Amid a selloff by whales, Tron’s Justin Sun has sold $143 million of his Ethereum holdings; this could trigger the ETH price to fall below $3K.

Justin Sun, the founder of Tron, has been selling his Ethereum (ETH) holdings rapidly, resulting in a 17% decline in Ethereum after the rejection at $4,000. Sun has sold 50% of his holdings, valued at $143 million, in the last seven days. Market analysts anticipate that the price of ETH may once again decline below $3,000 before resuming its upward trajectory.

Tron’s Justin Sun on the ETH Selling Spree

Since Donald Trump’s election victory, Ethereum has resumed its upward trajectory, prompting Justin Sun to engage in an extensive selling spree. This trend persisted until last week, when the founder of Tron sold $143 million in Ethereum, which resulted in a 15% decline in the price of Ethereum during the crypto market crash.

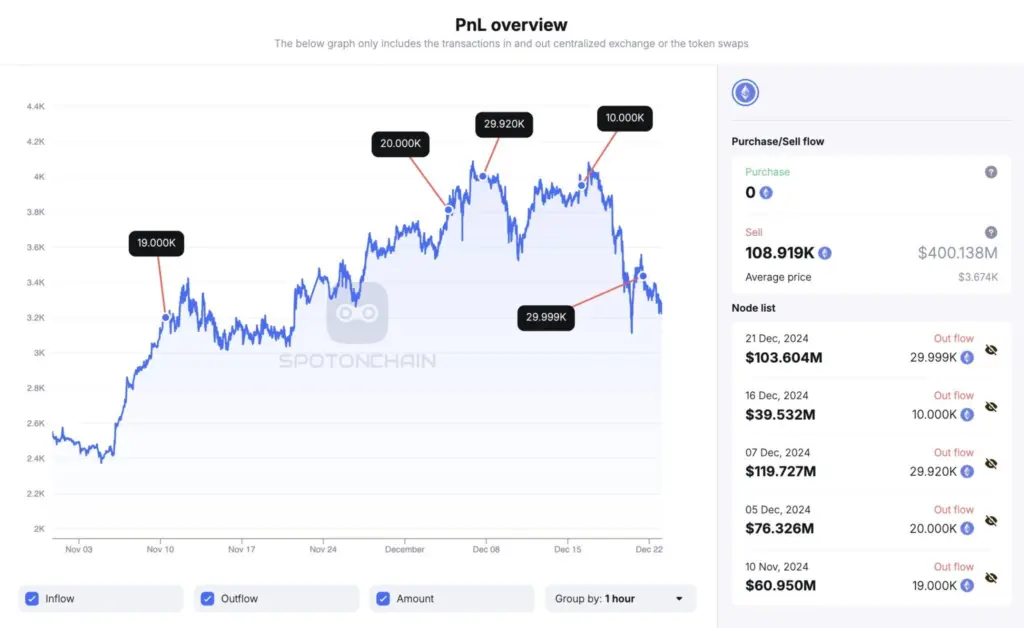

Spot On Chain, a blockchain analytics firm, reported that Justin Sun redeemed 39,999 ETH (equivalent to $143 million) from liquid staking platforms Lido Finance and EtherFi. Subsequently, he deposited the entire sum into HTX.

Sun has deposited 108,919 ETH (worth $400 million) to HTX at an average price of $3,674 since November 10, as the Ethereum price has trended upward. Notably, numerous of these deposits took place near local price peaks.

Spot On Chain also disclosed that Justin Sun is currently unstaking 42,904 ETH (equivalent to $139 million) from Lido Finance. The Tron founder may transfer these funds to HTX at a later date.

Is a price decline of Ethereum below $3,000 imminent?

The world’s most considerable altcoin market sentiment has shifted to bearish due to the Ethereum price losing its critical support of $3,500. After the selloff by whales last week, crypto market analysts became bearish on Ethereum, anticipating a $2,800 decline in the price.

Following a volatile week for stocks, Ethereum experienced a “low-volume weekend,” according to renowned market analyst IncomeSharks. The analysts also stated that the time to sell would not be opportune.

The On-Balance Volume (OBV) indicator, a tool utilized to assess the buying and selling pressure, maintains a consistent oscillation level within a channel. The market is receiving some support from recent profitable Ethereum buyers. Nevertheless, the chart below indicates that Ethereum has the potential to decline to $3,000.

A bullish outlook with a potential inverse head-and-shoulders (iHS) pattern was also emphasized by prominent crypto analyst “I am Crypto Wolf.” According to the analyst, the Ethereum price chart is currently forming the “right shoulder” of the iHS continuation pattern.

This configuration has the potential to generate the momentum necessary to surpass the $4,000 resistance and pursue a $10,000 target by May. He noted that a retest of the $3,000 level is a possibility before the rally takes off, but a breakout is expected by the end of January.