Tuttle Capital plans a July 16, 2025, launch for 2x leveraged ETFs tracking XRP, SOL, TRUMP, LTC, BONK, BNB, ADA, MELANIA, LINK, and DOT, pending SEC approval.

Tuttle Capital has announced a new effective date for the launch of several cryptocurrency-focused exchange-traded funds (ETFs). A series of 2x leveraged ETFs that target XRP, Solana, Trump, Litecoin, Bonk, BNB, Cardano, Melania, Chainlink, and Polkadot will be subject to the new date of July 16, 2025.

Tuttle Capital’s Launch Date for the XRP, Solana, BNB, Trump, and ADA ETF

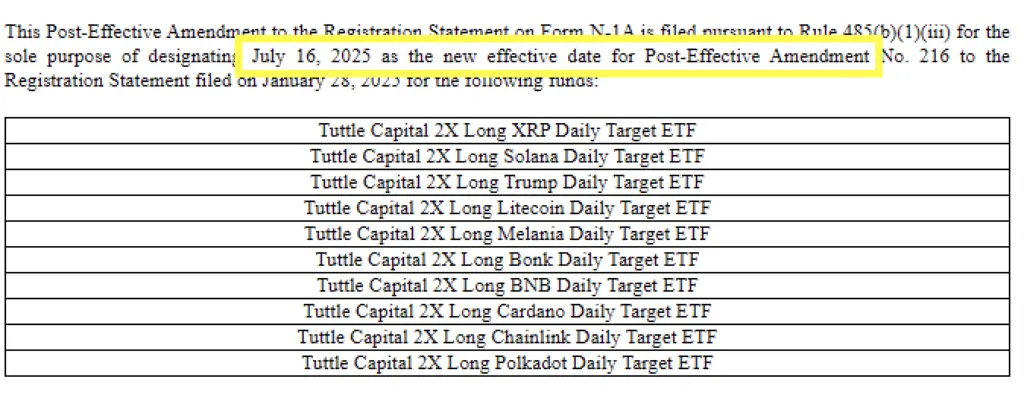

According to Bloomberg analyst Eric Balchunas, Tuttle Capital submitted a post-effective amendment to the Registration Statement for a diverse array of crypto-related exchange-traded funds (ETFs).

A series of funds, such as the Tuttle Capital 2X Long Daily Target ETFs for XRP, Solana, Trump, Litecoin, Bonk, BNB, Cardano, Melania, Chainlink, and Polkadot, will be effective on July 16, 2025, as designated by the new amendment.

The amendment does not necessarily indicate that these ETFs will be launched immediately, even though an official date has been established. In the past, the effective dates of ETFs during the registration process were regarded as a sign that they were prepared for market listing. However, regulatory or market-related delays may be needed before the ETFs are officially launched. The new date, as Eric Balchunas noted, indicates a potential transition toward the imminent launch of these ETFs, following the approval of Canada’s third-ranked XRP ETF in June.

The influence of the $SSK Solana ETF launch

The announcement of the new effective date for Tuttle Capital’s cryptocurrency ETFs follows the upcoming launch of the Rex-Osprey Solana Staking ETF ($SSK) tomorrow. The ETF will be the first of its kind to stake Solana tokens in the United States and is expected to be of interest to investors who are interested in exposure to Solana through an exchange-traded instrument.

Analysts believe that the success or failure of the $SSK launch could have a significant impact on the timeliness and success of other crypto ETFs.

The approval of the $SSK ETF by the US Securities and Exchange Commission (SEC) has generated some controversy due to how it was authorized. Contrary to other exchange-traded funds (ETFs), the $SSK was not officially sanctioned by the Securities and Exchange Commission (SEC). Instead, its availability was permitted by the absence of opposition. This has resulted in industry-wide concerns regarding the regulatory framework that governs cryptocurrency-based products.

However, the Rex-Osprey Solana ETF could serve as a modest stride toward the widespread acceptance of cryptocurrency ETFs in the US market. According to experts, the SEC is expected to sanction ETFs on other spot-based assets, such as Litecoin (LTC), Solana (SOL), and XRP, in the upcoming months. The probability of this happening is currently at 95%.

Tuttle Capital’s Emphasis on Leveraged Crypto ETFs

Tuttle Capital funds consist of 2x leveraged exchange-traded funds (ETFs), which offer a unique investment opportunity for individuals seeking to maximize their cryptocurrency investments.

The funds are intended to provide investors with a means to capitalize on the daily price fluctuations in cryptocurrencies such as XRP, Solana, Trump, Litecoin, Bonk, BNB, Cardano, Melania, Chainlink, and Polkadot. These exchange-traded funds (ETFs) are structured with leverage, meaning they aim to achieve twice the daily performance of their underlying assets.

Leveraged exchange-traded funds (ETFs) may appeal to speculators who seek to increase their short-term returns amid the volatility of cryptocurrency prices. However, they also carry an elevated risk, particularly during periods of significant volatility.