Trump urges Fed’s Powell for a 1% rate cut before June 17-18 FOMC meeting, citing ECB’s 10 cuts and strong US growth despite Powell’s delays.

Despite Jerome Powell’s and the committee’s reluctance to reduce interest rates, Donald Trump continues to exert pressure on the US Federal Reserve. This time, the president has requested a 100 basis points (Bps) reduction in the Federal Reserve’s interest rate in anticipation of the FOMC meeting later this month.

President Trump advocates for a 100 basis points reduction in the Federal Reserve’s interest rate

In a Truth Social post, the US president encouraged the Federal Reserve to implement a full point reduction, which he characterized as a “rocket fuel” for the economy. He also criticized Fed Chair Jerome Powell for being too late and a “disaster” while making this statement.

Trump observed that the European Central Bank (ECB) has implemented 10 rate decreases, whereas the Federal Open Market Committee (FOMC) has yet to implement any. The most recent ECB rate reduction occurred on June 5, as CoinGape reported. Europe reduced interest rates by 25 basis points to 2%.

In another Truth Social post, Trump reiterated his advocacy for reducing the Federal Reserve’s interest rate. He stated that the United States would significantly reduce interest rates on debt approaching maturity, both long and short if Powell were to reduce them.

He observed that Joe Biden’s tenure was predominantly brief. Nevertheless, the president thinks that inflation has essentially disappeared. Donald Trump even went so far as to request an agreement with the Federal Reserve, asking that they increase the rate to counteract the possibility of inflation return.

In the interim, he maintains that it is “extremely straightforward” to reduce rates. Additionally, Trump declared that Powell’s and FOMC’s reluctance is resulting in a significant financial loss for the nation, as borrowing costs should be significantly lower.

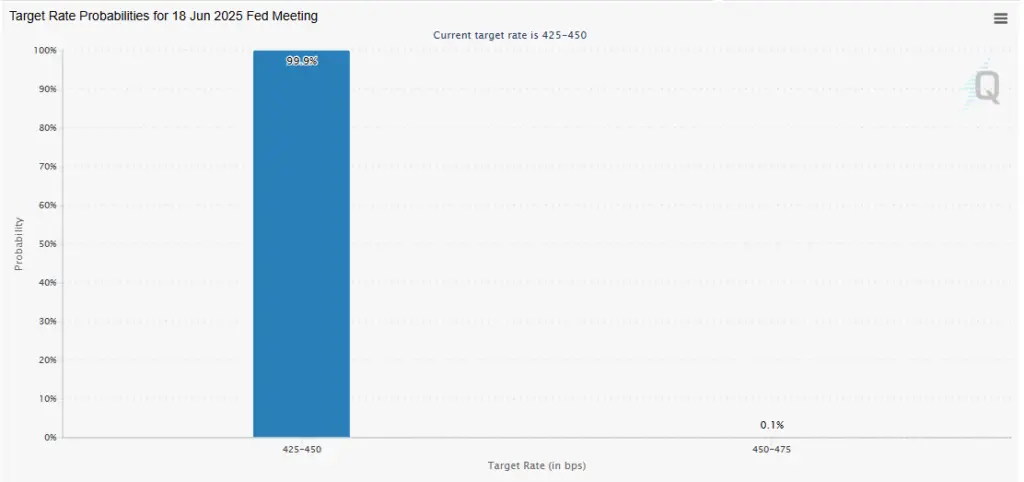

The president’s most recent request for a reduction in the Federal Reserve’s interest rate is issued two weeks before the FOMC meeting, which is scheduled for 17 and 18. According to CME FedWatch data, there is a 99.9% likelihood that the Federal Reserve will maintain interest rates at the present level of 425 to 450 basis points.

The minutes of the May FOMC meeting indicated that the FOMC is not in a rush to reduce interest rates. Instead, they are opting to observe the economic consequences of the Trump tariffs.