Bitcoin price slips from $118K intraday high after Trump announces 30% tariffs on EU and Mexico, sparking market jitters.

Once more, Trump’s tariffs threaten the positive trend of the Bitcoin price.

After the president announced his trade letters to the EU and Mexico, putting 30% tariffs on goods from both regions, the flagship cryptocurrency experienced a dramatic decline.

Bitcoin Price Fell As Trump Sent Trade Letters To EU, Mexico

Bitcoin has plummeted below $118,000, according to CoinMarketCap data, since Trump announced a 30% tariff on the EU and Mexico.

After this announcement, the flagship cryptocurrency, which had risen as high as $118,200 today, appears sure to hit new daily lows.

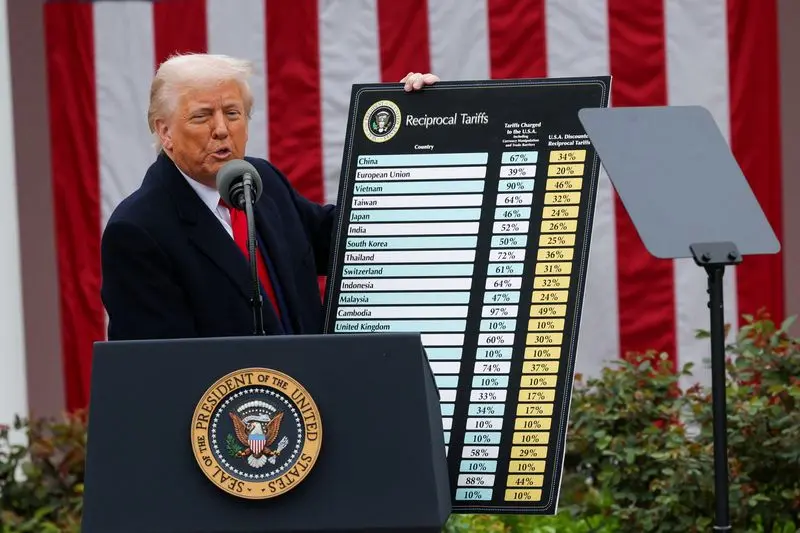

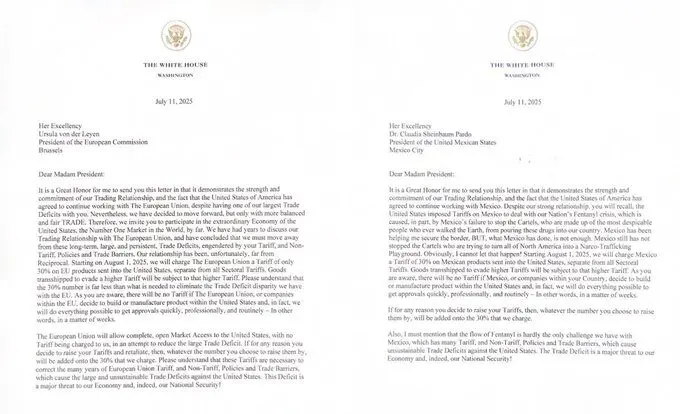

In a series of Truth Social posts, the president disclosed trade letters he addressed to both regions, alerting them to the 30% tariff on their incoming goods in the United States.

Like the other tariffs Trump has slapped on other nations, these will go into force on August 1, which has caused the price of bitcoin to decline.

As previously reported by CoinGape, Trump levied 25% tariffs on Japan and South Korea on July 7.

On the same day, he addressed trade letters to twelve other nations, imposing double-digit tariff rates on them.

During the day, the price of Bitcoin had fallen below $108,000.

Curiously, though, the flagship cryptocurrency bounced back nicely and reached a new all-time high (ATH) on July 9, surpassing $112,000 for the first time. Since then, Bitcoin has risen steadily, reaching its current all-time high of $118,800.

The spike above $112,000 coincided with Trump’s trade letters putting taxes on shipments from Iraq, Moldova, the Philippines, Algeria, and Libya.

However, given the potential trade war between the US and these nations, Trump’s tariffs negatively affect the bitcoin price.

If any nations decide to raise their tariff rates on US goods even further, the US president has already pledged to retaliate.

EU Reacts To Trump’s Tariff Declaration

EU President von der Leyen stated that after Trump announced a 30% tariff on EU exports, they are still prepared to continue negotiating an agreement by August 1.

However, she added that if necessary, they will implement proportionate responses as part of their efforts to protect EU interests.

Additionally, Mexico said it is trying to come to a deal with the United States before the deadline of August 1, which is good news for the price of Bitcoin.

A “TACO trade” might be at work, accounting for Bitcoin’s continued ability to rise to all-time highs despite these recent events.

Trump ultimately extended the trade deadline from its original July 9 deadline to August 1.

The term “Trump Always Chickens Out,” or “TACO,” is a market term coined by Wall Street analysts to characterize how prices first decline as a result of anxiety over tariff pronouncements but then rise as a result of the president’s unlikely failure to carry out his threats.

Amid these events, the price of bitcoin temporarily fell below $117,000, hitting a low of about $116,970.

However, the cost of the top cryptocurrency has already recovered, and the company is aiming to reach the $118,000 mark once more.