The SEC okays Trump Media’s Bitcoin plan weeks after it confirmed raising funds, reversing earlier denials of the $2.3B BTC treasury deal.

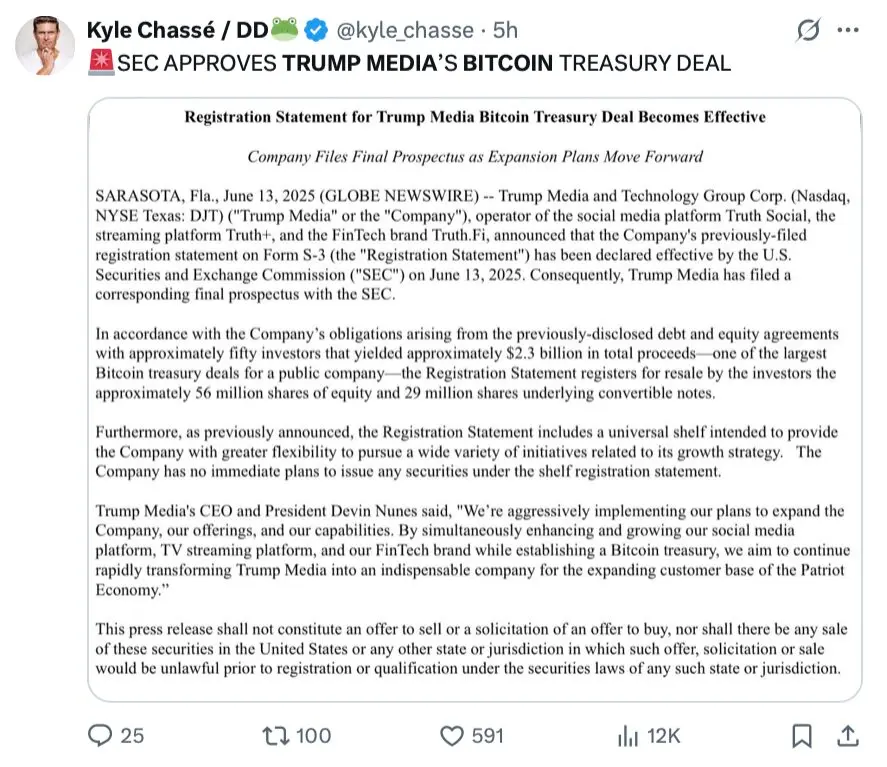

US President Donald Trump’s Truth Social platform is partially owned by Trump Media and Technology Group (TMTG), which has received approval from the US Securities and Exchange Commission (SEC) for its registration statement related to its $2.3 billion Bitcoin treasury deal.

The SEC “declared effective” TMTG’s S-3 registration statement for the Bitcoin treasury transaction, which was filed on June 6, according to a filing on June 13.

Various securities, including stocks, options, and multiple categories of debt, are registered for sale by US companies using the S-3 form.

The SEC received a corresponding final prospectus from TMTG on the same day.

CEO Says Trump Media Company Is Expanding “Aggressively”

The SEC filing stated that TMTG registered the resale of approximately 56 million shares and 29 million more linked to convertible notes as part of debt and equity agreements with approximately 50 investors as part of its Bitcoin treasury plan.

This transaction generated $2.3 billion.

Even though the registration statement includes a universal shelf to provide TMTG with “greater flexibility” for future growth plans, the company currently has “no immediate plans” to issue securities under It.

Devin Nunes, the CEO and President of Trump Media stated, “We are making significant strides in the implementation of our strategies to broaden the Company, our product line, and our capabilities.” Nunes included:

“By simultaneously enhancing and growing our social media platform, TV streaming platform, and our fintech brand while establishing a Bitcoin treasury, we aim to continue rapidly transforming Trump Media into an indispensable company for the expanding customer base of the Patriot Economy.”

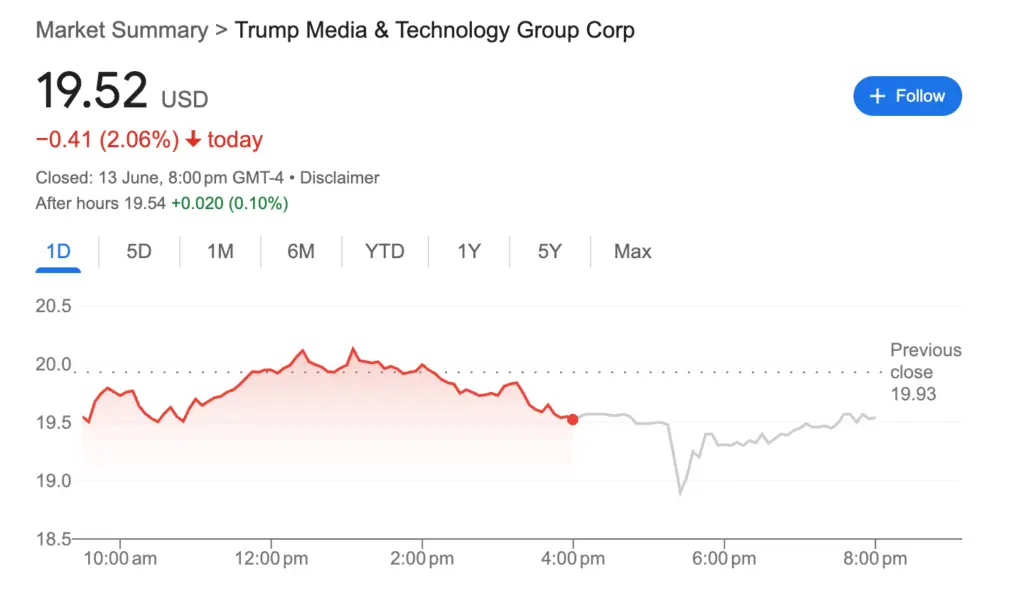

According to Google Finance data, TMTG’s stock price declined 2.06% on the same day, concluding the trading day at $19.52.

The confirmation of a $2.5 billion capital raise to purchase Bitcoin on May 27 was a mere few weeks after the company had previously denied reports of the deal.

At the time, Nunes stated that TMTG regards “Bitcoin as an apex instrument of financial freedom, and now Trump Media will hold cryptocurrency as a crucial part of our assets.”

TMTG Has Recently Submitted Filing To Establish Spot Bitcoin ETF

In a post on May 28, Arkham, a blockchain analysis company, announced that “Donald Trump’s company, Trump Media, will purchase $2.5 BILLION of Bitcoin.”

Is it possible that Trump is on the brink of entering Saylor Mode?

At the same time, on June 5, TMTG submitted a filing with the Securities and Exchange Commission (SEC) to establish a Bitcoin exchange-traded fund (ETF).

“The Trust’s assets are primarily Bitcoin, which a custodian holds on its behalf,” TMTG stated in a filing on June 5 that the Trust aims to convey the overall performance of the Bitcoin price.