Ali Martinez predicts that TRUMP coin will have a bullish run as it establishes a falling wedge pattern, which indicates a recovery following consolidation.

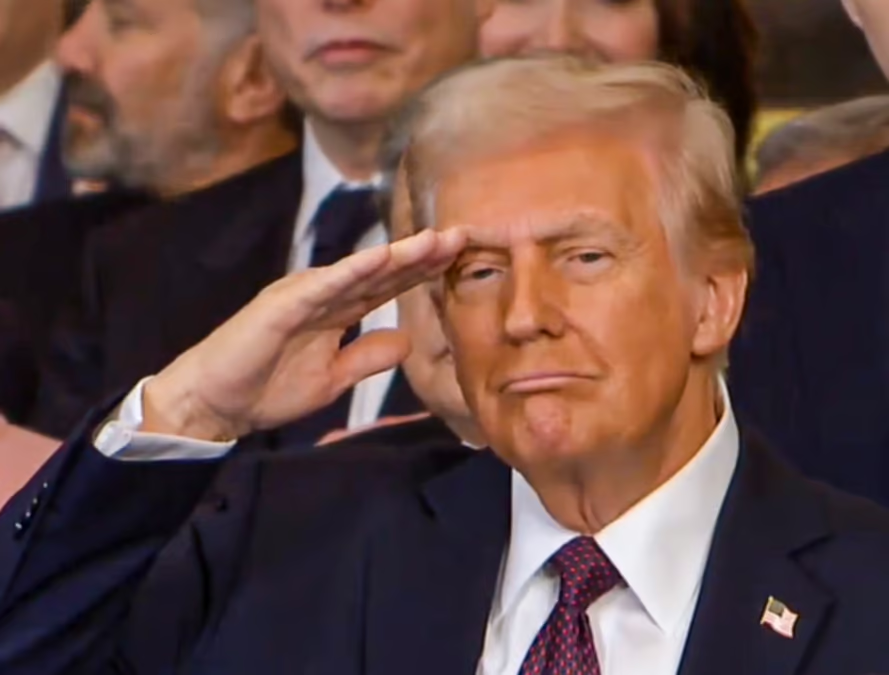

The TRUMP coin has garnered market attention due to its price fluctuations during and following President Donald Trump’s inauguration. According to a technical analysis conducted by Ali Martinez, the cryptocurrency is forming a falling wedge pattern, which suggests a potential bullish breakout. This pattern indicates that the price may recover after consolidation.

Amidst a $54 breakout, the TRUMP Meme Coin establishes a bullish pattern

Ali Martinez, a crypto analyst, observed a declining wedge pattern forming on lower timeframes for the TRUMP coin. This technical pattern is frequently considered a bullish reversal signal, as it indicates a decrease in selling pressure and a higher probability of a breakout.

Martinez anticipates that the new meme coin may rebound toward $54 following a consolidation phase near the wedge’s apex, indicating an upward momentum.

The TRUMP coin experienced a surge in market activity following the meme coin launch, reaching a 24-hour peak of $60. By the conclusion of the day, the value had plummeted to $40.25. Despite the downturn, the $31.82 billion in trading volume that accompanied the 11% price decrease suggests that trader interest was heightened.

Potential Reversal Signaled by Falling Wedge

The TRUMP meme coin’s falling wedge pattern suggests that there will be a decrease in selling pressure, which indicates that a bullish move is imminent. This phase of consolidation is essential for determining the token’s future trajectory.

The token has a circulating supply of 200 million tokens and a market capitalization of $8.05 billion. The reduced selling pressure and high trading activity further exacerbate the potential reversal.

Nevertheless, despite the optimistic forecast, the meme coin’s value plummeted to $35.87 in just 24 hours, a 27.33% decrease.

Concerns Are Raised by the Launch of Meme Coin

Regulatory and ethical concerns have been raised in response to the TRUMP meme coin introduced during the inauguration festivities. Affiliated entities are purportedly in control of four-fifths of the token supply, which raises concerns regarding market manipulation. Critics contend that the high concentration of ownership could impact the token’s price fluctuations and long-term stability.

Furthermore, a recent report from CNBC disclosed that the first family’s wealth increased by billions of dollars due to the inauguration weekend. The TRUMP meme coin, introduced on Friday night, has since reached a market capitalization of $14 billion. The value of $MELANIA, inaugurated on Sunday, has exceeded $2 billion. World Liberty Financial, which the family endorsed, raised more than $300 million through token sales, further increasing their net worth.

Furthermore, even though the token’s launch garnered attention, certain analysts advise against making speculative investments in meme currencies because of their volatility.

Mark Cuban addressed the developing concerns by asserting that the meme coin presents regulatory and ethical obstacles, mainly because President Donald Trump serves as both an investor and issuer. He emphasized the conflict of interest that this generates, cautioning that it could undermine investor confidence and perplex regulators. Cuban also criticized the absence of investor protections and contended that these projects have the potential to undermine the crypto industry’s endeavors.

President Donald Trump did not address cryptocurrencies in his inaugural address, despite the enthusiasm surrounding the TRUMP meme coin.