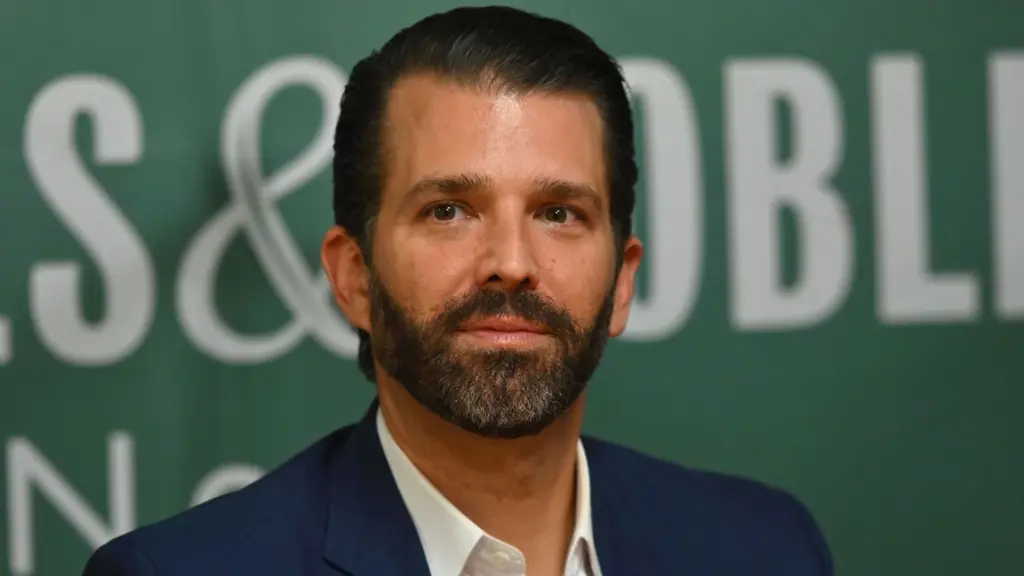

Donald Trump Jr.’s 1789 Capital invests double-digit millions in Polymarket, valued at over $1B, joining its advisory board to drive U.S. expansion.

Polymarket, the world’s largest prediction market platform, has received millions of dollars in investment from Donald Trump Jr.’s venture capital firm. The agreement represents one of the most prominent endorsements for the rapidly expanding sector.

Polymarket’s expansion plans in the United States are being fueled by VC backing and regulatory breakthroughs

Last year, Trump Jr. became a partner at 1789 Capital. Polymarket, which was recently valued at over $1 billion by Founders Fund, received a double-digit million investment from the fund, according to Axios. In addition to the investment, Trump Jr. will be appointed to the company’s advisory council, including his name in the company’s future expansion strategy.

The decision is made in anticipation of Polymarket’s expansion into the United States. Even though the platform hosted billions of predictions globally, Americans were prohibited from using it for years.

The company recently acquired derivatives exchange QCEX for $112 million, granting it a CFTC license that paves the way to the regulated U.S. market. Additionally, Polymarket recently secured $200 million in additional financing, which would place the company’s valuation at more than $1 billion.

Polymarket had encountered substantial challenges due to regulatory scrutiny. The company was the subject of investigations by the Department of Justice and the CFTC. In November of last year, the FBI searched the apartment of CEO Shayne Coplan. The Department of Justice has officially concluded those investigations, dispelling the ominous cloud enveloping its operations. After obtaining clearance, Polymarket now considers itself a potential candidate for an initial public offering (IPO).

The investment results from a developing relationship between Coplan and Omeed Malik, the proprietor of 1789 Capital. The firm delayed committing capital until legal clarity was established, even though discussions between the parties commenced over a year ago. Polymarket is perceived as a company with a strong cultural impact and high growth potential by 1789, including Anduril and SpaceX.

The investment by Trump Jr. indicates a turning point in the U.S. prediction markets

The intrigue is further exacerbated by the fact that Trump Jr. has been associated with Kalshi, a competitor of Polymarket. He was appointed a strategic advisor to Kalshi earlier this year, although the position was compensated rather than an investment. He currently has a significant influence on both factions.

Last year, Polymarket and Kalshi garnered national attention when users defied conventional polls by accurately forecasting Donald Trump’s election victory. The potential of prediction markets to accurately represent genuine sentiment was underscored by those results, which attracted the attention of regulators, investors, and political observers.

Given Trump Jr.’s support, Polymarket is well-positioned to evaluate the feasibility of regulated prediction markets entering the mainstream in the United States. Although professional sports leagues such as the NFL have expressed apprehension regarding the proliferation of these markets, the political environment under Trump 2.0 has shown minimal resistance.