These are the top 5 tokens to watch in July 2025: LILPEPE, SUI, SEI, JUP, and XLM, ranked by growth, utility, and market buzz.

Introduction

July 2025 has roared into action with the kind of momentum crypto traders dream of. From the SEC greenlighting new wave ETF listings to another memecoin frenzy lighting up Solana and Base, the market is humming with speculative energy.

Add in fierce competition among emerging layer-1s and you’ve got a recipe for a sizzling month. If you’ve been watching the charts, you already know: this isn’t the time to blink.

The post-halving rally continues to ripple through Bitcoin and altcoin markets alike, with inflation tapering and macro sentiment turning cautiously optimistic. With stablecoin flows rising and social media again ablaze with token chatter, July is shaping up to be a turning point.

Many investors are shifting focus from blue-chip consolidation to mid-cap climbers and high-upside newcomers. Layer-1 challengers are clawing for market share.

Meme projects are evolving. Infrastructure plays are heating up. And liquidity is finally moving into the altcoin lanes again.

That’s why we’ve curated this list of the top 5 tokens to watch in July 2025. This isn’t just about hype; it’s about potential, on-chain momentum, narrative alignment, and strong fundamentals.

Whether you’re a trader looking for high-velocity setups or an investor scouting long-term plays, these five tokens demand your attention right now. Let’s dive in.

Why These 5 Tokens?

The crypto market is overflowing with contenders, but not all tokens are created equal.

To identify the top 5 tokens to watch in July 2025, we used a focused framework: recent price performance, network activity, upcoming tech milestones, centralized exchange listings, and strength of community engagement.

We also filtered for tokens with rising trading volume and unique narratives that align with current market themes, whether it’s meme virality, DeFi utility, or cross-chain innovation.

Each project on this list has seen notable traction in the last 30 days, either via sharp upward trends in active addresses, surging social sentiment, or major protocol upgrades.

The goal is not to chase fleeting hype, but to spotlight tokens with momentum that look sustainable, or at least explosive in the short term.

We also paid attention to macro positioning. Some of the top 5 tokens to watch in July 2025 have benefited from the ETF spillover effect or integrations with layer-2 ecosystems, gaining traction.

Others are riding bullish catalysts like token burns, staking revamps, or partnerships with key crypto infra players. Whatever their angle, these tokens are on the move for a reason.

LILPEPE: Meme Culture Meets Layer-2 Utility

LILPEPE has leapt from meme status to multi-chain marvel in record time. What began as a cheeky frog-themed token on Base has evolved into a dynamic asset with real DeFi hooks, thanks to recent upgrades enabling cross-chain swaps and staking.

It’s not just meme magic anymore, it’s memetics with muscle. That evolution is one of the reasons it’s earned a spot among the top 5 tokens to watch in July 2025.

In July, rumors are swirling about a major decentralized exchange integrating LILPEPE liquidity pools, along with speculation about an official Solana bridge launching before the month’s end.

That alone has caused a 42% surge in daily social mentions and a 27% week-over-week increase in Telegram membership.

It’s also fueled an impressive 18% bump in price over just seven days. The token’s NFT collection, anchored in frog lore and mintable via on-chain quests, is also driving sticky engagement.

The community is LILPEPE’s secret weapon. X (formerly Twitter) engagement is at an all-time high, with meme campaigns going viral across Web3 culture.

Its new staking vaults, launched on Optimism and Arbitrum, are locking up LP supply at a fast clip. This social velocity, paired with deflationary token burns, has created a volatile but compelling setup.

Yes, LILPEPE comes with rollercoaster risk, but it also has asymmetric upside, especially in a market hungry for narratives with personality.

As part of the top 5 tokens to watch in July 2025, it’s a prime example of how meme energy, when paired with smart tokenomics and utility, can make real waves.

SUI: Real DeFi Traction on Move-Based Chain

Sui burst onto the scene with a bold claim, faster execution, better scalability, and a developer-first architecture built on the Move programming language.

While skeptics initially dismissed it as another L1 hopeful, July 2025 is proving otherwise. SUI is showing real DeFi traction, and its fundamentals are catching up to its early hype.

This month, total value locked (TVL) across the Sui ecosystem has jumped over 35%, driven by a wave of new DeFi protocols, including decentralized perpetuals and lending platforms.

Meanwhile, the introduction of zkLogin, a native, privacy-friendly wallet login tool, is making onboarding far smoother for everyday users. These advancements are a big reason why SUI is one of the top 5 tokens to watch in July 2025.

Beyond user growth, developers are doubling down.

GitHub commits and open-source contributions tied to Sui’s core SDKs have spiked, and a newly announced partnership with a major Web3 gaming studio is expected to funnel more attention into the chain’s NFT and metaverse layers.

This convergence of DeFi infrastructure and gaming primitives is creating strong network effects.

From an investment lens, SUI is also catching institutional attention. Its tokenomics, centered on staking rewards, validator incentives, and capped emissions, are proving attractive to yield strategists.

As yield aggregators begin integrating Sui-native protocols, and with a multichain bridge rollout rumored for late July, the upside potential is mounting.

Whether you’re looking at growth metrics or smart contract adoption, SUI is gaining momentum in multiple lanes. It’s no surprise it’s among the top 5 tokens to watch in July 2025.

SEI: Speed-Optimized Infrastructure for DeFi & Games

SEI has carved out a unique space within the Cosmos ecosystem by doubling down on performance.

With the launch of SEI V2 this month, the chain now boasts parallel execution, native price oracles, and a turbocharged engine tailored for high-frequency DeFi and blockchain-based gaming.

That speed isn’t just a marketing line—it’s translating into real-world usage and momentum.

July is pivotal for SEI. Developer activity is on the rise, with ecosystem grants drawing in fresh projects and builders.

Tooling has improved, onboarding is smoother, and key integrations, especially with Cosmos-native wallets, have streamlined the user experience. Combined, these moves have made SEI a standout among the top 5 tokens to watch in July 2025.

On the token side, SEI has posted a steady climb throughout Q2 and early Q3, outperforming many of its Cosmos peers. Strong fundamentals, coupled with an ecosystem-friendly inflation curve and well-structured validator incentives, are attracting long-term capital. Its modular architecture is also gaining traction in conversations around interoperability, particularly as more chains explore app-specific rollups.

Investors are also watching a rumored major centralized exchange listing expected in late July.

That potential catalyst, along with growing buzz around SEI’s modularity narrative, positions it squarely in the spotlight. This isn’t just a fast chai, it’s a fast-moving opportunity.

With its latest upgrade, increasing developer pull, and favorable tokenomics, SEI is clearly one of the top 5 tokens to watch in July 2025.

JUP (Jupiter): Solana’s Liquidity King Scaling Up

Jupiter has become indispensable to the Solana DeFi experience, acting as the default DEX aggregator for everything from spot swaps to limit orders.

With Solana transaction volumes surging again in July, JUP is riding the liquidity wave at full throttle. As the native token powering Jupiter’s governance and ecosystem incentives, it’s a key player and one of the top 5 tokens to watch in July 2025.

This month, JUP is breaking records. Fee revenue has hit an all-time high, fueled by deeper integrations with MEV bots and routing engines.

Daily active users across Jupiter’s front-end have grown by over 20% since late June, and volume routed through its aggregator surpassed $1.5 billion in just the first week of July. Meanwhile, the DAO is actively debating proposals on emissions tuning and builder grants, signaling a maturing governance layer.

What sets JUP apart right now is its evolving utility within Jupiter Station, Solana’s broader liquidity engine.

The token is taking on greater weight as a governance and staking asset in a growing suite of modules, including smart order routing, MEV protection, and RFQ systems. It’s becoming more than a DEX token—it’s a protocol cornerstone.

Backed by strong network fundamentals, real usage, and meaningful revenue, JUP earns its place among the top 5 tokens to watch in July 2025.

In a market where utility and cash flow matter again, Jupiter’s token model is one of the few delivering both at scale.

XLM (Stellar Lumens): The OG Utility Token Makes a Comeback

Stellar Lumens may be one of the oldest names in crypto, but in July 2025, it’s writing a surprising comeback story. XLM is gaining traction again, powered by real-world use cases like USDC-based cross-border payments, ongoing MoneyGram integrations, and pilot programs with major global financial institutions.

The remittance narrative, often overlooked in bull markets, is gaining steam, and XLM is once again in the spotlight as one of the top 5 tokens to watch in July 2025.

The most significant development this month is Stellar’s long-awaited smart contract functionality.

Now live on the mainnet, it opens the door for DeFi protocols and payment applications to launch directly on Stellar’s ultra-efficient rails. Backed by a new round of ecosystem grants, developers are actively building financial tools optimized for low-cost, high-speed settlements, a sweet spot Stellar was built for.

XLM’s comeback is rooted in its relevance to institutional crypto adoption. Unlike newer chains chasing hype cycles, Stellar’s strategy has always been slow, steady, and focused on utility. That approach is aging well.

With TradFi warming up to blockchain infrastructure again, the demand for compliant, scalable, cross-border solutions is rising, and XLM is already integrated where it matters.

This resurgence isn’t just technical, it’s narrative-driven. As governments and banks revisit blockchain for payment rails, XLM’s foundational partnerships and global reach position it well for long-term growth. No wonder it’s among the top 5 tokens to watch in July 2025.

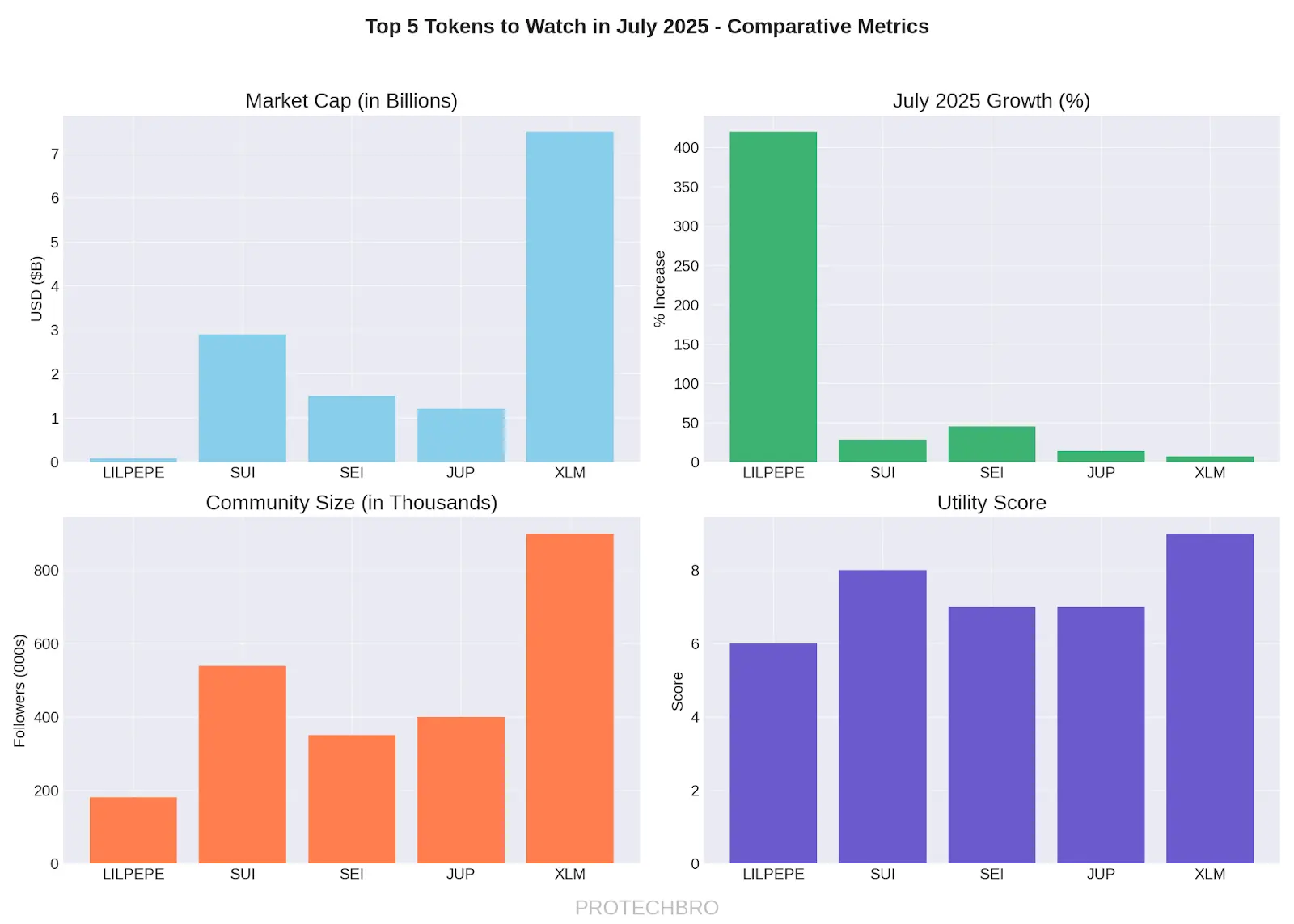

Quick Comparison

LILPEPE is a micro-cap memecoin with high risk but strong community momentum, especially around its upcoming Solana bridge and continued hype cycles.

SUI, a mid-cap token, benefits from July’s zkLogin rollout and focuses on DeFi and user experience, carrying a moderate risk profile.

SEI, also mid-cap, is gaining traction after its SEI V2 launch, positioning itself in the modular infrastructure space with medium risk. J

UP, another mid-cap, is central to Solana’s liquidity layer, with DAO activity and DEX growth driving July interest and a moderate risk outlook.

Lastly, XLM stands out as a low-risk, large-cap token focused on real-world payments and CBDCs, boosted by ongoing TradFi integrations this month.

Conclusion

As the crypto market pivots into the second half of 2025, strategic positioning matters more than ever. This month’s top 5 tokens to watch in July 2025 reflect a range of narratives and risk appetites.

LILPEPE appeals to high-volatility speculators chasing social momentum and meme-fueled upside. SUI and SEI are attracting builders and investors aligned with real tech progress, whether in DeFi design or modular scalability.

JUP remains a go-to for those riding Solana’s liquidity wave and looking for protocol-level fee exposure. And XLM, the veteran of the group, is quietly threading the needle between crypto and traditional finance with real-world payment infrastructure.

Whether you’re trading short-term catalysts or building conviction for longer holds, these tokens represent key lanes in this market cycle. Just remember: the space moves fast. Always Do Your Own Research (DYOR), monitor official project channels, set price alerts, and stay informed. July 2025 is full of opportunity, but only if you’re ready to move with it.

Frequently Asked Questions (FAQs)

What are the top tokens to buy in July 2025?

The top 5 tokens to watch in July 2025 are LILPEPE, SUI, SEI, JUP, and XLM—each with active catalysts and growing ecosystem momentum.

Why is LILPEPE gaining attention this month?

LILPEPE is gaining traction due to Solana bridge rumors, rising social buzz, new staking vaults, and increased on-chain engagement.

Is SEI still a good buy after its V2 launch?

Yes—SEI V2 introduced parallel execution and native oracles, boosting developer interest and setting the stage for continued growth.

What makes SUI different from other Layer-1s?

SUI uses the Move language, prioritizes user-friendly features like zkLogin, and focuses on DeFi scalability with strong developer traction.

How is XLM being used in 2025?

XLM powers cross-border USDC transfers, supports smart contracts, and anchors blockchain-based remittance solutions via TradFi partnerships.