for second place in terms of volume of transactions. However, with 2.1 million daily active addresses, Solana and NEAR Protocol surpassed TON’s daily active wallets (all data as of September 30).

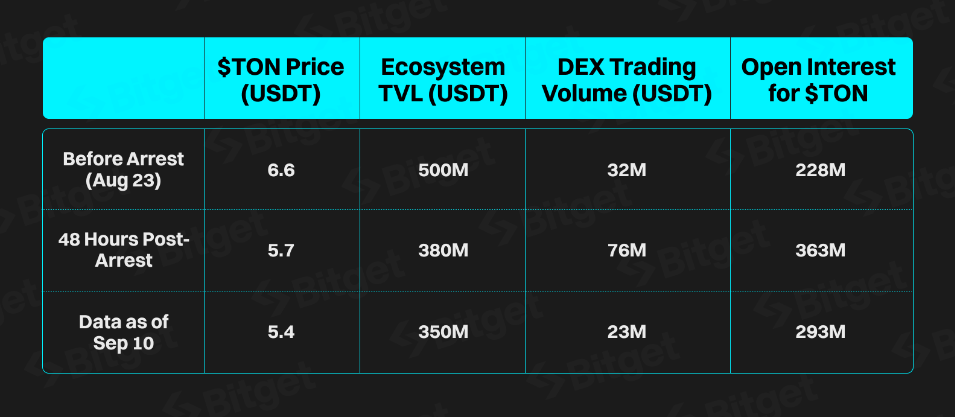

Bitget Foresees the De-Telegramization of TON

In its most recent report from September, Bitget—a cryptocurrency exchange and significant Open Network Foundation backer—outlined optimistic forecasts for the The Open Network ecosystem.

One of the report’s central forecasts is a possible “de-Telegramization” of the TON ecosystem. Bitget says that to reduce the risks involved, TON could have to break away from Telegram in light of the regulatory attention the chat service is receiving. In the immediate run, TON will still depend on Telegram’s user base, but the analysis predicts a trend toward increased independence over time.

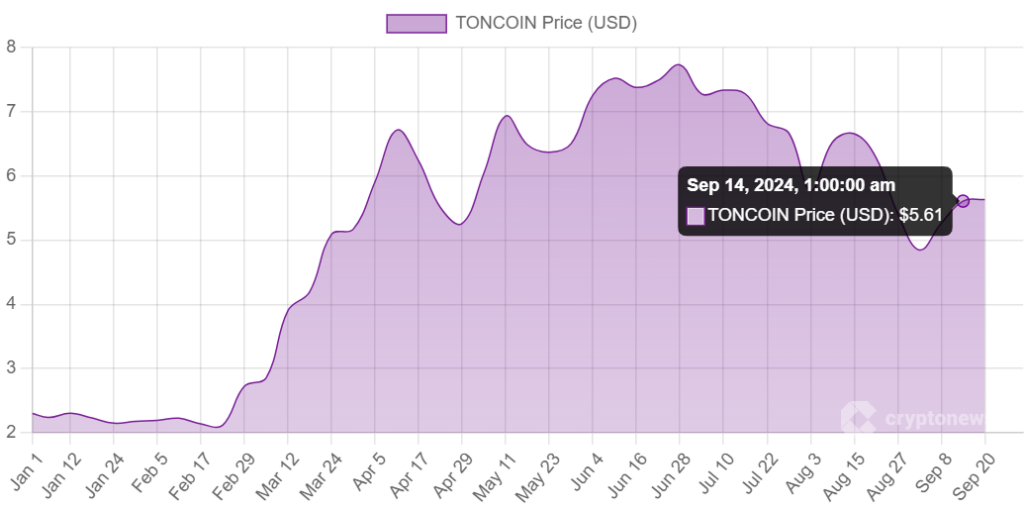

The TON ecosystem has seen a significant disruption with the announcement of Pavel Durov’s arrest on August 25. Durov is the CEO of Telegram. Consequently, in the week that followed the arrest, the price of the TON token fell by more than 17.6%. In addition, there has been a significant collapse in the TVL on the The Open Network chain, with a single-day drop of more than 60%.

TON’s total value locked (TVL) is about $427 million as of September 30, a 45% decrease from its peak of $776 million in July 2024.

Bitget projects that in a bull market, the native cryptocurrency of the The Open Network blockchain, Toncoin, will perform better than Bitcoin’s spot returns in token performance. The research also anticipates a rise in institutional interest in TON, with many institutions preferring over-the-counter (OTC) transactions.

Even with a notable decline when Telegram CEO Pavel Durov was arrested in August, Toncoin has recorded an astounding 149% return since the start of the year. As of this writing, the price has increased from $2.27 on January 1 to $5.82.

In contrast, Bitcoin (BTC) has increased by a more moderate 51% over the same period, from $43,835 on January 1, 2024, to $64,029 as of this writing.