Most lawmakers of the United States Senate vote to repeal the SEC to overturn a rule affecting financial institutions doing business with crypto firms.

Most senators in the United States Senate have approved a joint resolution urging the Securities and Exchange Commission (SEC) to revoke a regulation that sanctions financial institutions engaged in business with cryptocurrency firms.

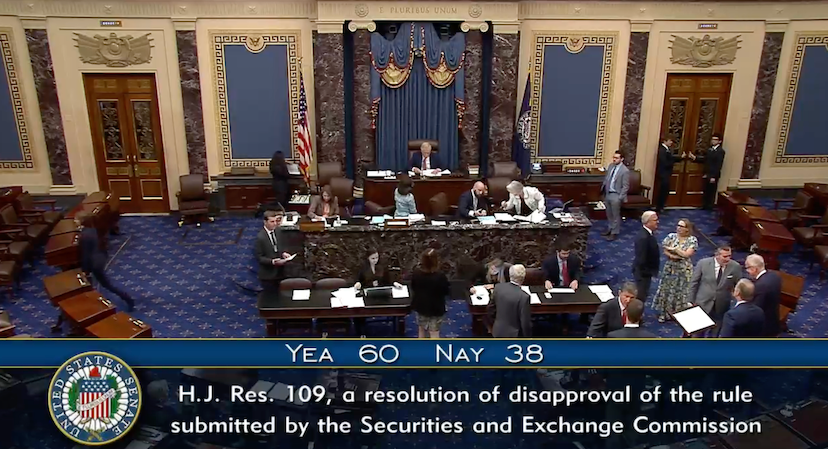

On May 16, U.S. Senators approved H.J.Res. 109, a resolution nullifying Staff Accounting Bulletin No. 121 of the SEC, by a vote of 60 to 38.

The rule imposed by the commission mandates that banks record the digital assets of their customers on their balance sheets and maintain capital against them.

This action has drawn criticism from numerous legislators and industry leaders who argue that it hampers innovation.

“The astounding sixty ‘Yeas’ in the Senate vote sends a clear message that both houses of Congress, across the political divide, strongly disapprove of this rule,” the Blockchain Association, an advocacy group for cryptocurrencies, wrote in an X post on May 16.

President Joe Biden intended to veto the measure on May 8, before its passage by the U.S. House of Representatives, to “protect investors in crypto-asset markets and ensure the integrity of the financial system as a whole.”

If the legislation is vetoed by the U.S. President, it shall reappear before Congress and reestablish passage by a two-thirds majority vote.

The Blockchain Association stated, “The threat of a presidential veto denies the growing awareness among the electorate, particularly young people, that crypto is something our elected officials should care about.”

The motion signified an unconventional bipartisan action from the United States Senate, which was divided in favor of Democrats 51-49.

As stated by Senator Cynthia Lummis, the passage of “standalone crypto legislation” marked the inaugural occurrence of this congressional session. There was no instantaneous statement issued by the White House regarding the resolution’s passage.

Representative Mike Flood, the resolution’s sponsor, stated, “It is evident that there is overwhelming opposition to SAB 121; therefore, I urge [President Biden] to reconsider his previous statement of intent to veto the resolution.”

The Joint Resolution may serve as an indicator for the Financial Innovation and Technology for the 21st Century Act, an alternative crypto measure.

The legislation specifies the regulatory responsibilities of the Commodity Futures Trading Commission and the SEC concerning digital assets. It was approved by the committee in July 2023 and is anticipated to be introduced for a floor vote in the House in May.