Bitcoin hits a new high as Trump’s pro-crypto executive order sparks $1.9B inflows to crypto ETPs, driving YTD totals to $4.7B with Bitcoin dominating at 92%.

Following US President Donald Trump’s executive order to create a strategic crypto reserve, cryptocurrency exchange-traded products (ETPs) performed better last week.

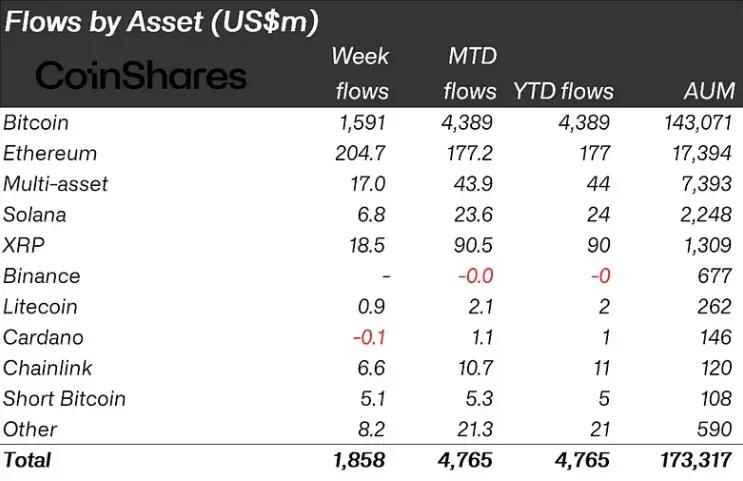

According to a January 27 study by cryptocurrency investment firm CoinShares, Trump’s order suggesting the creation of a strategic crypto reserve was one of the driving forces behind the recent $1.9 billion infusion into different crypto ETPs.

With inflows into global crypto ETPs for the third week, the year-to-date (YTD) total now stands at $4.7 billion.

CoinShares reports that last week’s inflows were about 13% lower than last week when $2.2 billion was invested in cryptocurrency ETPs.

92% of all crypto ETP inflows this year are from Bitcoin.

According to CoinShares’ research head James Butterfill, “BTC$98,415-based crypto ETPs accounted for the majority of inflows, attracting $1.6 billion last week, bringing YTD inflows to $4.4 billion, or 92% of all crypto ETP inflows YTD.”

Short Bitcoin ETPs gained momentum last week, recording $5.1 million inflows, as Bitcoin reached a fresh all-time high above $109,000 on January 20, according to Butterfill.

Bitcoin ETPs accounted for 82% of the $171 billion total assets under management (AUM) for all crypto ETPs.

Last week, all outflows were balanced by inflows.

Despite early-year selling, Ether ETPs priced at ETH$3,037 witnessed inflows of $205 million last week, maintaining their upward trend. Ether ETP inflows totaled $177 million so far this year.

Additionally, XRP XRP$2.75 ETPs had $18.5 million in inflows, around 40% less than the prior week.

With inflows of $6.9 million, $6.6 million, and $2.6 million, respectively, Solana SOL$222.48, Chainlink LINK$22.27, and Polkadot DOT$5.59 were the altcoins with the most noteworthy ETP flows.

“Last week, there were no outflows from any digital asset investment products, which is unusual,” said Butterfill.

Outflows are still visible in Grayscale.

With weekly inflows of $1.5 billion, or 76% of all crypto ETP inflows last week, BlackRock remained the leader among crypto ETP issuers. With a total AUM of $64 billion, the issuer has received $2.9 billion in inflows this year.

ARK and Fidelity, two more well-known issuers, saw inflows of $173 million and $202 million, respectively.

However, Grayscale’s cryptocurrency ETPs faced significant withdrawals, with weekly outflows topping $124 million.

Grayscale’s cryptocurrency ETPs have seen outflows of $392 million since the start of 2025.