Uphold’s Topper platform now offers a crypto off-ramp, letting MetaMask and other self-custodial wallet users convert crypto to fiat.

With the introduction of a new crypto off-ramp solution via its payment platform, Topper, Uphold, a global cryptocurrency broker, is broadening its capabilities for self-custodial wallets.

Topper has officially launched a crypto off-ramp solution that supports 232 cryptocurrencies, as the company announced to Cointelegraph on December 4.

The off-ramp tool is intended to enhance the accessibility of cryptocurrency by means of self-custodial or non-custodial wallets, decentralized exchanges (DEXs), and Web3 initiatives.

The off-ramp solution allows users of self-custodial wallets such as MetaMask to transfer crypto assets and withdraw fiat proceeds directly to their debit cards.

Complete Self-Custody Cycle Is Now Supported By Uphold’s Topper

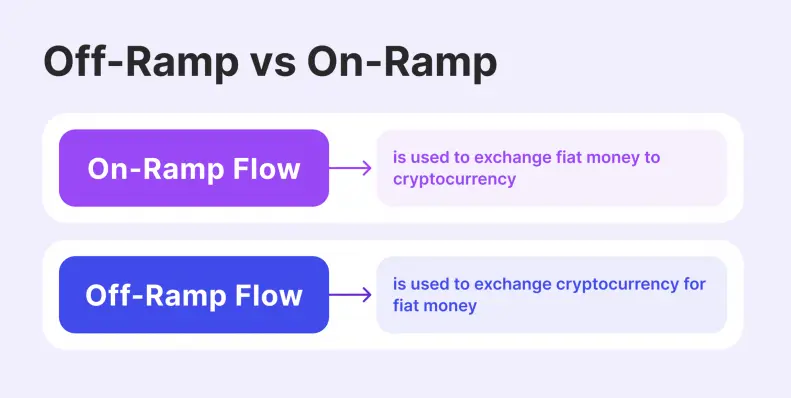

Fiat money exchanges against cryptocurrencies such as Bitcoin are referred to as crypto on-ramps and off-ramps, which serve to connect the crypto market with the conventional financial system.

Although Topper has extended its on-ramp support to prominent hardware wallets such as Ledger, these wallets have been associated with a scarcity of off-ramp options. As of September, Ledger offers only one off-ramp method.

“Topper now supports the full cycle, not only accepting digital payments but also enabling smooth and flexible off-ramps so users can exit the digital economy when they choose,” stated Frankie Picciano, Topper’s global head of sales.

Unlike crypto assets stored on centralized crypto exchanges (CEXs) or other custodial solutions, self-custodied assets can be moved freely by the owner, removing many frictions.

However, this also increases the holder’s responsibility for safely storing a private key.

How Can I Use Topper To Sell Cryptocurrency That I Own?

Robin O’Connell, CEO of Uphold Enterprise, told Cointelegraph that anyone who utilizes a self-custodial wallet can visit TopperPay.com and execute a sell transaction using Topper’s off-ramp solution.

According to O’Connell, the XRP wallet Xaman is among the wallets that are supported. He also specified that additional partners are currently in the process of integrating Topper’s off-ramp feature and will implement it “in the coming weeks.”

“Among those partners are Ledger, Trezor, Changelly, Onramper, Meld, and Vespr Wallet,” he continued.

O’Connell stated that while DEXs and self-custodial wallets will enable users to withdraw digital assets via the blockchain, not all of them offer a straightforward method for converting digital assets to fiat and sending them instantaneously to a bank account. Additionally, he stated:

“A regulated CEX typically has some level of ‘send to bank’ functionality. An unregulated DEX or a self-custodial wallet needs a regulated entity like Uphold to manage this aspect.”

KYC, Fees, Restrictions

O’Connell stated that Topper’s off-ramp solution will be accessible in over 230 countries worldwide, including regions that are more difficult to serve, such as Africa, the Asia-Pacific region, and Latin America.

“We employ Visa Direct and Mastercard Send, which are instant disbursements to a user’s debit card, which is linked to their bank account,” the CEO stated. He also mentioned that Topper converts funds immediately upon crypto reaching its wallets.”

“We may collect and verify a user’s personal information, including their legal name, address, government identification, date of birth, and any other relevant details as necessary, to ensure that we remain in compliance with the reporting requirements of the jurisdictions in which we operate,” O’Connell informed Cointelegraph.

He stated that Topper’s off-ramp will be subject to a 1.75% transaction charge at launch. He also mentioned that the tool will provide a no-fee promotion for off-ramp transactions until December 22. O’Connell stated that the daily withdrawal transaction limit is $24,000.