The White House may issue an order under Trump directing bank regulators to probe claims of debanking targeting crypto execs and conservatives.

According to reports, US President Donald Trump intends to issue an executive order ordering banking regulators to look into debanking allegations made by conservatives and the cryptocurrency industry.

A draft of the executive order, viewed and reported by The Wall Street Journal on Monday, would urge bank regulators to investigate if any financial institutions violated laws about fair lending practices, consumer financial protection, or antitrust.

Those who break the law may be subject to fines or other legal repercussions.

According to reports, Trump may sign the order this week, but the White House may alter or postpone the plan.

Executives in the cryptocurrency sector have long claimed that the Biden administration plotted to isolate cryptocurrency from the banking system by pressuring banks to evade customers who hold digital assets through the use of regulators.

Executive Directive Calling For Regulatory Reform

The alleged draft order instructs bank regulators to revoke any regulations that would have caused banks to lose clients, including cryptocurrency companies.

Additionally, it instructs the Small Business Administration of the US government to examine banking procedures that support the agency’s small business loans.

The directive requests that regulators forward certain possible infractions to the attorney general so that the Department of Justice can investigate.

According to a June Journal story, the White House was preparing for Trump to sign a similar order to prevent banks from cutting off services to sectors like cryptocurrency.

According To “Operation Choke Point 2.0,”

Following the collapse of FTX, a cryptocurrency exchange that was exposed as a big hoax, cryptocurrency insiders have stated that former President Joe Biden started to shut off their industry from banking in late 2022.

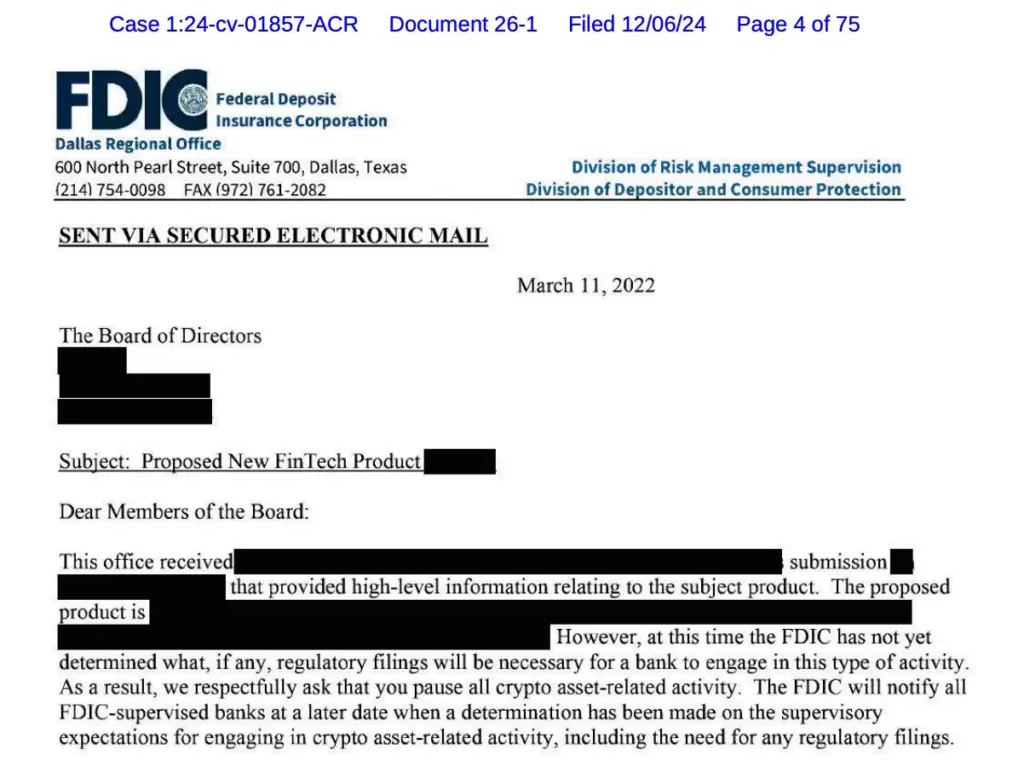

The Biden-era Federal Deposit Insurance Corporation (FDIC) “bludgeoned the banks” with investigations and inquiries about cryptocurrency and stablecoins until they “relented under the pressure,” according to testimony given by Coinbase chief legal officer Paul Grewal at a Congressional hearing in February.

Grewal said the industry’s assertion “wasn’t just some crypto conspiracy theory” after Coinbase sponsored a Freedom of Information Act lawsuit against the FDIC that revealed the government requested that some financial institutions halt their crypto banking operations.

Inspired by the Justice Department’s “Operation Choke Point” against banks and payday lenders in the 2010s, cryptocurrency venture capitalist Nic Carter created the name “Operation Choke Point 2.0” in February 2023 to characterize the alleged debanking movement.

Trump’s Directive To Pursue Purported Political Debanking As Well

According to reports, the order from Trump would also look into banks’ alleged denial or cancellation of services to political conservatives.

According to the Journal, the draft criticized financial institutions that allegedly assisted federal authorities in investigating the disturbances at the US Capitol on January 6, 2021.

However, it did not specifically name any banks.

Conservatives have also accused banks of refusing services because of their political views.

The technique is known as “derisking” in the banking sector, and financial organizations have the authority to terminate accounts regardless of whether the account holder presents a risk to the company’s finances, reputation, or legal standing.

After the FDIC and the Office of the Comptroller of the Currency took similar actions, the Federal Reserve announced in June that it would no longer be looking for reputational risk.