Trump accuses Fed Chair Powell of delaying rate cuts for political reasons, claiming it favors Democrats, despite Powell’s data-driven stance.

Donald Trump, the President of the United States, has once again targeted Jerome Powell, alleging that the Federal Reserve Chair is likely postponing an interest rate cut for political reasons. Nevertheless, despite the delay in the Fed rate cut, he did not intend to dismiss Powell.

Trump asserts that the delay in the Federal Reserve’s rate cut is “likely” political

President Trump accused Powell of maintaining high interest rates during a press briefing while hosting the Philippine president, likely for political reasons. He declared that the country is “hot” and requires rate reduction at this time, so interest rates should be set at 1%. However, he stated that he has no intention of dismissing the Fed Chair. He also acknowledged that his tenure will conclude in May 2026, and he will depart shortly.

The president also stated that the U.S. economy is robust; however, Powell and the FOMC persist in maintaining high rates rather than pursuing a Fed rate cut. His statement coincides with the Federal Reserve Chair’s speech today, during which he neglected to address monetary policy.

The president also capitalized on the occasion to criticize Powell for the Federal Reserve’s renovation expenses, concerning which the Fed Chair is currently experiencing considerable pressure. As previously reported, Rep. Anna Paulina Luna, Trump’s ally, has criminally referred him to the U.S. Department of Justice (DOJ) for perjury about the renovation costs.

Consequently, Powell is contemplating resignation, which could facilitate a Fed rate cut earlier than anticipated. Additionally, the president has indicated that the Federal Reserve Chair may resign if a fraud case is successful.

This year, there will be three cuts

Goldman Sachs anticipates that the Federal Reserve will implement three consecutive rate reductions at the subsequent three FOMC meetings this year, following the Committee’s decision to maintain rates at their current level at the July 30 meeting. The bank anticipates that this will transpire as the labor market experiences a decline.

Goldan Sachs observed that the employment rate in the private sector is nearly at a standstill, which could lead to a contraction in the U.S. economy. In the interim, consumer expenditure has experienced a six-month decline, a trend typically associated with a recession.

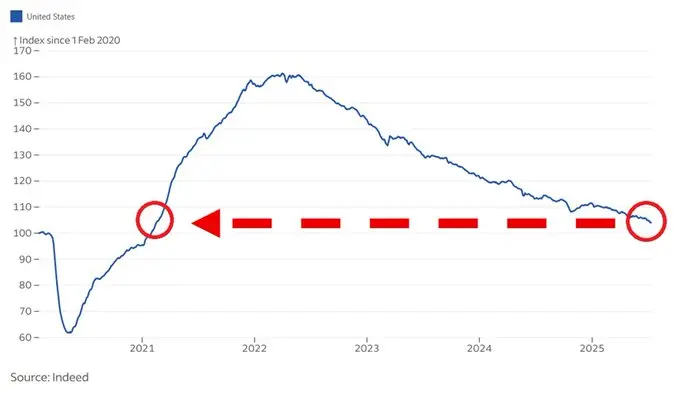

Market analyst The Kobeissi Letter also argued in favor of a Fed rate reduction, while simultaneously emphasizing the labor market’s ongoing deterioration. They observed that Indeed’s job postings experienced an 8% year-over-year (YoY) decrease in the week ending July 11, the lowest level since February 2021.

Additionally, the Kobeissi Letter disclosed that postings have declined by 65% since their apex in March 2022. As a result, the number of accessible positions in the United States has increased by only 4% from the pre-pandemic level.