Trump World Liberty Financial (WLFI) mints $205M in USD1 as ALT5 Sigma denies insider trading claims, boosting the stablecoin’s circulation.

Trump World Liberty Financial (WLFI) has boosted the circulation of its stablecoin USD1, minting $205 million.

This occurs at the same time that ALT5 Sigma, its treasury firm, is at the center of accusations of insider trading.

Trump World Liberty Increases Supply Of USD 1 By 9%

Trump World Liberty, a cryptocurrency initiative supported by the Trump family, stated in a recent X post that it generated $205 million in USD1 for its treasury.

As a result, the stablecoin supply reached a new high of $2.4 billion. This most recent issue is the token’s most significant growth since April.

Additionally, it solidifies its position as the sixth-largest stablecoin in market capitalization.

Although it currently lags behind market heavyweights like Tether and Circle, USD1, which was introduced earlier this year, has rapidly risen in the rankings.

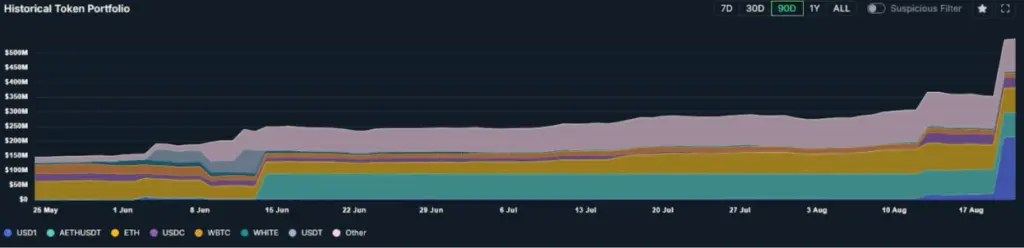

According to analytics firm Nansen, the fresh minting increased Trump World Liberty Financial (WLFI) treasury reserves to $548 million, and USD1 now accounts for the most significant portion of its cryptocurrency assets.

With $212.59 million, the stablecoin makes up about 40% of the portfolio, more than its $84.86 million holding in AETHUSDT.

According to experts, the action might be calculated before the debut of the Trump World Liberty Financial (WLFI) governance token.

With a phased community-focused unlock plan across centralized and decentralized platforms, the currency is anticipated to go live in September.

ALT5 Sigma Rejects Claims Of Insider Trading

World Liberty’s cryptocurrency vehicle, ALT5 Sigma, has been obliged to make forceful denials against allegations of insider conduct related to its $1.5 billion treasury funding round amid these optimistic reports.

According to several media outlets, the US SEC was looking into venture capitalist Jon Isaac, who was allegedly connected to the leadership of ALT5. Both ALT5 and Isaac promptly disputed the reports.

“The company does not know about any current investigation regarding its activities by the US SEC,” ALT5 Sigma added.

Isaac has never been its president or advisor, they explained. In a follow-up, Isaac reiterated this, emphasizing that he is the CEO of Live Ventures, which is listed on the Nasdaq, and does not have an executive position at ALT5.

He still owns over a million shares, making him a significant shareholder.

Reports state that Isaac agreed to a consulting deal with ALT5 Sigma in 2024.

He purportedly contributed strategically to client acquisition, restructuring, and product development.

Among these was a $540,000 note that was subsequently turned into equity.

Disclosures about share sales and earnings inflation also included his name.

The company’s $1.5 billion direct sale, which was intended to strengthen World Liberty’s USD1 reserves, has come under fire for this.

In the meantime, the Initiative, which Trump supports, keeps moving forward with its larger plan.

To strengthen its treasury goals and enter the market, the cryptocurrency vehicle ALT5 Sigma was introduced.

Fairness will be prioritized during the WLFI token’s impending launch through governance votes and community-driven unlocks.

Over the next two months, listings on significant exchanges are also anticipated.

Analysts contend that the USD1’s rapid adoption demonstrates investors’ strong interest in stablecoins with political branding.

Its success will depend on balancing rapid growth and the need to reassure investors.