MicroStrategy stock is targeted by short sellers; however, what is the rationale behind this?

Kerrisdale Capital, an investment firm, is shorting MicroStrategy stock, which it claims is trading at an “unjustifiable premium” to Bitcoin.

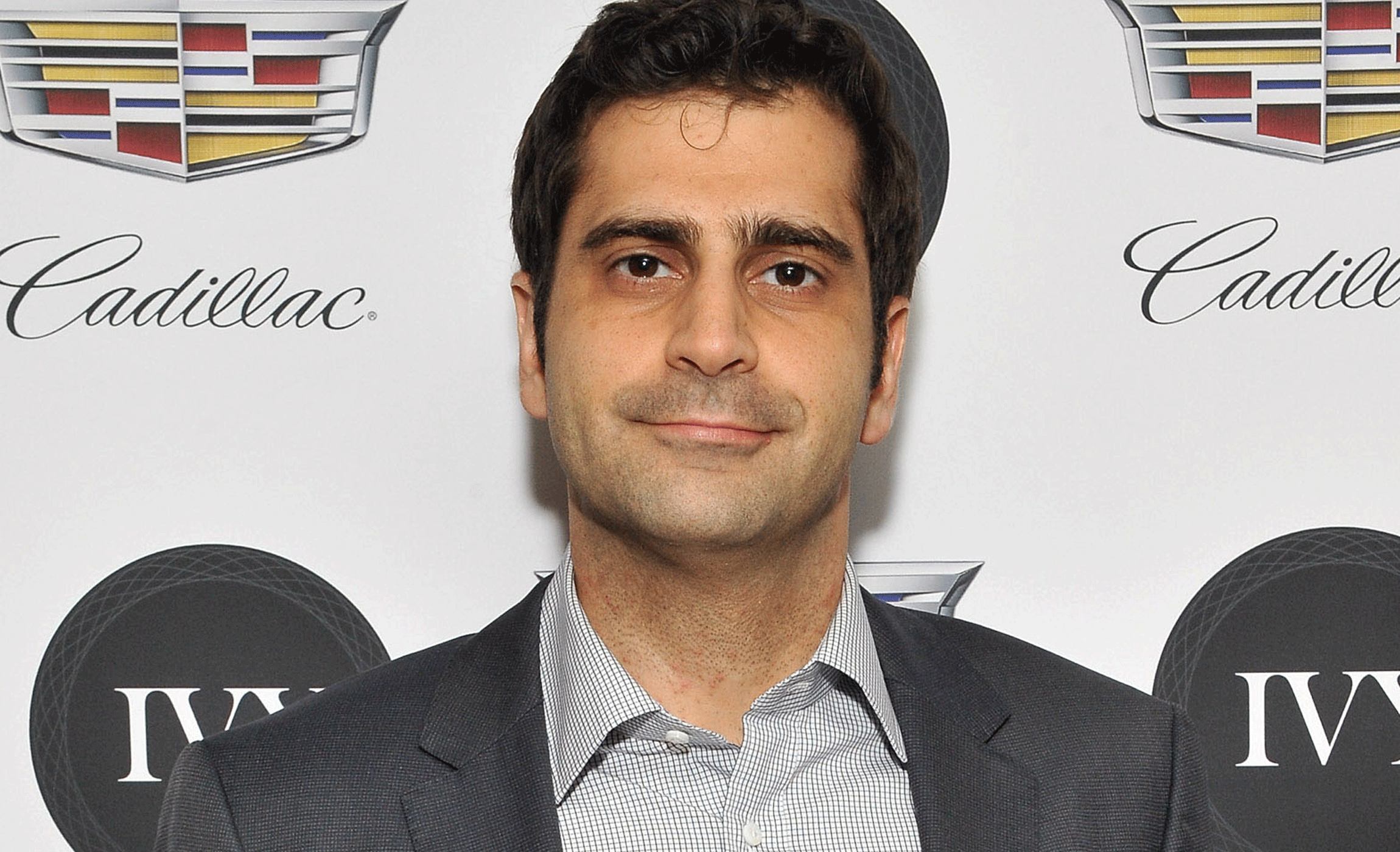

To gain a more comprehensive understanding of Kerrisdale Capital’s assessment that MicroStrategy stock is overvalued, Cointelegraph interviewed Sahm Adrangi, the chief investment officer.

Adrangi reduced the MicroStrategy business model to six syllables.

“They possess an arbitrary quantity of Bitcoin,” he stated.

The cost of MicroStrategy was not justified for Adrangi and his colleagues in Kerrisdale solely because of this fact. In its March report, MicroStrategy stock indicated a Bitcoin BTC price of $61,137, two and a half times the actual value.

Adrangi elaborated, “The software business is not worth very much; it is worth a billion, maybe a billion [point] five, or somewhere in between.” Michael Saylor has acquired all of this Bitcoin […] If he desires to acquire additional Bitcoin, he issues $1 billion of debt and purchases $1 billion more. It does not contribute to the company’s enterprise value.

“Bitcoin prices have to go up for the value of the company to increase. If they go down the value of the company goes down. The company should be trading at the value of Bitcoin. Our argument is ‘go short MicroStrategy, go long Bitcoin.’”

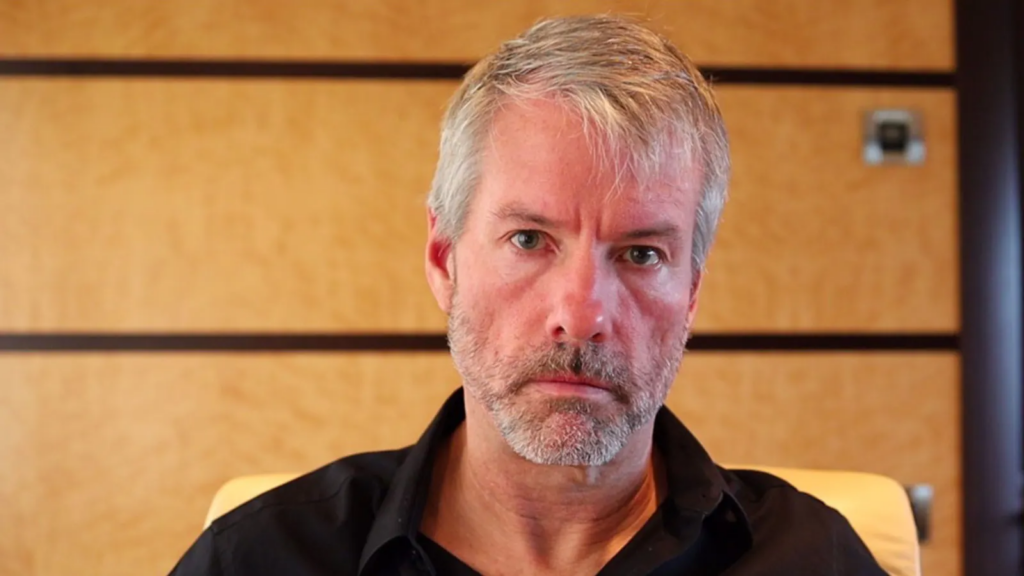

Michael Saylor’s Bitcoin strategy

MicroStrategy initiated its acquisition of Bitcoin in 2020 under the guidance of its executive chairman and co-founder, Michael Saylor.

Saylor is a fervent supporter of Bitcoin, and MicroStrategy has acquired substantial amounts of the cryptocurrency due to his Bitcoin strategy. MicroStrategy acquired an additional 11,931 BTC for $786 million on June 20, increasing the total number of Bitcoin in its possession to 226,331 BTC.

MicroStrategy has invested $8.3 billion in the acquisition of Bitcoin. Its Bitcoin holdings are valued at $14.6 billion.

Adrangi is less than impressed by what may appear to be a robust unrealized profit to a layman.

“There is not a significant amount of evidence in MicroStrategy’s history that suggests it is particularly adept at purchasing at a low price and selling at a high one.” Ultimately, [Saylor] purchases Bitcoin at various intervals. Adrangi also stated that Bitcoin can be purchased at various periods.

The Bitcoin strategy of Kerrisdale Capital

Kerrisdale Capital is an investment firm recognized for its shorting of stocks and publication of research. Kerrisdale frequently releases skeptical reports on the securities it shorts, which frequently coincide with these two components of the organization.

Kerrisdale has previously shorted companies in the biotechnology and traditional mining sectors; however, it is currently demonstrating a heightened interest in cryptocurrency.

Kerrisdale has targeted Bitcoin processing firms since shorting MicroStrategy. In a June report that Cointelegraph previously covered, Kerrisdale announced that it was shorting Riot, a mining firm. The company claimed that Riot’s business model was one of the “worst business models for a public company we have ever encountered.”

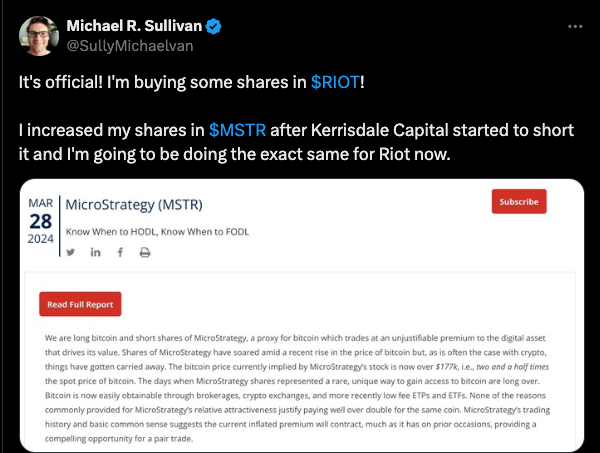

The crypto community has exhibited a protectionist stance toward both firms, which has resulted in substantial criticism and ridicule of Kerrisdale’s strategy.

Michael Sullivan encapsulated the atmosphere on X:

Some individuals have even begun to exult whenever Riot or MicroStrategy stocks increase.

Adrangi, on the other hand, continues to have faith in Kerrisdale’s research and conclusions.

“Ultimately, the price action will be advantageous to us if our thesis is accurate in the long term,” he stated.

Cointelegraph inquired of Adrangi regarding the potential outcomes of a shorting over a specific time frame.

He further stated, “It may require several years.”

A word of warning

The crypto community harbors an inexhaustible supply of contempt and animosity toward those who undermine its members. From an outsider’s perspective, this passion can also be detrimental, as it is challenging to discern which of its advocates is arguing from a position of logic and a position of unadulterated tribalism.

It would appear that Zackary Morris, a research analyst at Onramp, a Bitcoin financial services firm, falls under the first category. Morris, who has previously followed Kerrisdale’s brief ideas, has also found cause to critique its MicroStrategy proposition. He is an avowed supporter of the organization.

In an April LinkedIn post, Morris stated, “MicroStrategy is currently trading at 250% of the value of its bitcoin holdings.” As recently as January, it traded for the value of its bitcoin holdings.

Morris believes that it is entirely feasible for MicroStrategy to increase the value of its Bitcoin holdings by up to 500%.

Morris suggested that the foundations may not be the optimal starting point for developing a thesis on MicroStrategy. “In my opinion, it is not a sound strategy to argue that something is not constrained by reality and then place a bet on it becoming constrained.”

Bitcoin, a scheme that promises rapid wealth accumulation

A “go short MicroStrategy, go long Bitcoin” mantra has been previously adopted by Adrangi and Kerrisdale, which may indicate that the company believes Bitcoin is a prudent investment.

Nevertheless, Adrangi disabused Cointelegraph of any such notion.

“I am not sympathetic to the excessive energy consumption being used to incite speculation regarding this fabricated fantasy land asset,” he stated.

“In the final analysis, Bitcoin is merely a massive scheme designed to generate wealth quickly.” Adrangi stated, “People present a variety of libertarian justifications and express dissatisfaction with the Federal Reserve, the monetary system, and transaction fees.”

“In my opinion, it’s all BS. It’s just a bunch of people who want to get rich so they can buy lambos and watches and they’d rather speculate on Bitcoin versus, you know, go get a real job.”