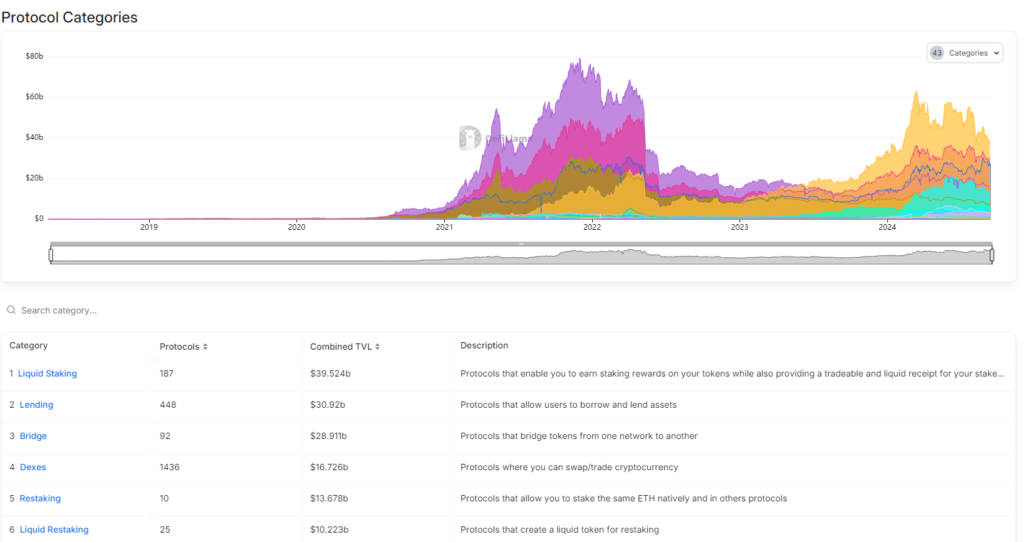

Restaking and liquid staking mechanisms are becoming increasingly popular on well-known blockchain networks like Solana and Ethereum.

Before the protocol introduction, Utonic, an up-and-coming restaking protocol on The Open Network (TON), secured an institutional commitment of $100 million in total value locked (TVL).

Businesses like TonStake, iZUMi Finance, InfStones, SatLayer, and StakeStone committed $100 million to the TON-based restaking protocol.

As per Lemon Lin, co-founder of Utonic, the protocol seeks to enhance the security and decentralization of TON. Lin stated:

“The tech path of Restaking has been proven successful by Eigenlayer & others on Ethereum, and can be perfectly practiced on TON to enhance security and the level of decentralization.”

The success of EigenLayer, an Ethereum-native restaking protocol, which crossed $1 billion in TVL on December 28, 2023, sparked interest in restaking. By February 15, EigenLayer has amassed $6.99 billion in TVL, making it the fourth-largest restaking protocol.

To protect and validate other networks, validators, and stakers can re-stake liquid staking derivative tokens like Lido Staked ETH and RocketPool’s rETH thanks to restaking protocols like EigenLayer. These assets can also be used in other decentralized finance (DeFi) protocols to increase yield.

Even in a lousy market, Utonic anticipates 20% APY.

With a lucrative annual percentage yield (APY) of up to 30%, UTONIC protocol hopes to launch.

Regarding a possible yield decrease in a down market, Lin stated that he anticipates a yield of more than 20%. He clarified:

“Native 3.65% APY + extra 5-15% APY coming from AVS, expecting farming incentives on L2s, the total can be over 30% APY. Even if it’s in a bear market where on-chain liquidity is draining, we still expect 20% APY”

Through the Utonic protocol, yield may be obtained by TON restakers from three distinct sources: farming incentives, native validator yield, and Actively Validated Services (AVS) yield.

Users can use the protocol to stake TON tokens and reallocate the staked equivalent into other applications, such as safeguarding AVS, to receive additional passive returns on their assets.

Utonic is scheduled to launch by the end of September.

Top blockchains are seeing an increase in interest in restaking and liquid staking.

The trend of growing interest in restaking and liquid staking solutions has been aided by EigenLayer’s recent expansion.

Bybit Research predicts that retail investor adoption of Solana will be driven by improved liquidity and capital efficiency, resulting in a nearly five-fold increase in liquid stake to $18 billion.

Because liquid staking provides an equivalent token to the one initially staked, which may be used in other DeFi applications, it increases capital efficiency for investors.

With a total TVL of over $39.5 billion, liquid staking is the largest protocol category on Ethereum.