Trump to impose 50% EU import tariff starting June 1, triggering nervousness and a correction in recent crypto market momentum.

In response to what Trump characterized as persistent trade imbalances and regulatory barriers, tariffs have been proposed. He accused the EU of perpetuating unfair trade practices that have caused harm to US businesses.

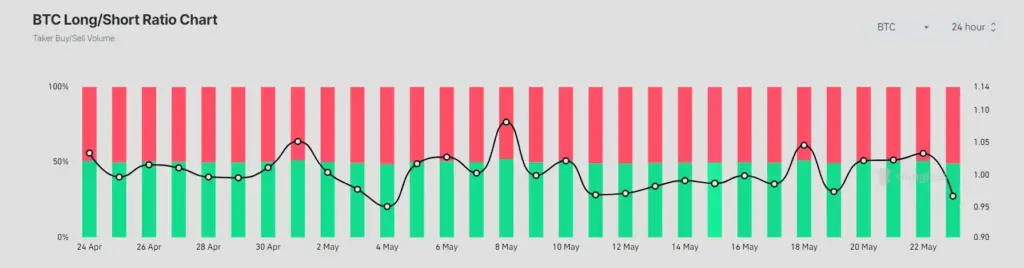

The Long-Short Ratio demonstrates Market Confusion

The announcement caused Bitcoin to decline from a session high of $111,000 to $108,000. However, it continues to be under duress, having recovered to approximately $109,000. The crypto market has experienced a 4% decline in the past 24 hours.

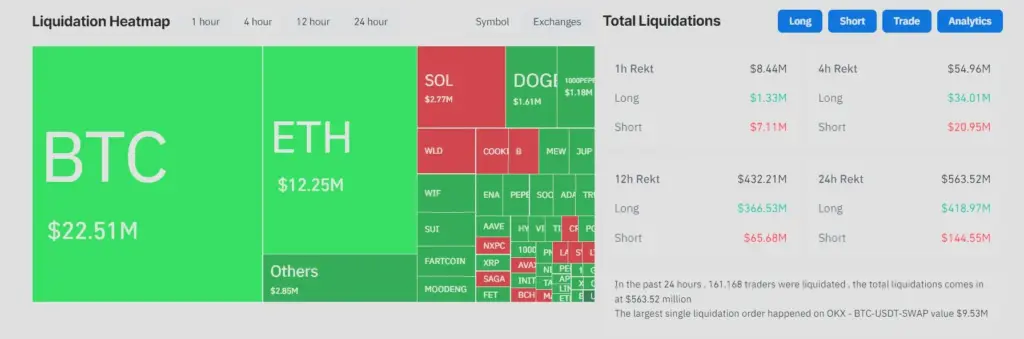

The most recent four hours have seen $64.13 million in crypto liquidations, according to data from Coinglass. Short positions comprised $30.09 million, while long positions comprised $34.05 million.

Ethereum experienced $15.16 million in liquidations, while Bitcoin alone experienced $24.4 million.

In the interim, Bitcoin’s long-short ratio is nearly equal, indicating a short-term uncertainty in the market’s trajectory. Yesterday, Bitcoin’s long positions dominated the charts at 54%.

Numerous altcoins, including Solana and XRP, also experienced significant volatility, indicative of an overall increase in volatility.

The abrupt policy shift has caught retail traders off guard, as most altcoins experienced a greater wipeout in long positions.

Growing apprehension regarding macroeconomic volatility

The crypto market received a much-needed boost due to the US-China trade agreement signed earlier this month. It was a sign that the macroeconomic uncertainty may have been factored in. Nevertheless, Trump’s threats to the European Union have reignited apprehensions.

Analysts caution that the tariff announcement may serve as the inception of a more extensive economic disruption. The European stock indices experienced a significant decline, and US technology equities were also subjected to selling pressure.

The cryptocurrency market’s liquidation heatmap illustrates a market entangled between upward retracement attempts and downward dread.

The situation is in a state of flux. Risk assets like cryptocurrencies may encounter additional challenges if the tariff threat escalates into a full-scale trade dispute. Traders are intently monitoring any indications of negotiation or a response from the EU.

Over the past 24 hours, a total of $567.65 million in trades was liquidated, which involves 162,419 traders. Although crypto has frequently served as a hedge during conventional market duress, recent developments demonstrate that it is not impervious to global policy fluctuations.